The "Art of War" maintains that if you know the date and place of the battle, you can be well-prepared for it even if your troops have to march a thousand miles before engaging the enemies. The International Monetary Fund (IMF) has given us a framework for thinking about the future: In 2030, there will be a reshuffle of the rankings of the world's biggest economies. But if there are human interventions, how can we look at the unknown future?

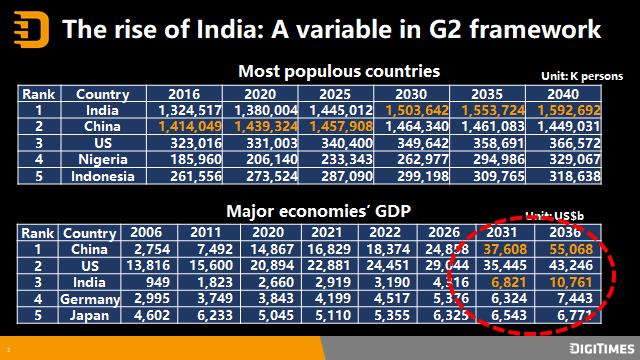

According to the IMF survey, in 2031 China will overtake the US as the world's biggest economy, with the US demoted to second place and Japan to fifth, and India and Germany staying strong. Western countries and industrialized countries in Northeast Asia are seeing their populations aging. But India's total population will reach 1.5 billion by 2030 and will surpass China to become the world's most populous country.

There are things that can be learned from China's experience. The Indian government has adopted a more aggressive industrial development strategy by opening its market to a certain extent, and wooing foreign investments from around the world. We are seeing a very different Indian government, and expect India to become one of the fastest growing among Asia's major economies. Driven by economic growth momentum, India will implement more industrial policies, targeting even the higher end of the display panel and semiconductor industries.

At the end of June, Young Liu, chairman of the world's largest EMS firm, Foxconn (Hon Hai), visited India and met with Indian prime minister Narendra Modi for 80 minutes. The scope of cooperation between the two sides was not only for the manufacturing of Apple's iPhones; they also disclosed later that they had talked about collaboration in semiconductor and electric vehicle (EV) businesses.

Credit: DIGITIMES Asia

From 1990 to 2020, China enjoyed a high degree of demographic dividend in the development of its technology industry. In the early stages, China provided abundant labor force and low social costs. But following the launch of the iPhone in 2007 and the success of the Beijing Olympics in 2008, China seized the opportunity of the mobile age and made efforts to develop its local industries, and created Internet giants of its own.

China's successful model has been followed by ASEAN and South Asian countries, and "techno-nationalism" will become the focal point of the international situation in the post-pandemic era. India will follow in China's footsteps to create its own Internet giants. According to CB Insights, 68 of the world's 1,170 unicorns as of the end of June 2022 came from India, thanks to the country's large population and the advantage of widespread use of the English language.

However, while the demographic dividend will support the development of the "platform economy," the value of the real economy must be realized; otherwise the rewards of economic growth will remain too much in the virtual world, with large parts of the general public who depend on the real economy to be left out.

Many people applaud Israel's achievements in developing communication services and semiconductor design. But many Israeli companies sell their businesses before they get fully mature and then move on to the next business. Israel's startup firms can certainly reap high profits, but after all, only a small number of people can engage in high-tech R&D, and the distribution of social resources and wealth will also become a social problem.

In Taiwan, the situation is rather different. There are more than 300,000 people working in Taiwan's three major science parks alone, and 320,000 people in the semiconductor industry contribute 12% of Taiwan's GDP. And there are nearly one million people working across all sectors of the electronics industry supply chain nationwide, and even the financial sector benefits from them.

Taiwan's upstream-downstream integration and complete ecosystem is a model of tech industry development that ASEAN and South Asian countries can learn from. It is no surprise that ASEAN and India have been wooing investments from Taiwan. ASEAN countries, with their markets and abundant work forces and engineers, are indeed very good potential partners for Taiwan. But at present they have limited understanding of Taiwan's industry, and Taiwan also has a lot of concerns about the labor laws and infrastructures of these countries.

Nouriel Roubini has warned that the economy is heading towards a long and severe recession. Compared to other industries, the semiconductor and ICT supply chains are forward-looking ones with high value-add. We must step up two-way communication efforts and accelerate Taiwanese firms' move to ASEAN and South Asia, in order to preserve the momentum of recovery for the international community.

(Editor's note: This is part of a series of articles that revolves around the issues of the US-China confrontation, but focuses on the problems that Taiwan, Japan, Korea, ASEAN, India and other emerging Asian countries have to face in their industrial strategies and ICT supply chains.)