LiDAR is rising to be the emerging component differentiating car models in China. According to Evan Chen, an analyst with DIGITIMES Research, global automotive LiDAR shipment is expected to reach 500,000 units in 2023, with China taking up at least 80% of it.

Shortened for light detection and ranging, LiDARs have grown critical as automakers start to invest more resources in advanced driver assistance systems (ADAS) and autonomous driving technologies.

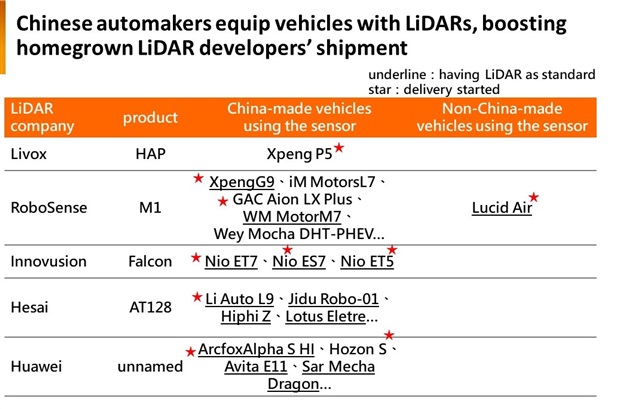

At the Shanghai auto show in April, more cars were rolled out with LiDARs. China-based CnEVPost reported that among the 38 models equipped with the sensors, 18 used domestic supplier RoboSense's LiDARs. Other major suppliers include Hesai Technology and Innovusion.

Chen said worldwide shipment of passenger car-used LiDARs was about 150,000 units in 2022. The number largely resulted from China's homegrown automakers launching and delivering models that enable Level 2 vehicle autonomy with LiDARs. For example, Hesai shipped 20,000 LiDAR units just in December 2022, primarily because Li Auto adopted the technology.

As for 2023, Chen said global automotive LiDAR shipment is projected to achieve 500,000 units. China will contribute 80% to 90% of the deliveries. He said carmakers tend to equip their vehicles with LiDAR or other advanced technologies to stand out from rivals in China, which has a highly competitive EV market.

However, Chen said most LiDARs on the vehicles have not been activated. Automakers would tell customers that the sensors would start working in the coming years through over-the-air updates, he added.

While LiDARs have not functioned as they should, Chen said they have boosted China's car market. Primarily, medium- to high-priced vehicles will come with LiDARs because those vehicles' owners are more likely to be able to afford the technology.

Another driving force for LiDAR shipment will come from cars made in Europe, the US, Japan, and South Korea, according to Chen. He said a few countries have approved L3 vehicle autonomy on the road, which will gradually increase LiDAR adoption.

Mercedes-Benz has developed Drive Pilot and Honda Motor has Sensing Elite. Both are L3 systems. Volvo Cars will begin producing the EX90 model by the end of this year, equipped with its Ride Pilot that can achieve the same level of autonomous driving.

Source: Carmakers and LiDAR companies, compiled by DIGITIMES Research

LiDAR prices must lower to increase adoption

Chen said the average price of the LiDAR hardware is about US$1,000. He expected the cost to fall below US$500 by 2030 to grow adoption. The analyst said LiDARs are challenged by cameras and radars that can enable standard ADAS features at a lower price.

In addition, he said LiDARs are adopted by medium- to high-priced vehicles in China, which account for a limited proportion of the market. To bring the sensor to the medium or lower price market, reducing the cost would be a challenge and priority.

Chinese LiDAR developers have gained a global presence. According to Chen, RoboSense has won orders from the US-based Lucid besides supplying XPeng, GAC Aion and other domestic brands.

He said Hesai will likely see more interest from US and European carmakers after gaining momentum in 2022 with Li Auto. US-based robotaxi developers like Cruise also use the company's LiDARs.

Chen added that Hesai leads the ISO Automotive Lidar Working Group and initiated the pre-research work on ISO standards for automotive LiDAR test methods. The company's contribution shows its leading position in the industry.

About the analyst

Evan Chen holds a master's degree in library and information science from National Taiwan University. His research focuses on autonomous driving technology, ride-hailing service/mobility as a service (MaaS), EVs and batteries.