After the subprime mortgage crisis, most people cut back on spending. The gap between supply and demand was small in about 10 years, largely maintaining an equilibrium. It is fair to say that the past two or three decades have been the most efficient era of supply chain globalization. To maintain cost-effectiveness, European and American branded enterprises entrusted large orders to Taiwanese firms and other manufacturers in the Asia-Pacific region. They took advantage of the cheap labor and social costs of China, giving birth to the world's factories, as well as an unparalleled supply chain production system. Concentrated resources from labor, energy and capital have facilitated the process of mass production which brings commercial success for technology invented in the advanced countries. Taiwanese firms have benefited from the opportunities to build up their industrial strength. China has capitalized on the trends to rise. This is the core of the changes in the global ICT industrial system that the world has seen since year 2000.

But since the beginning of 2019, COVID-19 has created global chaos. To mitigate the impact of the outbreak, governments have been pouring money to expand consumption. It is estimated that all countries combined have been funneling in more than US$10 trillion, equivalent to the amount of China's GDP.

During the subprime mortgage crisis in 2008, the unemployment rate of the US was soaring from 4.7% to more than 14%. It took the US about seven years to stabilize the rate below 5%. But the latest relief packages have failed to bring people back to work. More people prefer to get grants first and watch. Restaurants in the US and Canada are short-handed. British drivers are leaving their jobs. Supply chain disruptions are seen everywhere from daily service to multinational logistics sectors.

In Europe, energy prices are soaring due to policies of energy saving and decarbonization. Aviation fuels rose from US$26 a barrel in April 2020 to US$84 in September 2021. The European big powers which have raised moral concerns in the past few years on climate change have placed carbon neutrality on ESG agenda as a remedy to the greenhouse effect. But such moves pose a formidable challenge for supply chains that are sensitive to transportation costs and for countries desperate for winter heating. Labor shortages coupled with diminishing direct foreign investment and the impacts of immigration control on population mobility are issues we will face in the next 10 or 20 years.

Above all, China has been protecting its domestic industries and markets in the name of protecting domestic assets, privileges of late movers, etc. China has certainly seized the opportunity to exploit the country's potential during the past decade in the sectors of mobile communications and smart applications. China's remarkable success records have become a reference model for many emerging countries today.

To sell "Made in India" computers in India, Acer and HP collaborate with supply chains to make computers in India. Even earlier, Apple had done the same thing through support of Taiwanese and Chinese supply chains.

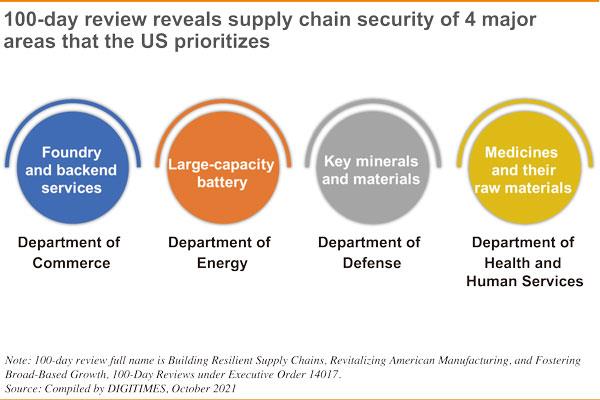

In February 2021, semiconductors, car batteries, rare earths and pharmaceuticals took center stage in the Biden administration's vow to regain control over the global supply chain. This is a crystal clear message delivered from a superpower. India, Vietnam, the Philippines, Thailand, Malaysia, Indonesia are also inspired by the global trends. We have come to be aware the rise of technological nationalism to protect physical supply chains and intangible data assets. For Taiwanese makers, there seems to be multiple challenges. However, it is difficult for any country to establish independent industries in the short term. With their harmless and reciprocal way of operation, Taiwan enterprises are welcomed by many countries as their partners. Taiwan will collaborate with Japan, ASEAN, South Asian countries to forge the Asia-Pacific region's new supply system in the long run.

Taiwanese enterprises can beef up the supply chains for countries in the Asia-Pacific region and mitigate the operational risks of local manufacturers to quickly achieve economies of scale. For upstream vendors and Taiwanese firms, a decentralized production base would allow them to get away from the awkward position that relies entirely on branded enterprises.

(Editor's note: This is part of a series of analysis of Taiwan's role in the global ICT industry.)