In the 1990s, Intel, the peerless CPU market leader, even produced motherboards, challenging Taiwan's motherboard makers. Was Intel really interested in making motherboards? Certainly not. It was Intel's intention to use its self-made motherboards to motivate Taiwan makers to upgrade their skill level. It's very similar to TSMC's strategic purpose of developing technology of IC packaging and testing. Intel purchased PCBs from Taiwan to assemble motherboards in Puerto Rico that offered cheap labor with strategic purpose of selling advanced microprocessors to Taiwan makers and seeking vertical integration for the maturing market at the same time. Intel was eyeing a winner-take-all plan. But Intel's plan never succeeded, or the notebook and mobile phone supply chain would not have thrived, and it would have even wreaked havoc on the IC design industry.

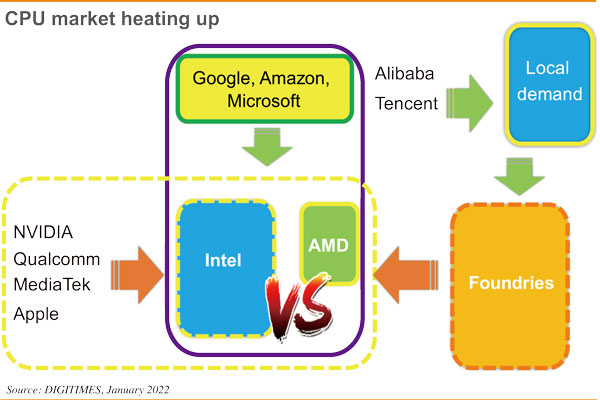

At that time, Intel knocked out AMD. After Lisa Su took office as AMD's CEO, she drastically changed the strategy to make good use of TSMC's production capacity, staging a strong comeback in advanced node processes, subduing Intel that hit a snag at 10nm and 7nm. AMD has survived. After gaining ground in the mobile phone market, Apple is eager to cash in on business opportunities of high-performance computing. Besides, Nvidia has seized a strategic foothold in the AI and metaverse markets, relying on the manufacturing capabilities of its foundry partners.

Qualcom and MediaTek are also taking actions. Will Google, Amazon, Microsoft ignore the business opportunities of self-driving chips, AI and metaverse? Of course not. Neither would the Chinese players miss the opportunities to compete head to head with the US Internet giants.

Under the intense global race, with the most advanced node process originally limited to a handful of key adopters, wafer foundries as the pivotal sector of the entire supply chain seem to play the role of a game-changer in the years to come thanks to the phenomenal growth of silicon content. So, we may assume that TSMC's global leadership will remain secure until 2025 when 2nm comes into play. But what's lying ahead beyond 2025? If TSMC failed, what would be the root cause?

There are no unbeatable players in this industry! During the 1980s, who would believe IBM's leading position would be on the wane. During the 1990s, Intel was peerless. We don't believe Intel stands a chance of beating TSMC before 2025. Taiwanese dub TSMC the "Sacred Mountain" that protects the country, but 80% of the equity of this sacred mountain is foreign-owned. No one really knows what would happen if there were drastic changes.