During the past 20 years, especially after China and Taiwan successively joined the World Trade Organization (WTO), thanks to China's cheap labor and social costs, coupled with the industrial structure that is highly dependent on PC and mobile phone brands, manufacturers of Taiwan, South Korea and China capitalized on the golden period of the supply chain. But the industry has undergone structural changes in the wake of the US-China trade war, COVID-19 and the rise of the EV industry. The new market structure is redefining the semiconductor industry and its supply chains.

Jerry Sanders, founder of AMD, has said: "Real Men have fabs!" - a punchline of the wafer and IC communities which means "fab is indispensable for any players." Now the phrase has relapsed to be discussed again due to the semiconductor industry's soaring capital expenditure. Many IC design houses and IDMs even prepay to book production capacity for securing the supply of parts in the future. The two US presidents Biden and Trump regard semiconductors as a top priority. Wary of being cut off lifeblood, China has been launching massive investments in the semiconductor industry during the past two years equivalent to another kind of arms race. Many would doubt whether the demand is really that robust? When would the market reach a supply-and-demand equilibrium? Who will be the winners in the wake of the equilibrium followed by "supply surplus"?

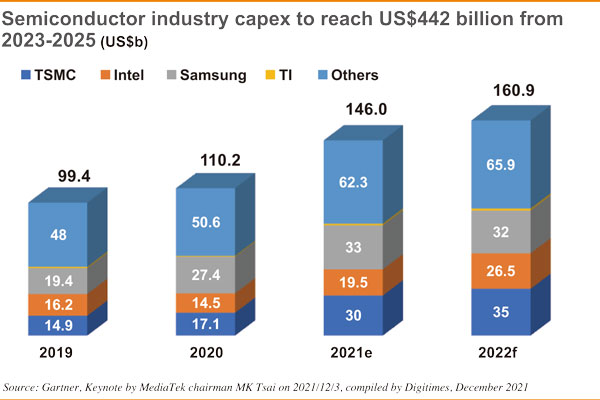

Citing Gartner's statistics, MediaTek chairman Ming-Kai Tsai said the semiconductor industry will spend US$442 billion on capital expenditures during 2023-2025. Major semiconductor players are adopting active investment strategies. IDMs particularly are following suit to undertake various large-scale investment plans. Texas Instruments (TI) unveiled its US$30 billion plan to construct four new wafer fabs. Aiming at Taiwan and saying that "Taiwan is not a stable place," Intel was calling for the US government subsidies to support the local semiconductor industry. Geopolitics has been exposed at the forefront and become a medium to long-term development variable of the semiconductor industry. TSMC chairman Mark Liu has downplayed the geopolitical concerns with constant talk that TSMC has been focused on customer needs. Placing customers as its top priority and never speaking ill of other companies duly reflect TSMC's market leadership position.

TSMC founder Morris Chang has commented that he hasn't seen any signs to call a halt to increasing demand for semiconductors. There are multiple interactive factors supporting the observation. "Supply-chain disruptions" as a result of geopolitical impact may incur higher costs and risks and thus trigger demand for greater spare capacity. However, some major players may overestimate the demand and overreport capital expenditures. Booming business opportunities can be anticipated in one year or two. But "supply surplus" would occur once the market reaches a supply-and-demand equilibrium. Then there comes the issue of efficiency. Companies of excellent efficiency always take the lead. The competitive edge applies to both mature processes and advanced processes. Etron chairman Nicky Lu has called for implementing "effective capacity" management and re-optimizing the processes of mature technologies of 28-90nm to maximize the investment efficiency.

The traditional semiconductor manufacturers in Europe, the US and Japan have been deeply affected. The key lies in promoting optimal collaboration among IC design houses, wafer contract manufacturers and package & testing players to meet market demand in the next few years. ASE CEO Tien Wu, who observes the changes in the semiconductor industry from the perspective of package & testing business, said: "The challenges are still there, but there are far more opportunities for Taiwan."