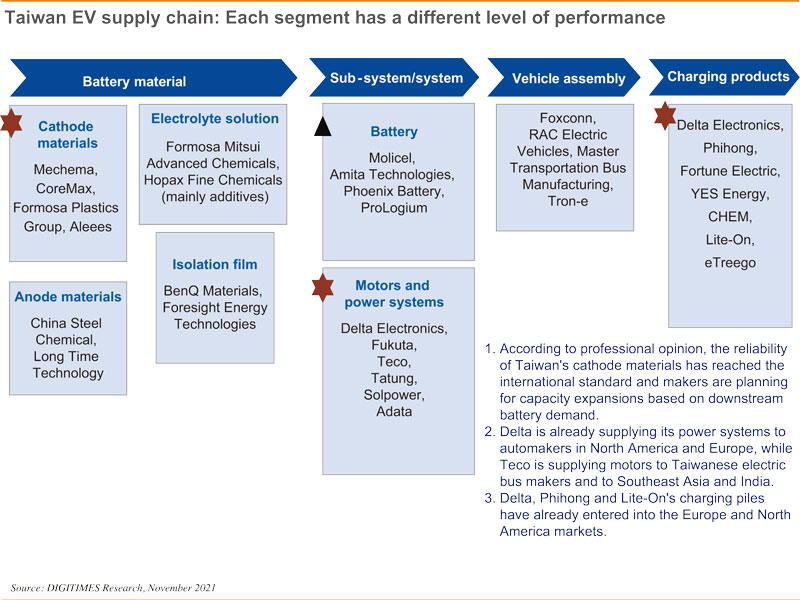

During the inception of EV development, Taiwan makers have made substantial gains in the upstream field like in-car computer and cockpit panels. Battery material firms also have gained ground in the cathode, anode and electrolyte segments. Electric bus makers Rac and Master, power charging solution providers Delta, Phihong and Fortune have all joined MIH Consortium initiated by Foxconn (Hon-Hai).

In the past, AUO's automotive panels were delivered through Tier 1 suppliers. But now seven of the world's top-10 automakers are AUO's customers. AUO's automotive panels now account for 10% of its overall revenue, with global market share of 13.4% close to that of China's market leaders Tianma and JDI. By exploiting advantages of Taiwan's ecosystem, AUO may partner with Playnitride and Ennostar to develop innovative panel technology and usher in emerging business opportunities once the supply chain is flipped to cater to surging demand of EVs, even though Tianma and JDI both have the support of China's local carmakers.

Some Taiwan's sensor makers have made their way to Tier-1 ADAS supply chain. Camera modules are shipped to several major automotive manufacturers such as Bosch and Continental. Alongside gradual market maturity of the PCs and handsets, Taiwan's makers are moving to the EV area on a large scale. The automotive industry accounts for 7-10% of national GDP for the US, Germany, Japan, Italy, Canada, and even Mexico. With average life span of each EV being 11.9 years, they are key to the peripheral sectors. Considering the huge potential benefits of the future V2X services and the data economy, the EV/self-driving car industry is as vital as national security.

Taiwan's EV industry initiated in 2004 when Tesla came looking for suppliers in Taiwan. CFTC provides relays. Hota is the major supplier of reduction gear sets. The ECUs come from Quanta. Delta Electronics, China Steel, Chroma and Fukuta are Tesla's suppliers. At present, revenues of Delta's EV division has exceeded 5% of the company's total revenues. Yancey Hai, chairman of Delta, even said that Delta is to usher in a growth period of great leaps. Young-Way Liu, chairman of Foxconn, said that EV's revenue share will start to pick up from 2023. We are coming to realize that the momentum of revenue growth will come from EV and renewable energy.

Tesla's long-term partner Quanta is also regarded as a partner of Waymo and Apple in ECUs. Quanta has been deploying in cockpit, navigation and video services and collaborating with Toyota in EV development. Quanta won't miss business opportunities of surging demand for data computing and high-speed streaming since they are closely related to cloud service.

Taiwan makers won't be satisfied with merely supplying parts and components, though it is their traditional strength. How to identify business opportunities in the subsystem or in-car services is the key to observing Taiwan's development of EV industry. Foxconn initiated MIH as a platform for the development of EVs, and its early stage should center on producing parts and components. Foxconn takes over Yulon's car-making know-how and will develop the entire system into a model of a turn-key transfer as well as contracting business. The industry structure is changing, and decentralized production mechanisms will coexist and prosper alongside with EVs. The hotbeds of EV development in emerging markets may be ASEAN countries, or densely populated and seriously polluted countries such as India.