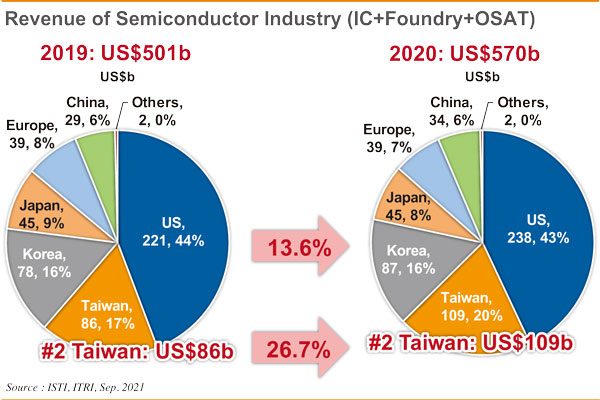

According to the Industrial Technology Research Institute (ITRI), the global semiconductor manufacturing revenue including wafer foundry and IC package and testing industries, grew 13.6% from US$501 billion in 2019 to US$570 billion in 2020, with Taiwan's corresponding revenues growing from US$86 billion to US$109 billion. With contribution of 20% for the global semiconductor industry, Taiwan is the world's second-largest semiconductor powerhouse next to the US, surpassing South Korea and Japan and leaving China far behind.

Terry Tsao, global chief marketing officer at SEMI and president of SEMI Taiwan, pointed out that Taiwan has been the largest buyer of equipment and materials in the past decade. In the past 10 years, Taiwan has purchased the most semiconductor equipment and materials for at least seven or eight years. Driven by multiple factors, Taiwan has become the world's most important semicondutor production base. With combined industrial strength from upstream and downstream sectors, Taiwan has been serving world-class customers for 30 or 40 years, creating a pillar of its economy. What's more, desperate needs and interests of the international community have placed Taiwan to the front line in the global conflicts.

Fortune and misfortune live in the same courtyard. China is developing its semiconductor industry with the government's Big Fund initiative. Japan, Germany, and even India are wooing Taiwan enterprises to build plants in their countries. The changes of the global semiconductor industry structure are flipping to reshape Taiwan's macro strategy. The winning formula of exploiting advantages of concentrated industrial clusters to become the world's semiconductor factory is under examination. Taiwan firms are likely to be swamped with issues concerning industrial ecosystems revamps and green energy.

TSMC, Samsung and SK Hynix had submitted confidential documents reportedly containing business secrets before the deadline of November 8 requested by the US Department of Commerce. But outsiders probably wouldn't know what the Department of Commerce had actually asked for. Neither Taiwan nor South Korea was in a position to resist the request. Nevertheless, under Taiwan's macro strategy of "regional deployment" and the support of the Japanese government, TSMC pushed the envelope to jointly establish a subsidiary with Sony (JASM). Bloomberg reported that India is also inviting Taiwan's UMC to invest in India. ASEAN member states are much interested in Taiwan's IC packaging/testing and design industries.

Apart from Japan, does Taiwan have a chance to cooperate with the ASEAN and India? The future EV industry can be a new era of diversity. Unlike the traditional industry that makes fuel-powered cars, the EV supply chain will no longer need to go through multiple barriers to become carmakers' suppliers. The decentralized production system of semiconductors will be catering to emerging diverse demand. Governments would have to make a "Taiwan policy" seeking to expand investments and talent pools.

The rules of the game have changed, and Taiwan needs to have a say on the global stage. How would Taiwan respond to such changes? Taiwan is already a global leader in some specialty fields, and there are no precedents to learn from. Neither can it avoid such changes. Taiwan will no longer be just a follower of international rules; instead it will play a more active and even find itself among those who make the rules.

Taiwan's big strategy for the IT industry should be to transform from a follower to an active participant and even a game changer. Is Taiwan ready? Taiwan is on it and the whole world is watching!

(Editor's note: This is part of a series of analysis of Taiwan's role in the global ICT industry.)