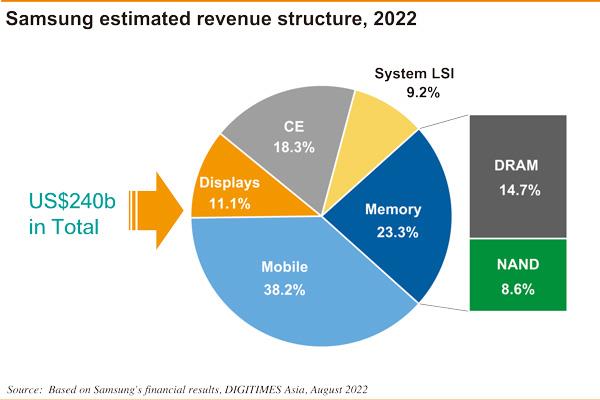

To understand Samsung Electronics, it is important to look at its business structure. Samsung's revenue is forecast to reach US$240 billion in 2022, of which nearly 40% will come from its mobile communications division - formed by mainly handsets - and about 30% from semiconductors, with memory being the bulk of the semiconductor revenue.

However, in terms of profitability, the memory division accounts for more than 50% of the group's revenue, while the mobile division, which generates nearly 40% of its revenue, only contributes 22% of the group's profits. For Samsung, memory is the "lifeline" of the group, but standard memory is vulnerable to market price fluctuations, affecting profitability.

The economy has been heading for a downturn since mid-2022, with DRAM bearing the brunt of the impact. DRAM is unlikely to recover until mid-2023, and NAND will not even have a chance to return to a supply-demand balance until the end of 2023. Samsung does not want to rely too much on memory, which is why it is trying to get a meaningful market presence for its non-memory System LSI segment.

It is estimated that in 2022, the revenue of the System LSI division, which mainly focuses on foundry business, will account for more than 9% of the company's revenue, but the profit of this division only took up 3% of the total profit in 2021. Whether this division's profit can rise sharply in 2022 will depend on whether Samsung can secure orders from clients for its 3nm node - a manufacturing process that it has spent heavily developing. Samsung has high expectations for its foundry business, and believes that TSMC and Intel are its only competitors for advanced sub-7nm processes and that many chipmakers hope to have a second source of supply besides TSMC, so even if Samsung cannot outrace TSMC, it can at least get a slice of the pie.

But chip manufacturing orders for advanced processes are very different from the ones for manufacturing notebooks or handsets where changes may take place rather frequently. Even if Samsung spends heavily on buying semiconductor equipment, it still would not be able to challenge TSMC's dominance in the foreseeable future; and instead, over-investment would only create a heavy burden for Samsung. In 2018, Samsung's foundry capex was only 15.6% of its entire semiconductor business, but it will remain close to 40% of the total in the next few years, accounting for about 25% of global foundry capex.

If there is no breakthrough in the advanced chipmaking processes, and if handsets and memory products can no longer generate handsome profits, Samsung will inevitably find itself caught in a difficult position. TSMC has received more than US$30 billion in advance payments from clients for 2023 alone, so it can really sit back watching the changes in the semiconductor market when Samsung's foundry business comes under pressure.

In terms of sales volume, Samsung's handset business is the world's No. 1, but Samsung's handset sales have been stagnant in the past few years. The handset division, which once contributed more than half of the company's profits, now only generates slightly over 20% of the profits. Samsung hopes handset sales could strengthen its components deployments, but it may not end up the way it would like in the future.

For a long time, the South Korean media had often reported that Samsung's annual sales volume target for handsets would be to reach 300 million units, but in recent years the volume has been around 270 million units annually. Entry-level and midrange phones have reached a certain proportion of Samsung's total handset sales, but for Samsung, whose annual revenues amount to US$240 billion, producing entry-level and midrange phones is now hardly meaningful. Samsung therefore is increasing the proportion of outsourcing. The emphasis on maintaining "friendship between China and South Korea" means Samsung's priority outsourcing partners were previously those from China, with Taiwanese ones playing a secondary supporting role.

But apparently Samsung's goodwill gesture has not been well received, and in the Chinese market Samsung's handsets come under fierce competition from local brands. Samsung's current handset market share in China is less than 1%, which is why Samsung is now more actively establishing production lines in Vietnam and India.

As for TVs and other consumer electronics, the proportion of revenue is not low (18.3%). Samsung has repeatedly stressed that its TVs have ranked first in the world for 16 consecutive years; in the high-end TVs above 55 inches, Samsung has more than half of the global market. But the consumer electronics division has been in the doldrums for a long time, only contributing about 4% of the overall company profits - which is a drop in the bucket.

As far as business structure is concerned, the consumer electronics segment doesn't mean much, the handset division can hardly see growth, and the standard memory business is vulnerable to fluctuations in the economy, with Micron, YMTC and Kioxia showing aggressiveness. It seems reasonable for Samsung to bet on the System LSI business, but a high barrier in the form of TSMC is lying head. It will be much harder than one would imagine for Samsung to surpass TSMC.

(Editor's note: This is part of a series of 10 articles by DIGITIMES Asia president Colley Hwang about Samsung's outlook.)