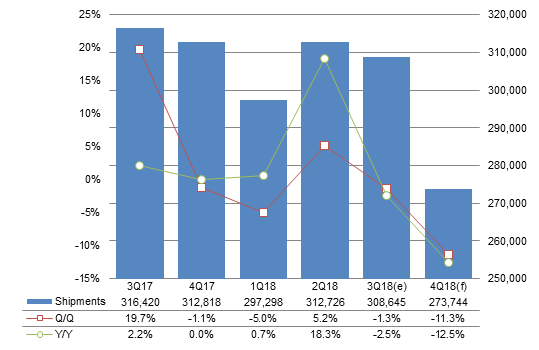

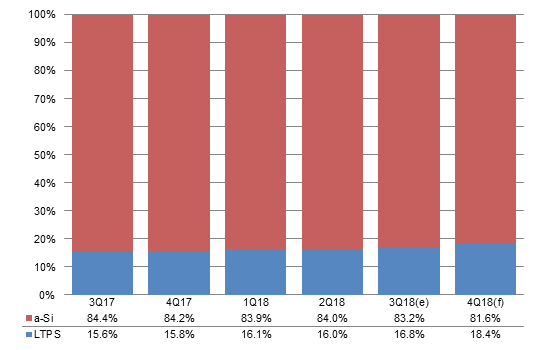

Chart 1: Small- to medium-size LCD shipments, 3Q17-4Q18 (k units)

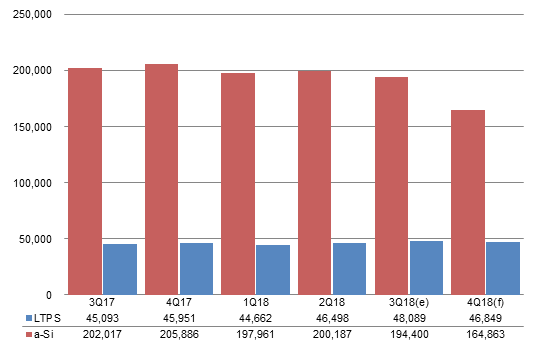

Chart 6: Handset panel shipments by technology, 3Q17-4Q18 (k units)

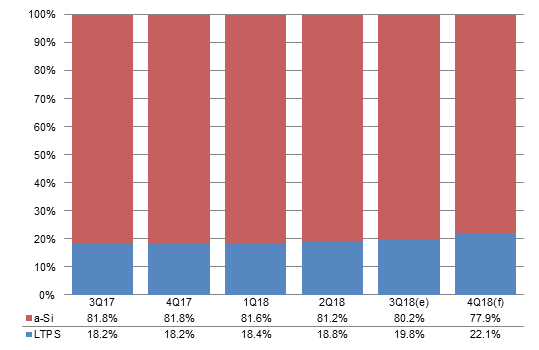

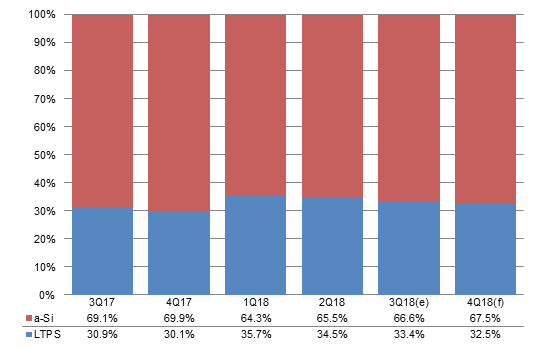

Chart 7: Handset panel shipment share by technology, 3Q17-4Q18

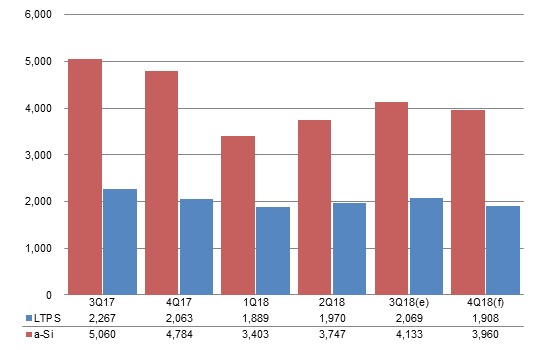

Chart 8: DSC panel shipments by technology, 3Q17-4Q18 (k units)

Chart 12: Small- to medium-size LCD shipments and global share, 2018-2023 (m units)

Introduction

Chart 1: Small- to medium-size LCD shipments, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

The third quarter of 2018 failed to see the usual high-season effects, as downstream clients were slow in building their panel inventory due to weakening demand from consumers for feature phones and white-box tablets. The weak demand resulted in Taiwan's small- to medium-size panel shipments recording decreases of 1.3% sequentially and 2.5% on year to arrive at 308.65 million units. (Note: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.)

