As global brands have adopted ESG into their corporate strategy, related policies have also been extended to the global supply chain. ESG rankings have become a trending topic. To help Taiwan businesses meet the standards of international markets, Dun & Bradstreet, a leading global provider of business decisioning data and analytics, today released the inaugural edition of "ESG Competitiveness Analysis for Taiwan Supply Chain," the only global ESG analysis that is built from all five leading sustainability frameworks and provides fair and objective recommendations. According to the analysis, Taiwan is ranked 7th out of 11 countries and regions surveyed in sustainability, with opportunities for improvement.

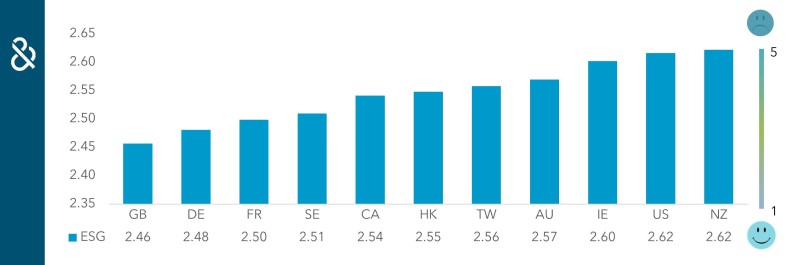

The "ESG Competitiveness Analysis for Taiwan Supply Chain" surveyed the United Kingdom, Germany, France, Sweden, Canada, Hong Kong, Taiwan, Australia, Ireland, the United States, and New Zealand. With the largest business intelligence database in the world, Dun & Bradstreet aims to expand the global coverage of its ESG rankings to over a hundred countries and regions this year and offer the global supply chain a single measurable standard.

Among the 11 countries and regions evaluated, the United Kingdom ranks the highest in ESG performance, followed by Germany; Taiwan ranks at the 50th percentile, slightly ahead of Australia, Ireland, the United States, and New Zealand. Smaller score indicates better performance.

Taiwan businesses excel in social and governance categories with opportunities for improvement in environmental areas

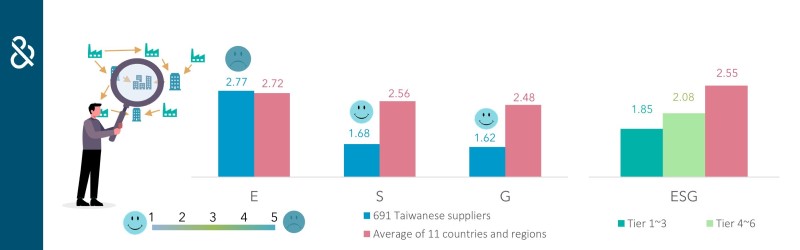

Using its long-term accumulated industry knowledge of Taiwan, Dun & Bradstreet ranked 691 Taiwan suppliers serving the six leading manufacturers that made the Fortune Global 500 list: Hon Hai Precision Industry, Pegatron, TSMC, Quanta Computer, Compal Electronics, and Wistron. The survey categorized the suppliers into six tiers according to their positions in the supply chain and conducted analysis on environmental, social, and governance factors.

In general, 691 Taiwan suppliers performed relatively well in social and governance categories, thanks to Taiwan government's long-term interest in these areas. On the other hand, there still exist challenges to be resolved in the environmental category. Based on observations, emission reduction and management driven by the government is necessary, as Taiwan aims to achieve net zero by 2050.

If analyzed by tiers, the performance of businesses in tier 1 to 3 outshined other tiers, as suppliers and leading manufacturers in these categories share a direct relationship and face more scrutiny. On the contrary, businesses in tiers 4 to 6 are less correlated, hence explaining their greater opportunities for improvement in scores.

Taiwan businesses excel in social and governance categories with opportunities for improvement in environmental factors.

Implementing ESG is critical for Taiwan businesses to unlock the value of the global supply chain

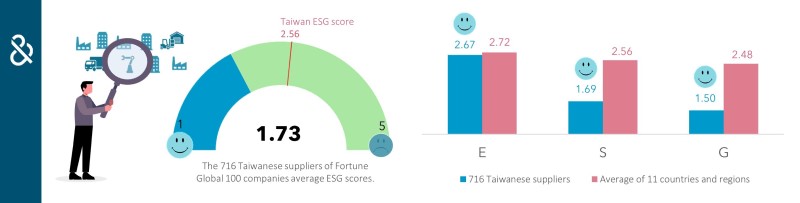

Dun & Bradstreet also conducted an analysis of 716 Taiwanese suppliers of Fortune Global 100 companies. These companies span across industries including energy conversion and management, ICT, and more, with total revenue accounting for 59% of Taiwan's annual GDP in 2020. They are pillars of Taiwan's economy. Dun & Bradstreet research found that their excellent revenue performance is also reflected in their ESG practices. These 716 suppliers earned an average ESG score of 1.73, which is significantly higher than Taiwan's overall average of 2.56, and better than the performance of other countries and regions. This indicates that Taiwan companies not only excel in R&D, but outperform their international counterparts in sustainability as well. As ESG becomes more mainstream, it becomes critical for businesses to unlock the value of the global supply chain.

"ESG has obviously become the entry ticket for small and medium-sized enterprises to the global supply chain, but the evaluations are not standardized on the market," said Michelle Sun, General Manager of Dun & Bradstreet Taiwan. "Through our ESG intelligence, built from deep coverage of public and private companies in Taiwan, coupled with the top five standards, Dun & Bradstreet hopes to reveal data-driven insights that are comprehensive and objective, enabling Taiwan businesses to review and put their ESG goals into practice, while strengthening their competitiveness on the global market."

Dun & Bradstreet provides business data and public ESG-related information of 27+ million public and private companies worldwide. Dun & Bradstreet's ESG services are created from objective data modeling and third-party processes. Its ESG rankings, structured around leading sustainability frameworks, SASB, GRI, UN SDGs, TCFD, UN PRI, provide a single benchmark to enable companies balance short-term profitability and long-term competitiveness.

Among the 11 countries and regions evaluated, the United Kingdom ranks the highest in ESG performance, followed by Germany; Taiwan ranks at the 50th percentile, slightly ahead of Australia, Ireland, the United States, and New Zealand. Smaller score indicates better performance.