Battery makers have fired on all cylinders with expansion this year to meet the surging demand from EV manufacturers. Looking ahead to 2023, major Asian battery companies will keep leading the pack. The competition in North America will grow tense in the next few years as the US is determined to localize battery supply chains.

According to Korea-based SNE Research, global EV battery installation reached 341.3GWh in the first nine months of 2022, a 75.2% increase from last year. Battery makers from China, South Korea and Japan dominated the top 10. CATL stayed at the forefront with a market share of 35%, while LG Energy Solution grabbed second and third place.

Top 10 battery makers by global usage for EVs, January to September 2022 | ||||

Rank | Battery maker | Installation (GWh) | YoY (%) | Market share(%) |

1 | CATL | 119.8 | 100.3 | 35.1 |

2 | LG Energy Solution | 48.1 | 14.1 | 14.1 |

3 | BYD | 43.6 | 177 | 12.8 |

4 | Panasonic | 27.8 | 4.4 | 8.1 |

5 | SK On | 21.2 | 92 | 6.2 |

6 | Samsung SDI | 16.6 | 65.1 | 4.9 |

7 | CALB | 13.7 | 151.6 | 4.0 |

8 | Gotion | 9.9 | 149.5 | 2.9 |

9 | Sunwoda | 5.9 | 414.2 | 1.7 |

10 | Svolt | 4.5 | 151.9 | 1.3 |

Source: SNE Research, compiled by DIGITIMES Asia, November 2022

The battery industry has seen dramatic price hikes in battery materials, especially lithium. Jessie Lin, an EV analyst with DIGITIMES Research, said global lithium prices surged 700% within two years.

She said the supply would not keep up with demand until 2023. Therefore, lithium prices will keep increasing next year.

According to S&P Global Commodity Insights, lithium prices in China may fall back to "a reasonable range" in 2023. Worldwide lithium resources will keep growing, especially in the second half of next year, cutting production costs for lithium chemicals moderately.

China-based Securities Times also reported that lithium prices will likely go down as early as the second half of 2023. The material costs will stay a primary challenge for manufacturers next year.

China-based companies continue to expand domestically and overseas

Although Europe and the US have started building battery supply chains, they are unlikely to rival their Asian counterparts in the short term. China will remain the leader as it has formed a battery ecosystem.

According to China EV100 Association, China has realized stable production of cathode and anode materials, electrolytes and separators, no longer relying on foreign supplies.

In August 2022, China announced it will extend tax credits for new energy vehicles, including EVs, until the end of 2023. The incentive would facilitate the EV market and drive battery makers' growth.

Multiple battery companies announced expansion domestically and overseas this year. For example, CATL became Ford Motor's strategic partner and will support LFP batteries to the automaker globally. It also expanded collaboration with Vietnam-based VinFast for skateboard chassis and other products.

Securing partnerships with EV makers will benefit a battery manufacturer's development in the future. That explains why Robin Zeng, CATL's founder and chairman, reportedly visited Hyundai Motor executives in early November. The market keeps a close eye on whether the two companies will strengthen their relationship in 2023.

Another subject remaining to be seen is if battery technology breakthroughs in China will help market share in the next few years. CATL revealed Qilin, a third-generation CTP (cell-to-pack) battery, and will first power China-based Zeekr's models. The battery can offer a 1,000 km range with one charge.

CATL plans to start mass-producing sodium-ion batteries in 2023, consolidating its leadership in the field. Sodium is cheaper than most battery minerals and works well in low temperatures, but it creates lower energy density than LFP batteries.

BYD, the second largest battery maker in China, released the CTB (cell to body) battery technology in May, raising the volume utilization rate to 66%. While the company's batteries primarily support its EVs, the new technology could give it leverage to grow its customer base in the future.

As China-based battery companies have expanded aggressively in recent years, a concern about a production glut has surfaced.

According to Ouyang Minggao, an academician with the Chinese Academy of Sciences, battery production in China will likely reach 1500GWh in 2023 and 3000GWh in 2025.

He said China may see a production glut in 2025 when considering the supply and demand balance, 21st Century Business Herald reported.

EVs account for more than 90% of battery usage in China. The industry expects EV sales growth to slow in the next few years. To avoid an oversupply situation, battery makers have added products for energy storage systems. Some experts also said companies should go overseas to grow their global presence.

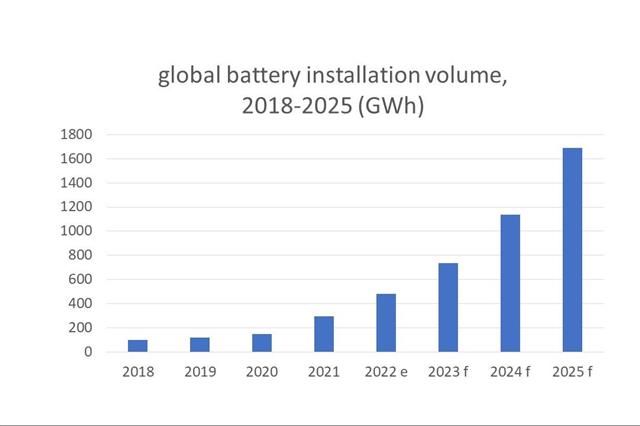

Battery installation will go upward through 2025 as EV penetration increases

Global EV sales will continue to grow through 2025, according to DIGITIMES Research. It is estimated that the world will see 9.78 million vehicle sales in 2022 and over 14.4 million next year.