With the market entering the slow season and the US-China trade tensions intensifying, orders from clients are expected to fall sharply by 11.3% sequentially and 12.5% on year in the fourth quarter.

Shipments breakdown

Applications

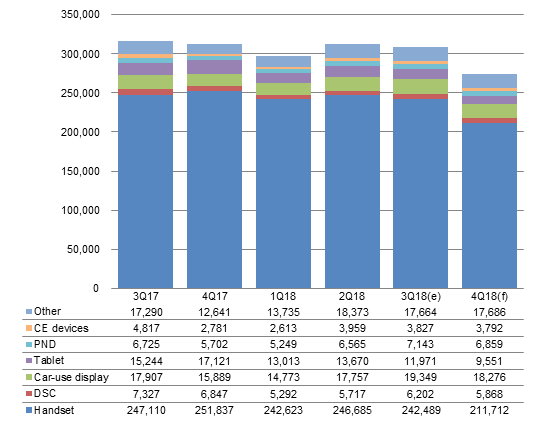

Chart 2: Shipments by application, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

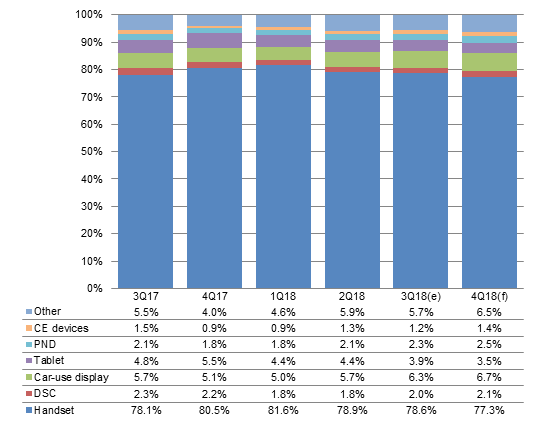

Chart 3: Shipment share by application, 3Q17-4Q18

Source: Digitimes Research, October 2018

As feature phone shipments are in decline and demand for entry-level smartphones is also weakening, Taiwan's small- to medium-size panel supply for handset applications dipped 1.7% sequentially in the third quarter.

Shipments for tablets had the worst performance in the third quarter, slipping 12.4% sequentially as orders from white-box tablet players continued shrinking.

Because of seasonality, shipments for all major applications are expected to drop sequentially in the fourth quarter except the "Other" category. Handset and tablet applications will have the worst declines.

The "CE (consumer electronics) devices" category includes portable DVD players, digital photo frames and smart speakers. The applications in "Other," including industrial control applications, office devices, wearables and niche devices, are usually less affected by seasonality.

Display technology

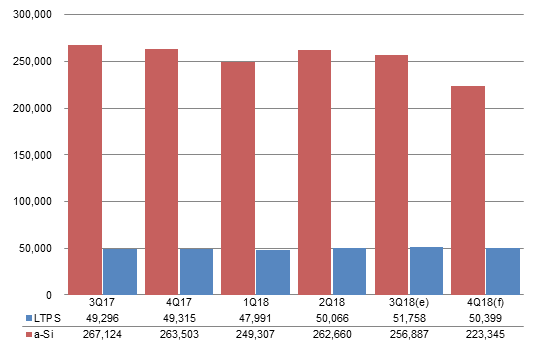

Chart 4: Shipments by technology, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Chart 5: Shipment share by technology, 3Q17-4Q18

Source: Digitimes Research, October 2018

Taiwan's LTPS panel shipments rose 3.4% sequentially in the third quarter thanks to Innolux strengthening its LTPS panel supply for mid-range to high-end smartphones.

