As the US rallies Japan and the Netherlands to tighten up semiconductor export controls against China, the world has been trying to estimate the extent of damage done to the Chinese semiconductor industry, especially to China's leading foundry Semiconductor Manufacturing International Corp. (SMIC)

Under US pressures, ASML has since 2019 stopped shipping its extreme ultraviolet (EUV) lithography machines. However, following the US export controls introduced last October against Chinese semiconductor industry that covered logic chips at 16/14nm or below, deep ultraviolet (DUV) machines have been under growing spotlight.

Current sanction list only reflects ASML's preferred scenario

According to ASML's statement on March 8, 2023, it will need to apply for export licenses to ship the most advanced immersion DUV systems. However, it will take time for these controls to be translated into legislation and take effect.

Notably, in the statement ASML indicates that the additional export controls "do not pertain to all immersion lithography tools but only to what is called 'most advanced.'" Since ASML has not received any additional information about the definition of 'most advanced', it interprets the reference as TWINSCAN NXT:2000i and subsequent immersion systems. Meanwhile, citing an anonymous source, Bloomberg reported on March 13, 2023 that ASML is planning to restrict the sales of three immersion systems: TWINSCAN NXT:2000i, NXT:2050i and NXT:2100i.

As the parameters of export controls remain vaguely defined, DIGITIMES Asia analyst Eric Chen believes that the potential scope of export controls negotiated between the Netherlands, the US and Japan could be wider, pointing to Washington's resolution to constrain Chinese advanced process technology development. The three aforementioned argon fluoride immersion (ArFi) DUV systems, according to Chen, likely only reflects ASML's preferred scenario.

Even though conventional ArF lasers can only bring feature size down to 57nm technology node, immersion lithography allows ArF laser to further shrink feature size down to 38nm. With the aid of multiple patterning, ArF immersion DUV machines can further overcome lithographic limitations and produce chips at 16/14nm nodes. In other words, a ban on immersion DUVs can impede not only Chinese 16/14nm development, but also 28nm process technology.

Noting the ongoing negotiations between Washington and the Hague, Chen doesn't rule out the possibility that the US export controls on lithography machines will be rolled out progressively. While the most likely scenario will see certain advanced immersion systems falling under US export controls, the full scope of US sanctions might cover all immersion lithography systems.

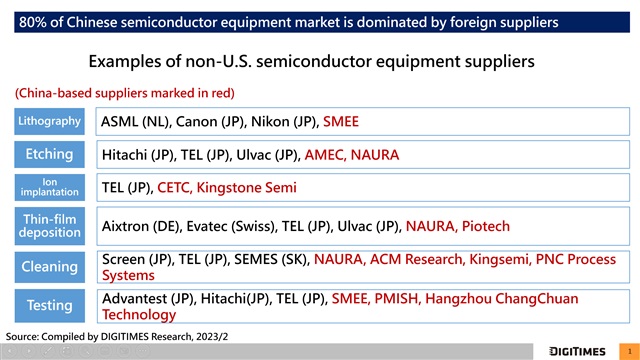

Chinese semiconductor equipment market dominated by foreign suppliers

Currently, more than 80% of China's semiconductor equipment market is dominated by suppliers not based in China. For example, ASML, Nikon and Canon lead the lithography segment, while Shanghai Micro Electronics Equipment Co. (SMEE) is the only China-based lithography machine supplier.

Other equipment segments such as etching, ion implantation, coating, wafer cleaning and testing have been led by players based in the US, Japan, Germany, Switzerland, and South Korea. Even though China is cultivating domestic champions like Advanced Micro-Fabrication Equipment Inc. China (AMEC) and NAURA Technology Group Co., these domestic players are still years behind their international peers, especially when China's semiconductor equipment ecosystem is not complete enough to support advanced process development.

The piling US semiconductor curbs against China will certainly impact the production level of the Chinese chip industry. On the demand side, according to Chen, industrial downturn will decrease domestic demand for production capacity. As IC design houses or brand companies seek production diversification to reduce geopolitical risks, demand for China-based production capacity will be further dented.

The only silver lining to the adverse situation would be the mid-to-long term demand for chip production capacity, particularly specialty process technologies, driven by Chinese 5G, AI and EV developments.

According to DIGITIMES Research, when it comes to 12-inch wafers, SMIC's capacity is estimated to grow from 160,000 wafers per month (WPM) in the end of 2022 to more than 190,000 WPM by the end of 2023. For 8-inch wafers, the capacity is expected to remain the same at 350,000 WPM.

Questions to be answered

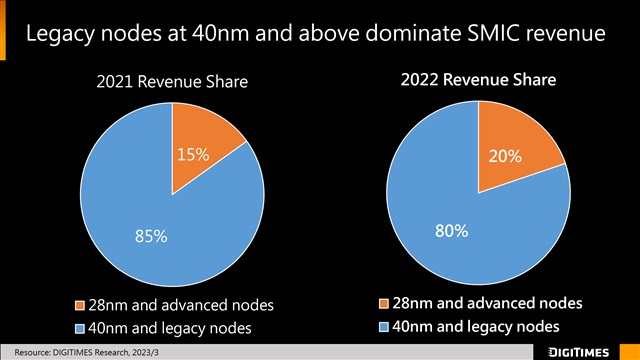

With the full scope of US sanctions remaining unknown, Eric Chen also drew attention to a potential issue that has largely evaded mainstream discussion: with China's legacy and advanced nodes at 28nm and below coming under sanctions, who can fill the capacity gap as the supply of 28nm production capacity remains tight? SMIC, for example, has been a major contributor to legacy capacity: as of 2022, 80% of SMIC revenue came from legacy nodes at 40nm and above, while advanced nodes at 28nm and below only accounted for 20%.

Moreover, according to Chen, the current US sanctions still leave loopholes, as the chemicals necessary for semiconductor production - a sector led by Japan - are not covered by the current export conrol regime.

Finally, Chen also raised the possibility that the US would gain better insights into Chinese industry's chip design capabilities as Chinese chipmakers turn to foundries based outside of China, though it remains to be seen to what extent the foundries in question would be willing to cooperate with Washington's requests.

Chart 1: China's semiconductor equipment self-sufficiency remains to be strengthened

Credit: DIGITIMES

Chart 2: Legacy nodes still contribute to more than half of SMIC's revenue

Credit: DIGITIMES

About the Analyst

Eric Chen is an Analyst and Project Manager at DIGITIMES Research. Chen received his Master's degree in International Business from Taiwan's Soochow University. His research focuses on foundry industry as well as IC assembly & packaging industry.