A recent DIGITIMES Research report shows that China has more IC design companies with revenue exceeding $100 million than Taiwan. While the difference in the number of papers presented at ISSCC between the two sides was not significant until 2020, Chinese companies have now surged ahead, indicating China's growing strength.

However, Taiwanese companies face challenges in developing more advanced process technology beyond 28nm, compared to China's comprehensive approach in advancing from mature processes to leading-edge nodes. As a result, Taiwanese companies are among the hardest hit by China's full-scale development of the semiconductor industry.

Despite facing pressure from the United States and dealing with multiple regulations, Taiwan-based businesses have some breathing room. However, Chinese companies are posing a significant threat to Taiwan by actively developing in mature processes, implementing import substitution policies, benefiting from China's subsidy policies, and booming mobile phone and EMS manufacturing industries.

Chinese IC design companies are eyeing SoCs in consumer electronics for smart TVs, Android tablets, true wireless earbuds (TWS), set-top boxes, as well as display driver ICs, power management ICs, and analog signal processing components. As most Taiwanese companies are relatively small, consolidating resources will be a significant challenge for them.

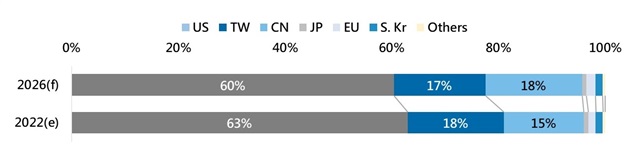

If the overall trend remains unchanged, Taiwan's global market share in the IC design industry will drop from 18% to 17% by 2026, while China's market share will increase from 15% to 18%, making it the world's second-largest IC design country.

Source: DIGITIMES Reseearch, January 2023

The aforementioned assumptions are established in the current industry landscape, yet China faces as many challenges as Taiwan does. China's IC design industry output value is only $31.5 billion, with over 120,000 employees, suggesting that China's labor efficiency and unit output value are not optimal. Inexperienced players are also vying for industry resources, compounded by government subsidies leading to the issue of excess resources with limited talent pool.

The most significant difference is that, amid the US-China trade war, China must depend more on its domestic market, while Taiwan has pursued OEM opportunities in China's local market and from European and American clients. The growth momentum of the "red supply chain" in the coming years will be a determining factor for the development of China's IC design industry.

Industry players are now focusing on the opportunities in the automotive and industrial control sectors. For the past 20 years, China's infrastructure construction has presented a golden opportunity for industrial control players, coupled with the demand for the Belt and Road Initiative, creating enormous business opportunities. However, as infrastructure reaches saturation, relying solely on domestic business opportunities to fuel industry development will pose a challenge for Chinese industry players.

In addition, the global production of electric vehicles is expected to reach nearly 10 million units in 2022, with Chinese players contributing as much as 59%. If this trend continues, China is poised to become a global leader in electric vehicle production, which will also drive demand for related semiconductors.

China's EVs hit bumps on its road due to quality concerns and intense price competition in the domestic market since early 2023, which has thrown a harsh spotlight on the Chinese automotive semiconductor industry. This is a hidden concern for the development of China's IC design industry.

To summarize, China no longer has an "ace up its sleeve" in the global market, and it will face real and possibly even reverse balancing in the future. It remains unclear whether Chinese industry players, who have lost their domestic market advantages and lack national protection, can still stand out as leaders in the industry.