DIGITIMES Asia released the "2023 Asia Supply Chain (ASC) Top 100 Market Cap Companies Ranking" on Jan 5, based on the market capitalizations of publicly-listed information communications technology and automotive manufacturing supply chain companies in Asia (on December 30th). The double-digit percentage decline in market capitalization of many companies in the ranking reminds us of the harsh market environment in the tumultuous year behind us.

TSMC maintained its top-notch leadership despite a 34% drop in its market capitalization to US$378 billion in 2022, followed by Samsung, Toyota, CATL, Sony, Keyence, BYD, LG Energy Solution, Midea, and Hitachi.

TSMC's market cap declined despite the fact that its Q1~Q3 revenues increased more than 30% from a year ago. This has more to do with geopolitical tensions, interest-rate hikes, and US tech stock corrections, rather than fundamentals.

"Since the stock market is a leading indicator, the sapping of the market cap is reflecting investors' views on a weaker performance for supply chain manufacturers, including TSMC, in the quarters ahead," said Eric Huang, vice president of DIGITIMES.

Sources said TSMC is bracing for a weak 1Q23, estimating a sequential decline of 15% in sales revenues. Eric Chen, a DIGITIMES semiconductor analyst, said the utilization rate of the semiconductor industry is widely anticipated to trough in 2Q23.

2023 Asia Supply Chain Top 20 Market Cap Ranking

Company Name | Country | Industry | Market Cap (US$M) | YoY | 2021 Ranking | |

1 | TSMC | Taiwan | Semiconductor | 378,450 | -34.3% | 1 |

2 | Samsung Electronics | S Korea | Tech Products and Equipment | 262,796 | -33.1% | 2 |

3 | Toyota Motor | Japan | Automotive Manufacturing | 225,715 | -24.4% | 3 |

4 | CATL | China | Electrical Components | 139,294 | -35.4% | 4 |

5 | Sony | Japan | Consumer Electronics | 96,595 | -39.1% | 5 |

6 | Keyence | Japan | Tech Products and Equipment | 95,456 | -37.5% | 6 |

7 | BYD | China | Automotive Manufacturing | 94,645 | -17.0% | 7 |

8 | LG Energy Solution | South Korea | Electrical Components | 81,122 | N/A | IPO in 2022 |

9 | Midea | China | Consumer Electronics | 52,529 | -35.2% | 9 |

10 | Hitachi | Japan | Machinery | 47,910 | -8.5% | Industry reclassified |

11 | Hangzhou Hikvision Digital Technology | China | Tech Products and Equipment | 47,410 | -38.3% | 11 |

12 | Tokyo Electron | Japan | Semiconductor | 46,656 | -48.5% | 8 |

13 | LONGi Green Energy Technology | China | Semiconductor | 46,444 | -36.7% | 12 |

14 | Hon Hai Precision Industry | Taiwan | Tech Products and Equipment | 45,067 | -13.5% | 21 |

15 | SK Hynix | South Korea | Semiconductor | 43,464 | -45.8% | 10 |

16 | Honda Motor | Japan | Automotive Manufacturing | 41,922 | -17.6% | 22 |

17 | Denso | Japan | Automotive Components and Equipment | 39,310 | -39.8% | 15 |

18 | Xiaomi | China | Tech Products and Equipment | 34,985 | -42.2% | 16 |

19 | Murata Manufacturing | Japan | Electronic Components | 33,984 | -36.8% | 20 |

20 | Luxshare Precision Industry | China | Electronic Components | 32,671 | -40.1% | 19 |

Market cap top 20 companies

Source: DIGITIMES Research

"In 2022, when the capital was flowing back to America due to US Federal Reserve's aggressive rate hikes, TSMC was like an ATM to foreign investors," said Tom Lo, DIGITIMES Analyst in charge of the ASC top 100 Market Cap Companies Report. According to Taiwan's Financial Supervisory Commission data, foreign investors registered a net selling of NT$1.02 trillion (US$33.7 billion) of Taiwan stocks and a net capital outflow of US$12.8 billion between January 1 to November 30, 2022.

Several sovereign wealth fund investors were also net sellers of TSMC stocks over cross-strait tension uncertainties. TSMC became so undervalued that Warren Buffett's Berkshire Hathaway started to invest in the chip foundry service provider in 3Q22.

