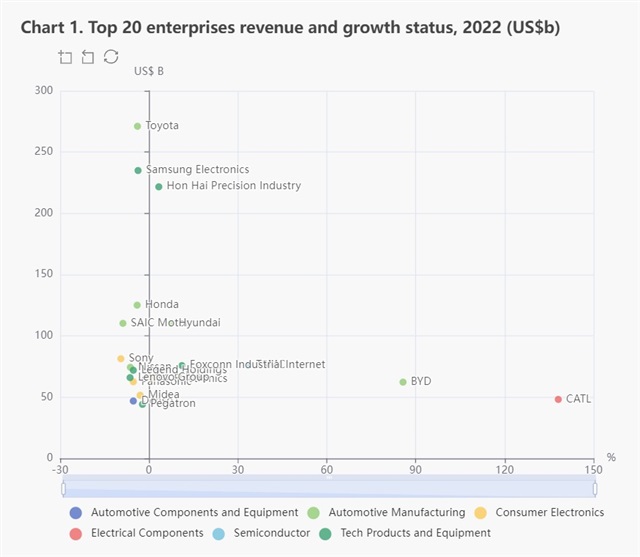

DIGITIMES Asia has unveiled the "2023 ASC 250 Rankings." In the post-pandemic era, the Russia-Ukraine war, and global inflation, more than half of the leading 10 companies are encountering a dip in their revenue growth rates. Notably, TSMC, the heavyweight champion of semiconductor foundry, leads the pack with an impressive revenue growth rate of 33.4%. However, within the top 20 companies, CATL stands out prominently, boasting a remarkable growth rate of 138%.

Source: DIGITIMES Asia

In a continuation of ASC 100 rankings released in 2022, aimed at delving deeper into supply chain dynamics, DIGITIMES Asia has extended its scope to showcase the elite 250 companies. This expanded ranking and comprehensive statistical analysis not only encompass conventional automotive titans but also closely monitor shifts within burgeoning industries. The objective is to deliver a more holistic overview of the supply chain landscape.

The ASC 250 survey encompasses approximately 5,000 enterprises hailing from various countries and territories: China (including Hong Kong), Japan, South Korea, Taiwan, Thailand, Indonesia, Malaysia, India, and others. Its primary focus lies on the technological and automotive supply chains within significant Asian economies, evaluating and ranking them based on financial metrics such as revenue and net profit. The study spans nine key sectors: consumer electronics, automotive manufacturing, automotive components and equipment, tech products and equipment, semiconductor, electronic components, electrical components, machinery, and solar.

The leading 250 companies exhibit a notable concentration within the east Asian region. Of these, 107 are situated in China (42.8%), 74 in Japan (29.6%), 37 in Taiwan (14.8%), and 20 in South Korea (8%). In contrast, a mere 12 enterprises from Southeast Asia and South Asia managed to secure positions on the ASC 250 list.

Eric Huang, the vice president of DIGITIMES overseeing this inquiry, emphasized that the rankings have undergone the most substantial shifts in numbers over the past three years, primarily between China and Japan, which correspondingly hold the positions of the world's second and third-largest economies. The data for this year vividly illustrates the ebb and flow of influence between these nations, with the most striking divergence apparent in the broader automotive sector and components related to EV batteries.

China's upward momentum hinges on this trend, while Japan's vigor, by comparison, has either remained stagnant or regressed. In 2022, its overall revenue witnessed a 3.9% year-on-year decline, making it the singular east Asian country experiencing negative sales growth. The proportion of Japanese enterprises included in the list also dipped below the 30% mark. This can be attributed to shortages in semiconductor components, late in rolling out competitive EVs, and a saturated demand for consumer electronics products.

"In the backdrop of diverse unfavorable macroeconomic factors from the previous year, fewer than one-third of companies achieved double-digit revenue growth rates. Under such circumstances, China's growth depends on sustaining high growth in the solar energy and EV-related sectors. China effectively harnesses the potential of its domestic market to propel industrial advancement, surpassing other countries and regions like Europe, America, and Japan," explained Eric Huang.

EVs and foundries are two main pillars of growth in Asia. Over the last two years, the pandemic spurred the sales of electronic tech products, creating a shortage in semiconductor fabrication capacity. However, with the end of the pandemic in sight, the demand for consumer electronic devices is slowing as saturation nears. Moreover, the deceleration in advanced economies, has led to a lack of substantial growth momentum in the utilization of contract manufacturing capacity.

On the contrary, the electric vehicle sector maintains its robustness. Looking ahead to the global EV market's evolution by 2025, DIGITIMES Research projects that global EV sales will hit 27.14 million units, with a penetration rate surpassing 30%. The compound annual growth rate (CAGR) of the EV market from 2021 to 2025 is anticipated to reach 42.5%.

The transition to EVs gives China an opportunity to leap ahead, outpacing its east Asian counterparts with a revenue growth exceeding 20% in the EV and battery supply sectors in 2022. However, following a phase of explosive expansion, EV sales cooled off in the first half of this year, leading to an oversupply of batteries and even instances of production line shutdowns and workforce reductions. Nonetheless, the Chinese government recently proclaimed an extension of new energy vehicle tax breaks until 2027. The industry players hold optimism for favorable policy measures that can sustainably boost demand in a market which had been impacted by the phasing out of subsidies at the end of 2022.

China turned into the biggest EV market, where both domestic and international players sparked a price war. The scale of state-backed support to China's EV industry far exceeds other nations' generosity, which is likely another similar playbook following the solar panels, to phase out rivals from other countries.

According to Eric Huang's estimation, amid the trade and technology wars between Washington and Beijing, China could secure a substantial market share in the global EV brand or its associated supply chain sectors, assuming EVs remain unsanctioned. This prospect could potentially disrupt the traditional automotive industry. Concerns from the US, EU and Japan revolve around China's influence, prompting endeavors to safeguard their own EV supply chains from homegrown automotive and national security standpoints. This initiative extends upstream to rare earth sources utilized in battery manufacturing, aiming to mitigate overreliance on China.

Analyzing the presence of companies from Southeast Asia and India on the list, it becomes evident that these enterprises are predominantly foreign-funded. This underscores the ongoing dependence of emerging markets on foreign investments for their domestic industrial growth. Local players still have huge rooms for catching up and meeting the minimum requirements for inclusion in the ASC 250 list. For instance, Japanese automakers established factories and supply chains in southeast Asia; however, substantial growth in the tech sector only transpired by diversifying sources of supply from China in the aftermath of the Sino-U.S. new cold war.

With India poised to become the globe's most populous country and a potential third-largest economy, coupled with the Modi government's resolute focus on bolstering domestic manufacturing and technology sectors through "Made in India," along with its expansive market size and labor force, the path of its development holds promise.

The transition in supply chains over the years becomes apparent through 2023's ASC 250: China, commands in terms of quantity with manufacturing heft, leaving Japan, Taiwan, and South Korea trailing behind. From the Sino-U.S. trade war morphing into a battle for advanced technology, multinational corporations falling victims to mounting risk are not immune to pressure to contemplate the "China plus one" strategy for alternatives. The question is, whether the emerging markets in ASEAN and south Asia, can successfully exploit the swiftly changing geopolitical environment and strike a balance between the world's superpowers.