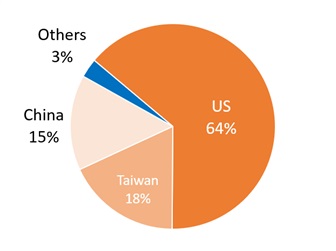

In 2022, the overall revenue of the global IC design industry reached US$215.4 billion. Among them, the US IC design sector is the largest in scale, with a 63% market share and revenue of over US$130 billion. Taiwan's IC design sector is the second largest in the world, with an 18% market share and revenue approaching US$40 billion. China comes in third, with a market share of nearly 15%.

As with Europe, Japan, South Korea, and other countries, they are home to a few IC design houses but haven't quite reached the scale of the US, Taiwan, and China.

Taiwan's IC design sector specializes in digital IC, with a global market share reaching 12%. In contrast, Taiwan's analog IC is estimated to have a global market of around 5%. As with memory and discrete components, Taiwan has a limited presence on the global market, with shares of less than 2%.

Observing the top 10 IC design houses in the world can reflect the development trends of IC design houses in Taiwan, the US, and China: in 2012, there were 9 US companies in the top 10, with a total global market share of over 50%. The only Taiwanese company making to the top 10 back then was MediaTek, which had a market share of 5% in terms of revenue. There were no Chinese IC design houses on the list.

Fast forward to 2022, 6 US design houses were still among the global top 10. They maintained a market share of over 50%, showing that the US is still the frontrunner in the global IC design sector. MediaTek, Realtek, and Novatek were the 3 Taiwanese IC design houses that entered the top 10. Huawei's Hisilicon and Tsinghua Unigroup dropped out of the top 10, despite making it in 2017, due to US sanctions and bankruptcy reorganization, respectively. Despite that, Chinese supplier Willsemi still made it at no.10 after acquiring US-based CIS maker OmniVision.

In terms of the different market segments for semiconductor products, the US still holds the leading market share in several major markets. Major US IC design houses like Qualcomm, AMD, Broadcom, NVIDIA, and Marvell are global leaders in smartphone chips, CPUs, GPUs, and networking chips. This gave them a dominant position in system architecture-related microprocessors/SoCs.

Taiwanese IC design houses achieved high market shares in peripheral chips like phone and consumer electronic SoCs, display, communication, audio, and other I/O. For example, MediaTek is right alongside Qualcomm as a leader in smartphone APs. In processors for Chromebooks and non-Apple tablet devices, MediaTek has sole possession of the top spot.

In addition, companies like Novatek, Himax, and FocalTech are the main suppliers for DDIC (display driver IC) and TDDI (touch and display driver integration). MediaTek's and Realtek's networking chips, as well as Phison's and Silicon Motion's client SSD control chips, all have high market shares. As with interface ICs like USB, PCle, and HDMI, Realtek and ASMedia are important suppliers to the international market.

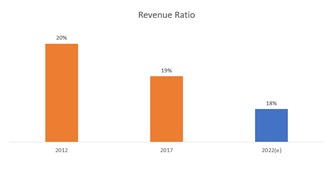

Taiwanese IC design's estimated revenue share of the global IC design sector's output value

Note: Calculated based on companies' HQ locations.

Credit: DIGITIMES Research, March 2023

Taiwan accounts for nearly 20% of the global IC design revenue, which is estimated to be US$215.4 billion in 2022

Note: Calculated based on companies' HQ locations.

Credit: DIGITIMES Research, March 2023

Editor's note: At the Taiwan IC Design Industrial Policy White Paper Presentation scheduled on March 28, Taiwan Semiconductor Industry Association (TSIA) will release its IC Design White Paper to guide Taiwan's semiconductor policy. As a co-organizer, DIGITIMES will publish a series of articles to summarize the document. The white paper will be available for download after the event.