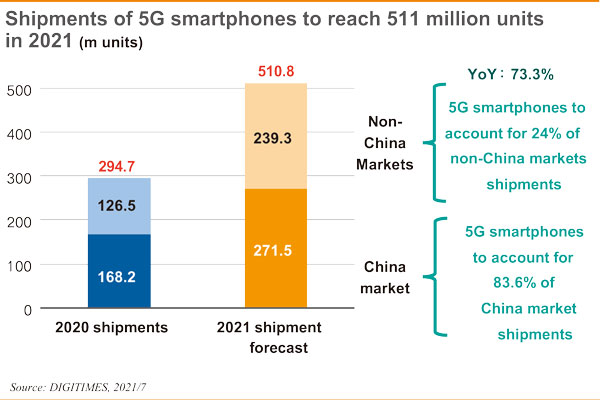

Following the 5G commercial launch, 5G handsets have experienced a surge in shipments since 2020, and China is the foremost market in terms of volume, keeping other countries at bay.

According to DIGITIMES' survey, global sales of 5G handsets amounted to 295 million units in 2020, accounting for 23.7% of the global smartphone shipments. The Chinese market alone contributed 168 million units, accounting for 57% of the global total. Global 5G hadnset shipments are projected to reach 510 million units in 2021, with an on-year growth of 73.3 %. Even though the Chinese market share will slightly slip to 53.1%, it is still a jaw-dropping proportion.

The Chinese market accounts for more than half of the global 5G smartphone market, thanks to the Chinese government's advocacy of domestic demand supporting local industries. In the wake of US-China trade frictions, China is expecting to leverage its huge domestic market to attract foreign investments, and keep close ties with IT manufacturers. The 5G infrastructure and environment are key platforms for creating supreme value for the Chinese market.

However, under the pressure of worsening US-China relations, Didi Chuxing's severe setbacks have inevitably deterred Chinese startups from going public in the US. According to CB Insights, as of early July 2021, there are 750 unicorn companies in the world, but the proportion of Chinese companies has dropped from 24% in the past to 21%. Following the Didi incident, European and American investors will naturally reevaluate Chinese companies in the Internet services sector. If China cutting off the way for Chinese companies to raise funds, or cutting off the way for corporate funds to leave the country?

The Chinese government undoubtedly is constructing more surveillance and control of networking activities. A centralized government will never tolerate private enterprises like Alibaba who is seeking to establish a tight relationship with 600 million people through electronic payment and online lending. This is two sides of a coin. Greater tolerance granted for private companies may stimulate greater business leeway and invigorate companies and industries. More conservative measures - such as setting the upper limit for the number of netizens, and regionalizing businesses - will avoid resources from being monopolized, but they will forfeit the huge business opportunities that China's 1.4 billion population may bring. Policymaking is a double-edged sword. It is the biggest responsibility and privilege of policymakers to make the most valuable strategic judgments at different times.

Metcalfe's Law tells us that more network nodes fetch higher market value. But once the government puts ceilings on enterprises, business is constrained to develop within the fixed framework, triggering a relapse to what Chen Yun - an influential Chinese communist official - called "bird cage economy." China's dilemma is ubiquitous, and we are observing the trends in China and the world from the best perspective.

(Editor's note: This is part of a series of analysis by DIGITIMES Asia president Colley Hwang about the global IT supply chain.)