While being a world-leading electronics manufacturer, Japan has not expanded its legacy to the fast-growing automotive battery manufacturing. With Panasonic as the only battery maker competitive in the world, the industry still needs efforts from the public and private sectors to foster growth.

A DIGITIMES Asia recent report, "2022 EV battery value-chain outlook in Asia," provides a comprehensive overview of the Japan EV battery industry. Below is the summary of the report.

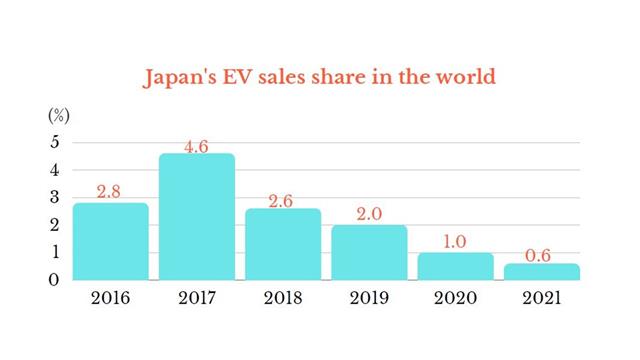

Japan's electric vehicle (EV) market penetration rate has been less than 1% in the past 10 years. Its global market share in EV sales is also far lower than neighboring China and South Korea.

Source: DIGITIMES Research

In addition, Japan's EV battery makers are conservative in expansion compared to Chinese and South Korean competitors. Even Panasonic, which manufactures batteries for Tesla in the US, has announced only a few projects in recent years.

However, the situation may get improved in the coming years. The Japanese government has announced to ban new internal combustion engine(ICE) vehicles sales after 2035. As a result, the need for EV batteries will increase. Panasonic will establish a facility in Wakayama to manufacture 4680 batteries for Tesla initially. Nissan will build a plant in Ibaraki prefecture with an annual output of 6GWh. TDK, a major electronics components supplier, has also entered the EV battery business as well.

Although Japan has not prospered in battery manufacturing, it has devoted itself to developing solid-state batteries. Legacy automakers like Toyota, Honda and the Renault-Nissan-Mitsubishi Alliance have invested in the technology and targeted the adoption between 2025 and 2030.

Realizing Japan needs to grow its global presence in the automotive battery industry, the government has initiated several projects to facilitate growth, including a JPY100 billion (US$864 million) investment and a subsidy program.

Additionally, more than 50 Japan-based enterprises established the Battery Association for Supply Chain (BASC) in April 2021. The organization will collaborate with the government to build a domestic EV battery recycling ecosystem to extract precious metals from spent batteries. It would also offer advice to the government to strengthen the country's battery supply and competitiveness.

To get the full content of this article, you may download the report via "2022 EV battery value-chain outlook in Asia."

Editor note: DIGITIMES Asia just released a series of industry reports, focusing on the "2022 EV battery value-chain outlook in Asia." The reports are divided into 3 parts – Overview of East and Northeast Asia EV battery supply chains, Southeast Asia, India EV battery and material supply chains, and EV battery tech trends and promising startups. These member-exclusive reports are now available for EV Weekly Subscribers.