Huawei's success in having its self-developed SoC produced with 7nm technology by SMIC, China's largest wafer foundry service provider, stunned the world. Since Huawei is unable to access EDA tools from US companies, how did they design the new chip? Are made-in-China EDA tools any good?

In a webinar hosted by Nikkei Asia, Dan Hutcheson, vice chair of TechInsights, tried to draw the audience's attention to the EDA tools with a similar question but was unsuccessful. Hutcheson discussed the latest Huawei Mate 60 Pro smartphone chip and geopolitical topics surrounding US export controls with Chris Miller, the author of the bestseller Chip War, and two Nikkei journalists, who told interesting stories about Huawei's effort to build up its own semiconductor supply chain, from EDA to packaging.

"The real question here is, how did they get the EDA to pull this off? It wasn't a question of whether the designers that HiSilicon are capable, the real interesting question is where did the EDA tools come from?" Hutcheson asked.

Since the world's most dominant EDA players which enjoy approximately 75% of global shares combined in 2021 – Synopsys, Cadence, and Siemens Mentor -- are all based in the United States and have been restricted from providing advanced EDA tools to companies that are on the US government's Entity List, how on earth did Huawei and its IC design arm HiSilicon get access to the EDA tool to design the 7nm chip and have it manufactured in such a short time?

"They would be stopped pretty cold, and they were stopped pretty cold. And there's no way that we can tell by just looking at the chip of how that came. It looks like they may have made major progress in the case of EDA, just like they did when they were locked out of having Android and they just designed their own operating system within about 13-14 months," said Hutcheson.

As there are reports saying that China is using AI to shorten its learning curve in developing domestic EDA tools to design chips, perhaps one should not rule out any possibility. A senior industry expert told DIGITIMES Asia China's EDA industry may have made significant progress since the Chinese government has been spending big money subsidizing its own EDA industry. "And we heard that EDA big companies get thousands of cyber attacks every day from you know where."

Export restriction not hitting on the spot

While EDA IPs are not subject to export restriction, it is important to note that only the EDA software required to design ICs with GAAFET architecture is under export embargo. The foundry service providers in China, including SMIC, are mainly producing chips in mature nodes.

As GAAFET is used in processes below 3nm, and Huawei's Kirin 9000S was produced with SMIC's N+2 7nm technology, which is basically FinFET-architecture, it is quite safe to say that the related EDA tools required for designing the Kirin 9000S chip are readily available in China.

"Since HiSilicon already had the ability to design 7nm chips before the US government put it under Entity List, taking the old design of the previous generation chip (Kirin 9000) and doing some upgrades and adjustments is also workable to have the new chip design ready for foundry manufacturing," said Eric Chen, semiconductor analyst of DIGITIMES Research.

Even though suppliers should not have transactions with Huawei and HiSilicon, including the EDA tools that contain US technologies, due to the fact that Huawei and all of its subsidiaries and affiliations are now under the Entity List restrictions, industry experts also point out that they may also use pirated EDA software to do the job. It turns out, an ex-HiSilicon Belgium subsidiary employee told DIGITIMES Asia, in 2019 when the ban on Huawei/Hisilicon was installed, they bought an enormous amount of licenses for 10 years, and 7nm was then supported by the tools.

Since the cost of producing Kirin 9000S must be prohibitively high due to multiple patterning processes, how Huawei managed to get SMIC to manufacture the chips for them without considering commercial feasibility is the most perplexing part of the incident for many analysts. "Unless there is a 'greater power' instructing SMIC to do it anyway because the money will be taken care of," said Eric Chen.

China's blossoming EDA industry

Nevertheless, China's EDA industry is indeed flourishing. Empyrean Technology, the largest domestic EDA tool company in China, reported a 51.9% growth in revenues for the first half of the year, totaling CNY404.8 million (US$55.6 million), compared to the same period last year. Net earnings attributable to public company shareholders increased by 107.3% year-on-year in 1H23.

Empyrean went public in July 2022, and its share price was up by 39% as of October 4, 2023, already coming down from a 61% surge in April 2023. Its sales in 2022 increased by 38% from a year ago to CNY798 million (US$110 million). The growth number is much higher than the 16-17% sales growth during the same period reported by SEMI for the Asia Pacific region.

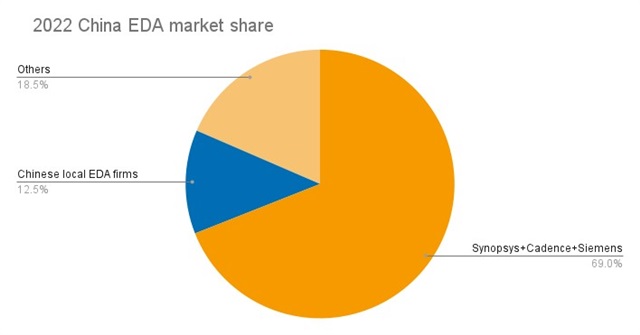

In its 1H23 earnings report, Empyrean said it garners more than 50% of the domestic EDA market currently shared by local companies. According to ChipInsights, the overall revenue of EDA companies in Mainland China in 2022 accounted for 2% of the global market and 12.5% of the domestic market. Empyrean also claimed to fully support 7nm process node earlier this year.

Source: ChipInsights Institute, compiled by DIGITIMES, Oct 2023

Besides Empyrean, Huawei's rotating chairman Xu Zhijun said earlier this year that Huawei is expected to finish testing on EDA software for 14nm and more advanced chips this year, and the software suite was developed in collaboration with domestic EDA companies, "basically realizing the localization of EDA tools for processes above 14nm."

Primarius, another EDA company that had its IPO in 2022, claims to have developed independent and controllable EDA core technology, able to support 7nm/5nm/3nm and other advanced process nodes and FinFET, FD-SOI, and other types of semiconductor processes.

There are dozens of startups in the EDA field in China, including Shanghai Ledatech, Shenzhen SMiT's S2C, XEPIC, Shanghai Univista, and Cellixsoft. S2C is also seeking to list its stock on China's Growth Enterprise Market. In 2022, 24 local EDA companies completed 28 financing rounds with a financing amount of more than CNY8 billion, a decrease of nine in the number of companies involved in financing compared to 2021, and a decrease of 15 in the number of financing rounds compared to 43 in 2021.

Xpeedic Corporation co-founder and SVP Dai Wenliang said in an interview that China has talent with experience and knowledge in producing its own competitive EDA tools for specific and niche applications. He said many local governments in China are subsidizing IC design companies to use local EDA tools for their work.

A Chinese EDA company executive said he is optimistic about the outlook of China's local EDA industry because there are growing EDA market demands unleashing new demand in niche areas and opportunities for domestic substitution.

Editor's note: Correct the company name "Hefechip" to "Xpeedic" and the title of Dai Wenliang to "SVP" in the second paragraph from the bottom.