China-based EV maker BYD has expanded its footprint in Europe to 15 countries. DIGITIMES Research analyst Jessie Lin said if BYD can compete with European carmakers, the company will significantly gain a global presence. She also said if the European Union decides to implement punitive tariffs on China-made EVs, BYD might accelerate its pace to reduce costs.

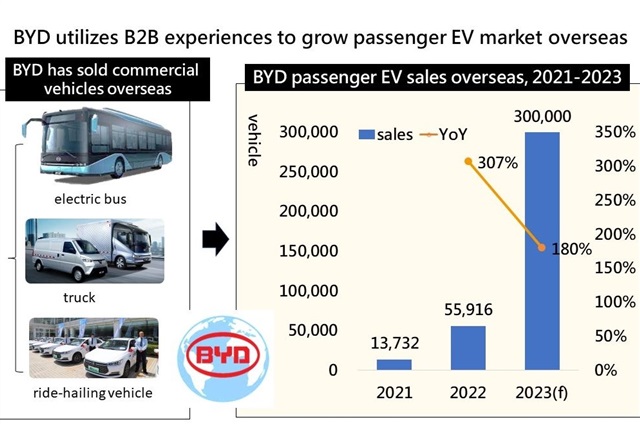

According to Lin, BYD sold 56,000 cars outside China in 2022. She estimated the company's overseas sales to reach 300,000 vehicles in 2023, 1.8 times last year.

BYD's European foray started in Norway in 2021. The company rolled out three EVs in Europe in October 2022, marking an official launch in the region. According to Lin, BYD sold 4,083 vehicles in Europe last year, up 282% from 2021.

Lin said BYD has built its reputation for commercial vehicles like electric buses overseas. However, European consumers generally are less familiar with China-made passenger cars. To scale up in the market, BYD will promote its vehicles as high-price-performance ratio products offering multiple functions.

Source: BYD, DIGITIMES Research

With the self-made batteries, Lin said BYD's vehicles can offer a longer driving range that European drivers need. She estimated that the price of a BYD car sold in Europe is EUR10,000 (US$10,500) to EUR20,000 less than that of a locally-made vehicle due to the cost advantages result from the carmaker's vertical integration.

Affordable BYD models will win some drivers

The entry of China-made EVs into the European market has alarmed legacy carmakers in the region. Stellantis CEO Carlos Tavares had said the European automotive industry will face a "terrible fight" with their Chinese competitors.

Lin said Europe-based automakers have fallen behind in the EV transition. If these companies can only offer high-priced EVs with fewer features, BYD will have more opportunities on the continent.

According to Lin, several factors in Europe will facilitate BYD's development. For example, the EU will ban new internal combustion vehicle sales starting in 2035. More consumers would have to turn to EVs.

Lin also said most countries that BYD targets in Europe, including Norway, Germany, the Netherlands and Sweden, have a higher EV penetration rate. They would have more consumers who would choose the cheaper Chinese EVs. BYD launched its Han, Tang and Atto 3 models in Europe. Lin said Atto 3 is the most affordable among the three vehicles and expected to win over some drivers. If BYD can compete with European rivals in the market, it will gain more global presence.

BYD currently exports cars from China to Europe. When its plant in Thailand is completed, it might ship vehicles from Thailand instead. The company is also reportedly considering building a manufacturing facility in Europe, which Lin said is a more likely option.

She said BYD may take a similar approach as Foxconn's build-operate-localize (BOL) strategy. Since cars are heavy, the company would want to manufacture them at a place closer to the market. Moreover, a local production site may be eligible for government incentives and can reduce the burden of tariffs.

Will EU probe force BYD to cut costs?

The EU has launched an anti-subsidy investigation into China-made EVs. Lin said since the bloc would need about 10 months to conduct the probe, the move is less likely to affect BYD's short- to medium-term sales.

She estimates that if the EU implemented a reported 27.5% punitive tariff on Chinese EVs, the price gap between BYD and European cars will narrow to EUR10,000 on average. However, Lin said it will unlikely impact BYD as about 90% of its sales are generated in the Chinese market.

She also said whether the tariff will push BYD to cut costs further is worth the attention. As the company self-supplies most of the components in its cars, it probably can reduce the costs of batteries, electric motors and electric power control units more.

"If BYD succeeds in further cost reduction, it will show how capable the carmaker is…That means Europe will likely enable a strong competitor for itself," Lin added.

About the analyst

Jessie Lin received a master's degree from the Department of Business Administration at the National Taiwan University of Science and Technology. Her research focuses on automotive, LED, and display panels.

Credit: DIGITIMES