Himax CEO Jordan Wu noted at a forum concerning Taiwan's IC design that many Taiwanese IC design houses have been able to achieve profitability. But despite the profits, they are still striving to secure government support or even trying to influence the government's policies. Why is that so? Wu pointed out that IC design is a knowledge-intensive sector that attracts global attention. Policies concerning IC design are unlike those for most other industry sectors and their making must take international competition into consideration.

DIGITIMES agrees that the IC design sector directly deals with end device makers on behalf of the entire semiconductor value chain. In the future applications-driven era, the IC design sector will be an important asset of Taiwan's. And such an important asset must be given top priority when the government lays out its strategic goals. Many critics totally miss the point when calling for equal treatment for all industries: treating IC design as any other industry sector will be crippling to Taiwan's international competitiveness.

In terms of tax incidence, the top-3 IC design houses in China is 7.1%, and in Taiwan it is 13.1% for the top-3. In China, key startup IC design houses enjoy tax-exempt status for the first five years, and 10% tax in the 6th year. These are much better treatments than those in Taiwan. Taiwan's wafer foundry sector has already been growing vibrantly with structural advantages. As Taiwan's government budget is close to TSMC's sales, government subsidies would mean very little for TSMC. We think the wafer foundry sector is expecting the government to do more to improve the country's supplies of water, electricity, and manpower. The one that really needs government support is the IC design sector.

A company's added value takes into account its net profits, tax, employees' salaries, depreciation, and capital costs. Employees' average annual salary at some of Taiwan's top IC design houses already exceeds NT$5 million, even higher than that of NT$3million at TSMC. MediaTek has a workforce of 12,000 in Taiwan, and their salaries come to over NT$60 billion a year in total, which is a major driving force for the country's economy.

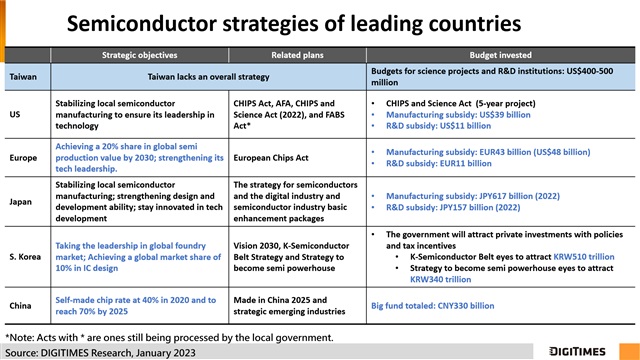

MediaTek chairman M. K. Tsai cited Andes Technology as an example. Andes, founded in 2005, originated from a government program. With joint efforts between the government and company, Andes managed to turn around after 10 straight years of losses. Such knowledge-based investments, regardless of their financial returns, produce important assets for the local industry in terms of ecosystem, talent, and experience. Big countries are now keen on reshoring semiconductor manufacturing, offering incentives and subsidies in order to secure a stable supply of semiconductors.

Judging from its previous policies, the Taiwanese government is unlikely to provide massive subsidies for the semiconductor industry. But perhaps it should focus its support on IC design, which will also indirectly benefit its foundry sector.

It is pointless to compare the tax incentives for the semiconductor industry with those for other industries. The semiconductor industry is a highly international one that must be judged on an international scale. Taiwan must assess the kind of support that its competitors give to their own semiconductor firms before deciding what kind of support its own deserves. Dealing out support equally among all industry sectors may simply harm the IC design sector that relies heavily on talent and offers high added value.

Credit: DIGITIMES