The smartphone sector in 2022 experienced a similar situation as the PC industry. The pandemic bonus in 2020 and 2021 created a high baseline, which in turn resulted in a double-digit shipment decline in 2022 for the sector.

Fortunately, on one hand, the impact of negative factors like the Covid pandemic, the Russia-Ukraine war, and inflation has gradually lessened and will eventually be things of the past. On the other hand, the trends of 5G upgrades, foldable phones, and low-tier smartphone purchases in emerging markets have continued.

This meant that in 2023, the smartphone sector will be able to bounce back and see its shipment numbers increase again, albeit just slightly.

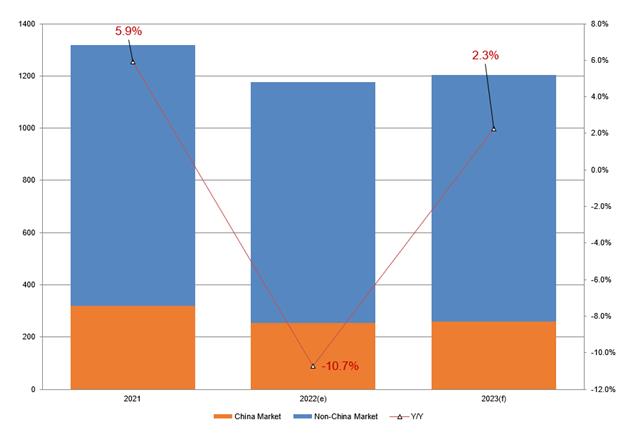

Global smartphone shipments are estimated to reach 1.176 billion units in 2022, a 10.7% YoY decrease compared to 1.317 billion units in 2021, according to data from DIGITIMES Research. This decline is largely caused by the decline in purchase power due to high inflation and a strong US dollar.

Another major contributing factor to the sector's poor performance in 2022 is the struggling China market, which accounts for over 20% of global smartphone shipments. Already dealing with a bad economic outlook, demand in China took a further hit in 2022 with the lockdowns and zero-Covid policy. Smartphone shipments in China are estimated to see a YoY decrease of over 20% in 2022, much worse compared to non-China markets, which are estimated to see a YoY decrease of around 7.6%.

Looking forward to 2023, global smartphone shipment is expected to slightly increase to 1.2 billion units, a YoY growth of 2.3%. As with China, due to continued pressure from its biggest competitor, the US, and its own compromised economic structure due to policy changes, demand may not be strong. Shipment in China is predicted to go from 255.2 million units in 2022 to 260.1 million units in 2023, a slight YoY increase of 1.9%.

Overall, 2023 is shaping up to be a year of gradual recovery. Negative factors from 2022, like the high global inflation caused by the Russia-Ukraine war and a strong US dollar caused by the Fed's aggressive rate increases, have resulted in a significant decrease in purchase power, especially among emerging markets. The impact from them will still linger, which limits how much the smartphone market can bounce back. More major growth is likely only coming in 2024.

In terms of brands, the top seven smartphone brands according to shipments are as follows: Samsung, Apple, Oppo, Xiaomi, Vivo, Transsion, and Honor. These seven brands are estimated to ship a total of 1.04 billion phones, accounting for over 86% of the global market share.

Regarding their outlooks for 2023, most brands have a more conservative approach to avoid building up inventory, believing that market demand will still be weak in the first half of the year and only see recovery in the second half. Nearly all brands predicted that their YoY growth for 2023 will be in the single digits, with most placing the figure below 5%.

The top two global brands, Samsung and Apple, both estimated a very modest level of growth. Samsung expects the gradual bounce back of emerging markets in the second half of 2023 can push its YoY growth to around 2.6%. Apple, expected to launch an upgraded version of the iPhone 14 in the second half of the year, is estimating a YoY growth of 1.3%. Apple's very conservative growth figures likely have to do with the ongoing pandemic-related issues its manufacturers in China are experiencing and the diversification of its supply chain.

The remaining five of the top seven are all Chinese brands and have mostly suffered from the struggling China market. Almost all of them estimated a YoY growth of under 5%. The only exception is Honor. Having found its footing in the China market in 2022, Honor plans to focus on the overseas market in 2023 and is expected to have a double-digit YoY growth, approaching 60 million units in total shipments.

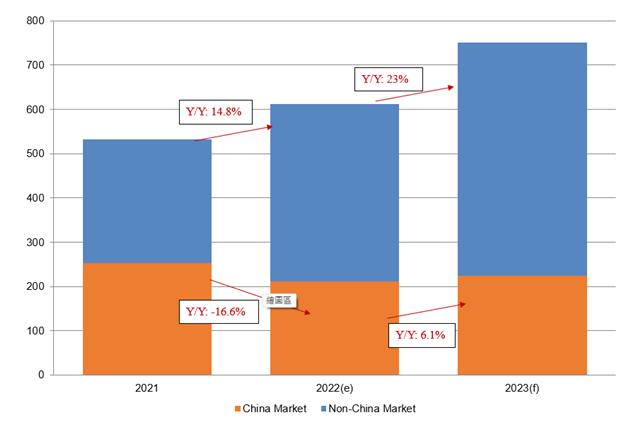

Amongst the overall bleak smartphone sector, one of the few positive trends is the rise of 5G smartphones. In 2022, approximately 611 million 5G smartphones will be shipped, a 14.8% YoY growth compared to 532.6 million in 2021.

This figure is even more impressive considering that the Chinese market saw a major decline in 5G shipments, reporting a YoY decrease of over 16% for 2022. The non-China markets were able to compensate for China's weak performance, reporting a 43.2% YoY growth.

According to DIGITIMES Research, in 2023, 5G smartphone shipments are estimated to grow by over 20% and will largely be fueled by the non-China markets as the China market slowly recovers from its current economic downturn. Markets outside of China are expected to account for more than 70% of the global 5G smartphone shipment in 2023.

The last trend to watch for 2023 is the diversification of the supply chain among major smartphone trends. The 2022 pandemic and China's shift in economic policy have resulted in many smartphone brands considering moving parts of their production outside of China, with India and Vietnam being the two primary locations brought up in discussions like this.

In 2022, Apple's manufacturers still have around 80% of the iPhone's production capacity located in China, but Apple seems determined to diversify the risks of having so much production concentrated in China. It's estimated that starting in 2023, Apple OEMs like Foxconn, Pegatron, and Wistron will be expanding their production in India and continue to improve the usage rate of the local production lines.

Samsung, already the least China-reliant major smartphone brand is also planning to equally allocate most (75-80%) of its production to India and Vietnam over the next 5 years.

Even Chinese smartphone brands cannot completely rule out shifting part of their production to India and Vietnam. In 2023, India is expected to account for 25-30% of its production capacity, with Vietnam expecting to account for 5-10%. Within the next 5 years, the production capacity of Chinese brands in China could drop below 50%.

Global 5G phone shipment, 2021-2023 (M units)

Source: DIGITIMES Research, December 2022

Global smartphone shipments, 2021-2023 (m units)

Source: DIGITIMES Research, December 2022