African startups in 2021 collected a record quantity of funding that exceeded the total of two years earlier, showing investors' interest in the continent's tech market.

Africa's economy is one of the world's fast-growing economies. Its GDP growth rate in 2021 could be estimated at 3.4%, while over 60% of its population are 25 years old or younger, according to the African Development Bank.

As of October 2021, African startups have collected a total funding of US$2.7 billion, surpassing the US$1.8 billion in 2019 and US$862 million gathered in 2020, Digest Africa's reports showed.

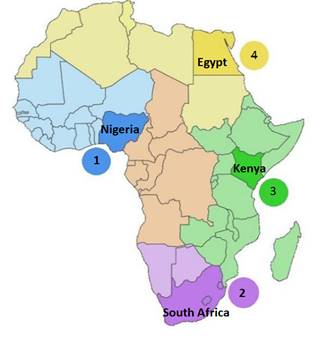

Data from two other agencies, Briter Bridges and Connecting Africa, also found African startups collected US$605 million in the single month of November 2021, almost half of the total funding (US$1.3 billion) of all African startups in 2020. In that month, startups based in Nigeria, South Africa, Egypt, and Kenya (F4) accounted for 80% of all funds collected by African startups, including 35% by Nigerian startups.

Top 4 African countries attracting most startup funds

Source: Briter Bridges; compiled by DIGITIMES, February 2022

Nigeria, outrunning peers

African startups are attracting increased capital from overseas amid the surging demand for virtual banking and online services during COVID-19.

In 2021, Nigerian startups collected US$1.37 billion, followed by US$838 million by South African startups, US$588 million by Egyptian startups, and US$375 million by Kenyan startups.

The most populated country in Africa, Nigeria in 2021 reported more than 200 deals completed by its startups, beating its three peer-competitors, which recorded about 100 deals.

Startups in Senegal and Tanzania gathered US$222 million and US$96 million respectively last year.

Egypt is also noteworthy. It is home to 562 tech startups, the fourth-highest number of African tech startups after Nigeria, South Africa, and Kenya. Egypt's startups are increasingly attracting capital.

Investors are showing more interest in French-speaking countries on the continent, perhaps inspired by the development of Wave - a mobile payment unicorn from Senegal.

In August 2021, Nigerian fintech startup Opay surpassed the fundraising of previous African startups when it completed series C financing with US$400 million, becoming the seventh unicorn in Africa.

While Africa's fintech startups gathered most of the funding, startups dealing with clean tech, including companies facilitating the transition to renewable energy, are attracting increasing funding from domestic and overseas investors. They are followed by startups in other fields including healthcare, data, IT infrastructure, and agriculture.

The growing number of venture capital (VC) investors in Africa backs the optimism of local startups. On average, the yearly number of VC deals in Africa has grown 46% year-on-year since 2015, showing that investors are confident and willing to bear considerable risks.

Crunchbase's data showed that there are nearly 200 VC headquarters in Africa. Back in 2015, there was no unicorn on the continent, and its startups only collected US$400 million in total that year.

According to Disrupt Africa, there were at least 774 startups in Africa, and they in 2020 raised US$701 million, a 42.7% increase from US$492 million in 2019. Five years ago, African startups were only able to collect a total US$186 million.

Inspirations from western tech giants

Founded in 2002, Interswitch took 17 years to become a unicorn, and is now the oldest unicorn in Africa. More recently, six other African unicorns took only 5 years or less to reach unicorn status. The five unicorns that emerged in 2021 took an average of 3.75 years to grow into entities valued at US$1 billion each.

Intriguingly, many African entrepreneurs used to work at big tech companies such as Google and IBM or fast-growing startups like Careem and Paypal. In hindsight, such work experiences prepared them for creating subversive startups. Likewise, half of the co-founders of African startups used to work in the same fields as their startups or had related expertise.

