The panel supply chain has seen oversupply with prices falling. In consequence of the waning epidemic, TV sales which could have been boosted by WFH economy can hardly regain momentum in the fourth quarter. On top of that, Samsung and LG are gradually fading out the traditional panel industry. Taiwanese firms on the other hand focus on cockpit panels, advanced TV models, gaming businesses and IT products. The global panel industry structure is transforming.

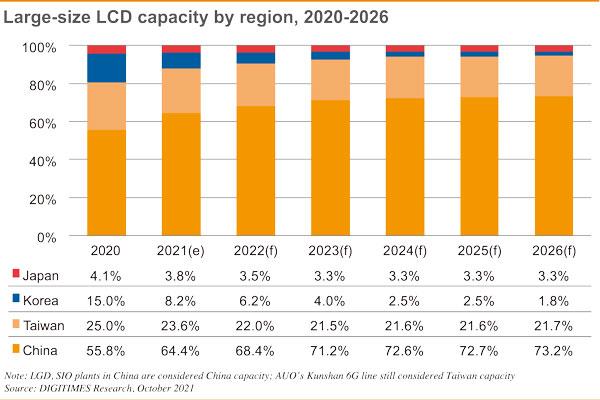

Chinese presence in the LCD panel industry continues its expansion. Samsung used to dominate in the high-end panel market but is now no longer obsessed with the business as before. Samsung has sold its panel production line to China's CSOT. China-made panels are expected to dominate the market before OLED panel is mature enough to erode the market share of LCD panels. It is predicted China-made panels will account for over 70% of the global panel market share.

In terms of applications, cockpit dashboards and central control systems both maintain double-digit growth. Interactive digital signage displays also perform well with good sales. The market preference is tilting towards the large-sized models. After taking over Samsung's production line, CSOT is to be a significant player and poses threats to Taiwanese firms.

Since the pandemic is waning, the global TV market as a panel end-user segment is facing a downturn in demand. Components shortage, port congestion, China's policy on power restrictions, coupled with typhoons in Asia have exacerbated the issues. Considering quarterly output between 7-8 million units, Taiwanese TV makers like TPV and Hon Hai (Foxconn) willl report moderate sequential growths in third-quarter and fourth-quarter 2021, but will see declines of about 15% year-on-year. Apparently, the big demand cycle of panels has come to an end.

As for the demand of tablets, since people are going back to normal life in the fourth quarter, supply-and-demand imbalance is slightly diminishing. High hopes of peak season expected in the fourth quarter may result in a let-down. However, normal shipments of some manufacturers are affected due to shortages of PMIC, TDDI and application processors.

Despite Huawei's staggering business, China is actively developing chips, servers and networking products. According to upstream equipment suppliers, despite bans on the equipment procurement, China was purchasing large batches of semiconductor equipment in the third quarter of 2021.

This indicates that China's development of its own semiconductor industry remains a significant part of its national development plan. The semiconductor industry is different from the panel industry. There is no telling if China's semiconductor can duplicate the model of its panel industry to capitalize on domestic support with massive capital funds.

(Editor's note: This is part of a series of analysis of Taiwan's role in the global ICT industry.)