In the fourth quarter, Taiwan's orders for LTPS panels for high-end smartphones will remain stable and drop only 2.6% sequentially. However, a-Si panel shipments are expected to fall 13.1% sequentially as a result of weakening demand for feature phone panels.

Handsets

Chart 6: Handset panel shipments by technology, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Chart 7: Handset panel shipment share by technology, 3Q17-4Q18

Source: Digitimes Research, October 2018

DSC

Chart 8: DSC panel shipments by technology, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Chart 9: DSC panel shipment share by technology, 3Q17-4Q18

Source: Digitimes Research, October 2018

Makers

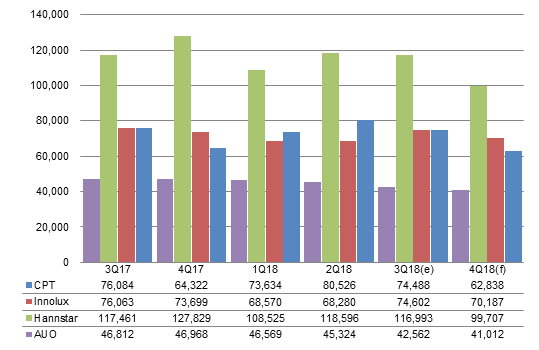

Chart 10: Shipments by maker, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

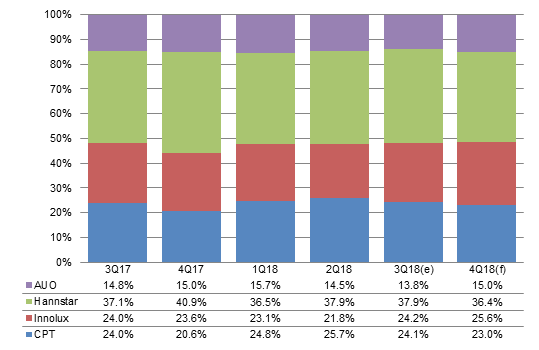

Chart 11: Shipment share by maker, 3Q17-4Q18

Source: Digitimes Research, October 2018

Innolux was the only maker in Taiwan with sequential shipment growth in the third quarter at 9.3% because the company has a strong focus on supplying LTPS panels for mid-range to high-end smartphones.

Other Taiwan makers saw shipments decline in the third quarter as a result of unstable demand from downstream clients for feature phone panels, and sluggish demand from the saturating entry-level smartphone market.

In the fourth quarter, AUO and Innolux are expected to see much smaller shipment declines than Chunghwa Picture Tubes (CPT) and HannStar, as the former pair is focusing more on the LTPS segment.

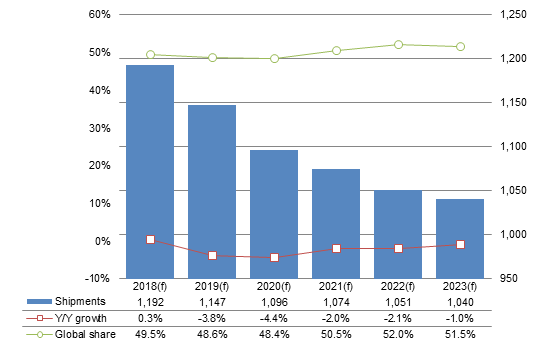

Annual shipments

Chart 12: Small- to medium-size LCD shipments and global share, 2018-2023 (m units)

Source: Digitimes Research, October 2018

China-based makers have been expanding their AMOLED capacities to meet opportunities from high-end AMOLED smartphones, including those with bendable displays.

AUO's 6G capacity in Kunshan, China; Innolux's 6G capacity in Luzhu, Taiwan; and CPT's invested 6G capacity in Fujian, China have all started contributing shipments in 2017-2018, but Taiwan's small- to medium-size panels shipments are only expected to grow 0.3% on year in 2018 amid decreasing demand for feature phone and white-box tablet panels. Their unit output is also affected by the production of 18:9 and free-form panels, both of which see increasing demand but result in fewer units that can be cut from a substrate.

China-based makers' AMOLED capacities are expected to gradually come online from 2018-2020, but the makers will still need to devote more efforts to improve the production lines' yields and costs in 2020-2021. It means their LCD production may not drop significantly in the meantime. As a result, Taiwan-based makers will not be able to have the majority share of worldwide shipments until 2021.