The supply chain of Asia's ICT industry has evolved from a PC-driven era to an era led by mobile communication over the past 30 years. The smartphone and notebook markets have driven the ups and downs of the Asian supply chain. Ushering in the booming era intertwined by 5G, low-Earth orbit satellites, EVs, and future cars coupled with emerging diverse applications, leading players of different sectors are advocating a new "application-driven" trend.

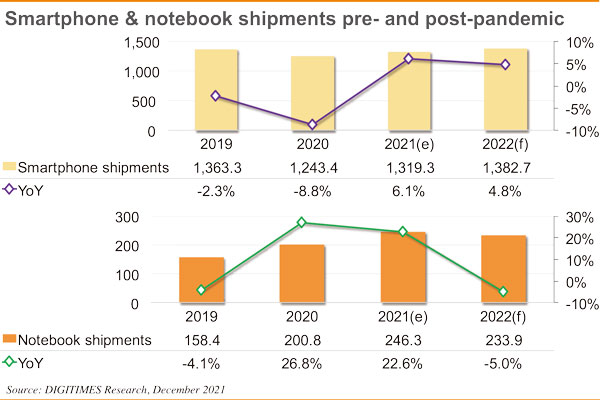

Under the impact of the COVID-19 pandemic, plus the G2 conflict and the industry's strategic shift from the past brand-oriented practice to application-driven mode, the supply-and-demand model of the global ICT industry is undergoing an unprecedented change. Take smartphone sales as an example. The sales volume in first-quarter 2021 skyrocketed to 344 million units from 230 million units in first-quarter 2020, with a remarkable growth rate of 49.5%. However, it dropped to 377million units in the peak season of fourth-quater 2021 from 398 million units in fourth-quarter 2020, with a slight decline of 5.2%. DIGITIMES Research has completed the statistics of global mobile phone shipments in 2021, estimating that global mobile phone shipments grew from 1.243 billion units in 2020 to 1.319 billion units in 2021, with a moderate growth rate of 6.1%.

As for the computing market, the shipment of notebooks grew from 200.8 million units in 2020 to 246 million units in 2021, with an impressive growth of 22.6%. Some notebooks were even exported by air to cope with the problems of port congestion. Even so, we can predict that the surging demand of the notebook industry is coming to an end, and shipments are forecast to shrink to 234 million units in 2022, with a 5% decline from 2021. The business opportunities for servers and cloud applications are just taking off. We can even sense self-driving business opportunities are arising let alone the highly anticipated EVs.

The future cars encompass dual characteristics empowered by both manufacturing and service sectors. BMW's new vehicle with magical exterior color change developed by E Ink released at 2022 CES was indeed eye-catching. The progress of AUO and Innolux in car panels also reminds us the panel technology has a role to play in the future self-driving area.

It is worth exploring the significance of "silicon content" and the strategic value of Taiwanese and South Korean semiconductor industries behind these emerging applications. The global semiconductor market has exceeded US$550 billion in 2021 and expected to reach US$600 billion in 2022, with the whole ICT community anticipating to mark the US$1 trillion milestone. If TSMC's market share remains unchanged, it may have 100,000 employees then. The impending issues of talent and power supply need to be addressed. We have often heard government officials say that "utility, public facilities and infrastructures" are the undeniable responsibility of the government. The toughest challenges for Taiwan's semiconductor industry are not business opportunities or technology, but the limits of government capabilities!