Despite being one of the primary beneficiaries of global supply chain relocation, Vietnam's electricity shortage has become acute amid the rising demand and supply crunch. DIGITIMES Research analyst Yen Chou said there would be no quick fix for the intense heat waves and imbalance between electricity supply and demand, which may become an issue on Vietnam's way to becoming the rising global production hub.

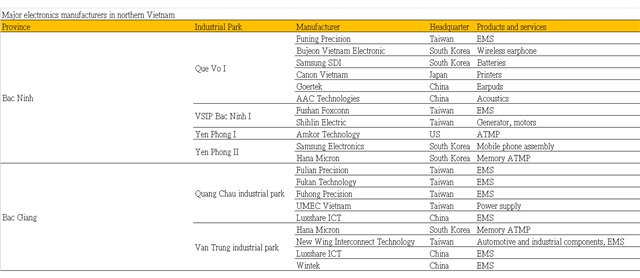

During the past months, the power grid of northern Vietnam, where many global electronics manufacturers are located, faced significant pressure due to scorching summer heat and dwindling water levels in hydropower reservoirs. This strain has led Vietnam's local governments to impose power consumption restrictions on thousands of factories.

DIGITIMES Research Yen Chou said that there are factors that led to Vietnam's power supply shortage. First, compared with other regions of Vietnam, northern Vietnam relies more on hydropower, which accounted for nearly 50% of its power demand in June when the less-than-average rainfall had significantly reduced the capacity of hydropower plants in the region, and some, such as Son La Ban Chat, Thac Ba, Hua Na, and Huong Son, even stopped working as the water level was too low.

Meanwhile, Vietnam's aging thermal power facilities, which supply nearly half of northern Vietnam's power, suffered from poor heat dissipation, resulting in an inability to achieve their planned power generation capacity during high temperatures, including Pha Lai 1, S6 Pha Lai 2, S2 Cam Pha, S2 Mao Khe, and S1 Quang Ninh.

Chou said that Vietnam's renewable energy generation capacity is insufficient to compensate for the gaps in thermal and hydro power generation, and it is mostly located in other regions, like central Vietnam.

Part of the power demand of northern Vietnam can be met with imports from China and Laos, but except for a single 110kV transmission line that connects Quang Ninh in Vietnam and Fangchenggang in China, which has been in place since 2021, there is not enough energy delivered to meet the surging demand in Vietnam. It will take years for other transmission lines between Vietnam and neighboring countries to be set up.

Vietnam is eyeing building a 500kV transmission line to connect the grids of energy-deficit northern and energy-surplus central Vietnam as the latter hosts much fewer power-intensive factories. Still, the huge expense will require the government of Vietnam to allocate its financial resources over several years to complete it, said Chou.

Meanwhile, rising electricity demand also worsened matters amid an electricity supply shortage. Chou quoted official data saying that the electricity consumption in northern Vietnam rose 11-12% annually in 2022 while the electricity supply grew by only 5% for the same period, especially when EMS providers, such as Foxconn, Inventec, and Quanta, are expanding their production capacities in the region.

According to Chou, some newly-established manufacturing plants have power generators installed in their facilities, while it would be difficult for those without installing their generators and therefore are required by local authorities to reduce power consumption, such as Samsung Electronics. Still, Chou added that it is not sustainable as relying on diesel generators to meet the power demand may increase the electricity cost by more than 200%.

Source: DIGITIMES Research, July 2023

About the analyst

Yen Chou received a master's degree from the Graduate Program for Political Economy at National Cheng Kung University. He worked as an assistant researcher at the Institute for Physical Planning and Information and as an analyst at DIGITIMES Research. His research focuses on Samsung's global investment and operation, the electronics industry in Vietnam, and the display industry in South Korea.