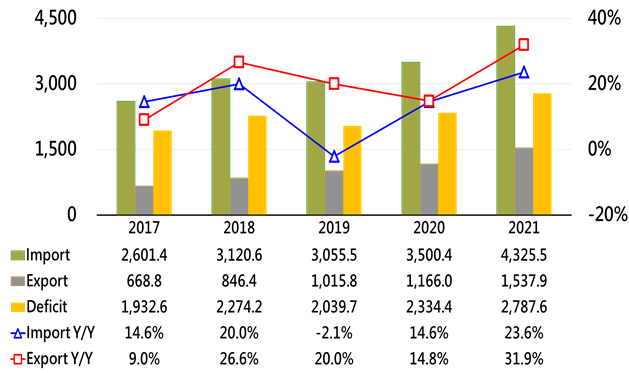

DIGITIMES Research recently conducted a survey of China's IC design industry. According to the data collected, China's total semiconductor imports in 2021 reached US$432.5 billion, up 23.6% from 2020, while exports totaled US$153.8 billion, up 31.9%, with a trade deficit of US$278.7 billion. Customs data is usually not too far off, but Taiwan is a major semiconductor producer and yet its exports reached only US$155.5 billion in 2021, so the structure of China's imports and exports clearly needs more explanation.

China's exports are large, including the contribution of Samsung Electronics and SK Hynix, with more than 40% of Samsung's NAND flash and SK Hynix's DRAM coming from Chinese factories, and of course there are several large foreign semiconductor plants in China, such as TSMC's and Intel's.

Secondly, China's semiconductor packaging and testing industry ranks second in the world after Taiwan, and the proportion of importing semiconductors for final packaging and testing and then exporting should not be low. Finally, it is also possible that Xiaomi, and even overseas factories of Taiwan-based companies such as Foxconn (Hon Hai), Pegatron, and Wistron, source some of their semiconductors from China, so it is possible that they first import components and then export them.

As for the semiconductors to be used in China, they should be basically differentiated between domestic market demand and processing and assembly for export, such as assembling cell phones for Apple and assembling computers for HP, Dell, Acer and Asus.

Both Taiwan and South Korea export 60% of their semiconductors to China, while China still produces a low percentage of its own semiconductors for use in its own market. The CEO of SMIC, Haijun Zhao, estimates that percentage at about 5% and DIGITIMES puts it at 6.1%. This reflects the current situations.

However, according to a survey conducted by the China Semiconductor Industry Association's design branch, China's IC design industry had total revenue of CNY458.7 billion (US$67.94 billion) in 2021, contributing 43.2% of the entire semiconductor industry's output value, and the number of practitioners in the thriving IC design industry increased from 200,000 in 2020 to 225,000.

As for Taiwan, its IC design industry output was US$44.8 billion, and according to the data of Taiwan Semiconductor Industry Association (TSIA), there are nearly 50,000 practitioners in Taiwan's IC design industry, including 36,000 R&D personnel and 13,500 non-R&D personnel. The figures lead us to question whether we are doing such comparisons of Taiwan and China on the same bases.

The per capita output value of Taiwan's IC design industry far exceeds that of China. The total output value of the global IC design industry is only US$189.9 billion, so if China's data is taken at face value, it means China accounts for one-third of the world's total.

If we interpret China's industry from the country's publicly disclosed data, it will be easy to come to misleading conclusions. At present, 49 Chinese IC design companies are publicly traded, which means their information can be more easily accessed, helping researchers better understand China's semiconductor industry structure.

China IC imports and exports, 2017-2021 (US$100m)

Source: China customs data, compiled by DIGITIMES, June 2022