DIGITIMES Research expected the US to double EV sales to 1.8 million vehicles in 2023, a more significant year-over-year growth than China and Europe. The increase would largely be driven by the EV tax credits renewed by the Inflation Reduction Act (IRA).

Lin said the EV penetration rate worldwide is expected to grow from 12.7% in 2022 to more than 30% in 2025. Since consumers seek models with long driving ranges, the average battery installation per car will keep increasing.

DIGITIMES Research projected the global EV battery installation will reach 735GWh in 2023, growing 53.3% from 2022. The number is expected to be 1689GWh in 2025, 3.5 times of 2022.

Source: SNE Research and DIGITIMES Research, compiled by DIGITIMES Asia, November 2022

LGES to lead battery industry in the US

The battery competition in the US will heat up in 2023. The Biden administration targets half of the new vehicles sold in the country to be plug-in hybrid or battery EVs in 2030. Along with the tax credits offered by the IRA, a notable demand for batteries will arise in the market.

To be eligible for the government subsidy, an EV must use batteries with a certain portion of materials sourced in the US or from its free trade partners. The restriction aims to help America set up battery supply chains.

LGES has been the most ambitious battery company to develop the US market. The first plant of Ultium Cells, a joint venture between LGES and General Motors, was commissioned in Ohio this year. Another Ultium factory will begin production in 2023.

While CATL is the world's largest battery maker, LGES leads in the market outside China. According to SNE Research, the South Korean company took up 30.1% of the world's market except for China for the first nine months of 2022. CATL and Panasonic both accounted for 18.9% of the installation.

LGES has secured more than 250GWh of battery production capacity in North America by 2025. Besides GM, it will build joint plants with Stellantis and Honda in the US.

SK On is another South Korean company that is set to play an important role in assisting the US to terminate reliance on China's batteries. SK On established a joint venture in July with Ford, BlueOval SK. The JV will build three battery plants in Tennessee and Kentucky with a total production capacity of 150GWh, according to SK On.

Like LGES, SK On will ramp up overall production mainly through its US factories in the coming years. It signed a memorandum of understanding with Hyundai Motor on November 29 to supply batteries to the carmaker in the US. SK On has two plants in Georgia, where Hyundai is building an EV base.

Panasonic will gain its US presence in the next few years, too. In early November, the Tesla supplier broke ground on a cylindrical battery plant in Kansas. It will begin mass production of 2170 cells in 2025.

Back in its factory in Japan, Panasonic is developing 4680 cells. In an interview with Bloomberg, Shoichiro Watanabe, Panasonic Energy CTO, said the mass production will start by the end of March 2024. Commercializing the high-capacity battery will bring the market competition to the next level.

Although the US is set to be the next battleground for battery makers, whether a great number of China-based companies will join the game remains to be seen.

CATL said IRA would only create a minor impact on its business. But the company has not proceeded with its reported North American expansion. Gotion High-tech, a Volkswagen-backed battery maker, has moved forward with a battery material project in Michigan.

According to supply chain sources, China-based battery makers have to cross at least two hurdles before investing in the US. First, they may need approval from the Chinese government because many are closely connected with the government.

In addition, they must receive permission from a committee reviewing applications for IRA subsidies. If the companies cannot get financial support from the US government, they will not be able to grow competitively in the market.

Race between South Korean and Chinese battery makers will grow tense in Europe

In Europe, the competition will remain primarily between South Korean and Chinese battery makers in the next few years. The EU is on target to ban new internal combustion engine vehicle sales from 2035, which will boost battery demand.

The three major South Korean battery companies entered the European market earlier than their Chinese counterparts. They are all growing production capacity. For example, LGES is expanding its plant in Poland and SK On is building its third factory in Hungary.

In 2021, Samsung SDI increased capacity at its first plant in Hungary. It has expanded the second plant this year. The "K-trio" has the advantage of responding to the market needs in coming years.

However, China-based companies are known for their aggressiveness and massive investment. The world-leading CATL's German plant is scheduled to commission by the end of this year, becoming a primary production base in Europe. The company has already announced the second plant in Hungary.

Gotion will establish a battery plant in Germany, while Svolt Energy Technology plans to build another cell assembly plant in the German state where Tesla's gigafactory is also located.

In September, BMW announced the adoption of cylindrical batteries in 2025. It awarded CATL and EVE Energy contracts to build plants in Europe and China. Similar collaborations between OEMs and Chinese battery makers are expected in the coming years when the latter secures its foothold in Europe.

Major battery companies will continue to dominate

In response to the increasing demand through 2025, battery makers' priority has been growing production capacity. Newcomers are emerging. However, Lin said major players will keep dominating the market.

She added that battery production heavily relies on experiences in mass production. It might take a new company 10 years to ramp up. The business also requires enormous funds. For instance, every GWh of batteries needs at least US$65 million investment. It is a high bar for emerging companies.