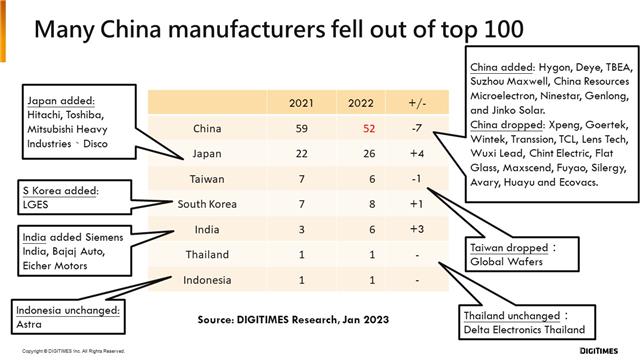

By country changes

Source: DIGITIMES Research

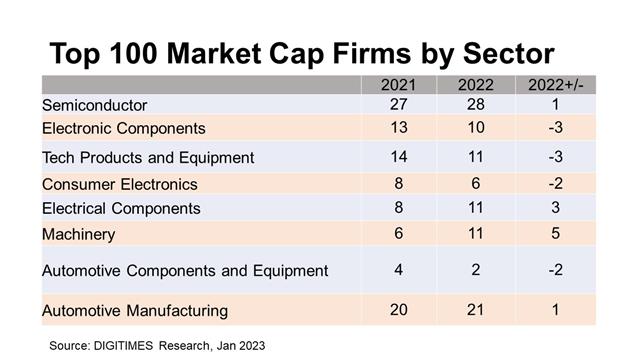

The percentage drops in market caps of automotive supply chain companies are generally smaller than that of the information communication technology (ICT) supply chains in the ASC top 100 market cap rankings. Company market capitalizations in electronic components, tech products and equipment, as well as consumer electronics sectors, all fell more than 35% compared to 2021.

"Tech companies which were beneficiaries of work-from-home (WFH) and remote schooling trends faced dramatic pull-back of their share prices amid normalized operations in a post-pandemic era," said Jim Hsiao, DIGITIMES notebook PC analyst, adding that inventories have peaked in Q2, but the slowdown in demand is more of a concern.

"Nevertheless, the changes in the top 20 rankings in 2022 are not significant, compared with the 2021 ranking. This reflects the leadership status of those companies in their respective territories," said Lo.

There are also some companies making notable advances. LG Energy Solution grabbed 8th place right in the first year of its IPO. Hon Hai Precision's ranking advanced 7 places to No. 14 this year.

Only 10 out of the top 100 companies reported growth in market cap year-on-year. They are Delta Electronics Thailand, Mitsubishi Heavy Industries, Ningbo Deye, Mahindra & Mahindra, Eicher Motors, Ginlong Technologies, Siemens India, Maruti Suzuki India, Ninestar Corp., and Bajaj Auto.

Semiconductor companies hit by geopolitical factors, business down cycle

Consumer electronic device manufacturers bore the brunt of the inventory correction, as the so-called 'pandemic bonus' recedes. That said, the chip makers also saw revenues declining sharply because customers started to cut orders, and an over-supply of memory products emerged. Though the challenges remain in 1H23, there are also signs to be monitored for robust rebounds in 2H23, said experts.

Geopolitical uncertainties such as the tightening US chip export control in October and the further addition of Entity List also increased the difficulties faced by tech supply chain manufacturers.

Semiconductor equipment makers in the ASC top 100 Market Cap ranking, mostly in Japan, saw their share prices hit because their sales in China will also be affected by the US restrictions.

Samsung Electronics received a double whammy from the decline in consumer electronic device demand as well as the memory chip price plunge. Memory chips contribute to 25% of Samsung's revenues, and 95% of that of SK Hynix, which ranked 15th in the ASC top 100 Market Cap ranking. There are still uncertainties ahead -- China's abrupt lockdown last year and ill-prepared reopening have impacted its economy while rising infection and futility have alarmed other countries. "The demand of China is very weak, so is Europe, which is likely to suffer stagflation next year," said Hsiao.

As memory chips are key components of PCs and smartphones, when those products' sales dwindle, so will memory chips. But it is worth noting that revenues of Samsung's foundry service business, display, and Harman held up quite well and even continue to grow.

Although companies such as TSMC and UMC have predicted that 1H23 will be the bottom of the industry downcycle, Andrew Lu, who has been an investment bank semiconductor analyst and now an independent investor, said "The end of the Ukraine war will be an important event to mark the end of the downcycle for the semiconductor industry." He estimated that the utilization rate of global semiconductor foundry manufacturers may fall to 66% in 1H23, which is much better than the 33% level in 1Q09, during the global financial crisis.

"Market conditions are changing rapidly, so it is very difficult to predict the utilization rate of semiconductor supply chains at this point of the year," said Eric Chen. "Currently the consensus of many analysts expects another significant drop in 1Q23, followed by a milder decline in 2Q23, which hopefully may be the bottom of the downcycle."

Changes by sectors

Source: DIGITIMES Research