According to Wee Tracker, there are seven unicorns in Africa: Jumia, Interswitch, Flutterwave, Andela, Wave, OPay, and Chipper Cash. The oldest two are Jumia (2016) and Interswitch (2019). In 2019, Jumia was listed on the New York Stock Exchange.

Since Africa opened up its fintech and other industries, many first-time investors have injected capital into the continent's startups. Among the five startups emerging in 2021, four – Flutterwave, OPay, Wave, and Chipper Cash - work in the fintech industry, while the other – Andela - is for tech talent pooling.

In March 2021, Flutterwave was valued at US$1 billion. Similarly, OPay was valued at US$2 billion in August, Wave and Andela at US$1.7 billion and US$1.5 billion in September, and Chipper Cash at US$2 billion in November.

The number of African startups is surging because local founders have become more experienced and because certain markets (especially Nigeria, South Africa, Egypt, and Kenya) are rising. Nigeria is recognized as the capital of African startups as it is home to most African startups.

Foreign capital boosts African startups

The financing of African startups still relies heavily on foreign investors. According to a report from Briter Bridges, American and British investments predominate in Africa, followed by French capital.

Asian investors from Singapore, China, and Japan are also showing more interest in Africa, and the continent's VC activities are luring new players from Saudi Arabia and Ireland. In Africa, South Africa and Mauritius accommodate the most headquarters of foreign investors.

The surging foreign investments in Africa can be explained by a few reasons.

First, Africa is getting closer with other parts of the world. Google and Facebook are building undersea cable networks connecting more than 20 African countries with Europe and the Middle East. Liquid Intelligent Technologies has launched a terrestrial fiber route connecting the east and west coasts of Africa. SpaceX's Starlink program aims to fill in the gaps of Internet service in Africa and elsewhere. Meanwhile, more and more Africans are using smartphones.

While each African country has its own system, local people are no strangers to innovations related to financing, logistics, healthcare, and retail business. Entrepreneurship is also inherent in the lifestyles of big cities such as Cairo, Johannesburg, Lagos, and Nairobi.

Africa is not without its shortcomings, though. For example, the governments and central banks of African countries remain vigilant about business proposals they are not familiar with.

Although African startups are attracting mounting investments from the US and China, most of the established business leaders in Africa prefer traditional industries such as food processing, import monopolies, mining, and hydrocarbon processing.

Despite some progress in its infrastructure, such as digital payments, Africa as a whole still has difficulty catching up with other parts of the world due to its insufficient education coverage, lack of logistics infrastructure, and low consumption power. These obstacles might impede the scalability of digital solutions and business models related to e-commerce and agritech.

Unicorns in Africa | ||||

Company | Country | Industry | Valuation (USD) | Time of turning into unicorn |

Jumia | Nigeria | e-commerce | >3 billion | 2016 |

Interswitch | fintech | ~1 billion | 2019 | |

Flutewave | >1 billion | 2021 | ||

OPay | ~2 billion | |||

Wave | Senegal | ~1.7 billion | ||

Andela | Nigeria | IT service | ~1.5 billion | |

Chipper Cash | Ghana | fintech | >2 billion | |

Source: Afridigest; compiled by DIGITIMES, February 2022

Top 10 pools of innovations in Africa | ||

Ranking | City | County |

1 | Lagos | Nigeria |

2 | Johannesburg | South Africa |

3 | Nairobi | Kenya |

4 | Abuja | Nigeria |

5 | Kampala | Uganda |

6 | Accra | Ghana |

7 | Cape Town | South Africa |

8 | Cairo | Egypt |

9 | Dar es Salaam | Tanzania |

10 | Benin City | Nigeria |

Source: Ripple Research; DIGITIMES, February 2022

African startup breakdown 2021 | |

Sectors | Ratio |

Fintech | 62% |

Health, biotechnology | 8% |

Logistics | 7% |

Education | 5% |

Clean technology | 5% |

Agriculture | 4% |

E-commerce | 3% |

Mobiles | 3% |

Data and analysis | 2% |

Source: Briter Bridges; compiled by DIGITIMES, February 2022