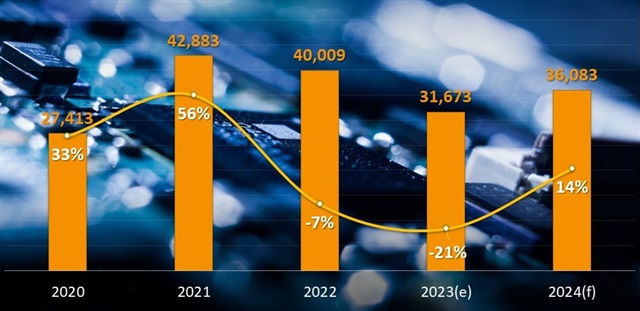

2023 spelled tough times for Taiwan's IC design industry as it grapples with a projected 21% dip in revenue. Global economic sluggishness, coupled with geopolitical tensions, war, interest rate hikes, and inflation, is taking a toll on companies in the smartphone and NB/PC chip sectors. Among Taiwan's top 10 IC design firms, only Global Unichip Corp stands out with an anticipated record-breaking revenue of nearly US$900 million in 2023, marking an 8% growth. Others are witnessing a downturn. However, the outlook for 2024 is promising, with global smartphone and NB/PC shipments set to soar by 14%, pushing industry revenue back to the US$36 billion mark.

Taiwan's IC design industry revenue projection (unit: US$1M)

Source: DIGITIMES Research, December 2023

As per DIGITIMES Research, the writing's on the wall for major tech products—smartphones, NBs, and PCs—with estimated drops of 5%, 12%, and 13%, respectively, in 2023 shipments. This slump is directly impacting the demand for associated chips. Nevertheless, the 5G wave, driven by emerging markets, is expected to boost global 5G smartphone shipments by a whopping 160 million units in 2024. Couple this with Intel and Apple launching new processors, and a demand resurgence for NBs and PCs is in the cards. Analyst Eric Chen predicts a ~5% growth in global shipments for smartphones, NBs, and PCs. With the Paris 2024 Olympic Games driving TV chip demand and the rise of Wi-Fi 7 in smartphones and NBs, it's anticipated to be a boon for MediaTek and Realtek, steering Taiwan's IC design industry toward growth.

Despite a gradual normalization of IC inventories for 3C products and a drop in turnover days, market demand remains sluggish. Terminal brand manufacturers are cautiously managing Q4 2023 inventory, considering the potential impact of an early 2024 off-season. Consequently, global NB shipments in Q4 2023 are set to decline by 7%, casting a shadow over the IC industry's quarterly growth. Summing it up, Taiwan's IC design industry is bracing for a significant 21% revenue slump in 2023, underscoring the industry's challenging landscape.

Analyst Jim Chien notes a warming trend in the global memory market in the latter half of 2023, thanks to normalized inventory levels in terminal distribution channels. This positive trend is aiding a reduction in turnover days for Taiwan's upstream memory-related IC design companies. After peaking at 393 days in Q1 2023, average inventory turnover days have shown a two-quarter decline, settling at 262 days.

In Q3 2023, as the memory market steadied, seven companies witnessed revenue stabilization or growth. However, cumulative revenues still lagged behind the same period in 2022. With terminal customer inventories being cleared in Q4 and the growth prospects in AI servers and automotive applications, certain memory-related IC companies are poised to benefit.

Ongoing production cuts by Samsung and SK Hynix in H2 2023 have contributed to stabilizing memory prices, aiding the revenue recovery of Taiwan's memory-related IC companies. In Q4, MediaTek is grabbing attention with the Dimensity 9300, featuring generative AI, and the surge in Chinese smartphone sales. This is expected to fuel a 24.6% YoY increase in AP shipments, positioning MediaTek among the few IC design companies in Taiwan experiencing quarterly and annual revenue growth.

Looking ahead to 2024, a gradual uptick in global smartphone, NB, and PC shipments is anticipated, driven by factors like the replacement cycle, translating to increased chip demand. Taiwan's IC design industry, focusing on communication and NB/PC peripheral chips, is poised to see its industry revenue return to the $36 billion mark in 2024.

About the Analyst

Eric Chen is an Analyst and Project Manager at DIGITIMES Research. Chen received his Master's degree in International Business from Taiwan's Soochow University. His research focuses on the foundry industry and IC assembly & packaging industry.

Jim Chien received his B.S. and M.S. degrees in communication engineering. He engaged in academic research of advanced signal processing and smartphone development and currently focuses on semiconductor technology development and market trends, especially in communication IC design and RF.