Introduction

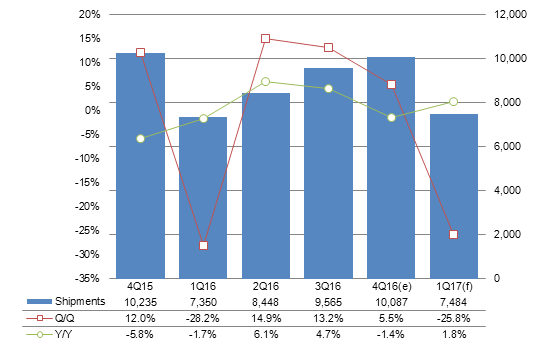

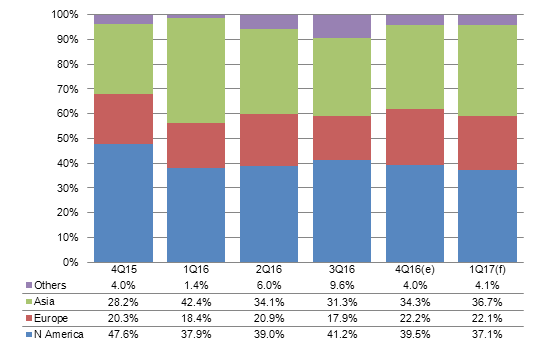

- Taiwan makers' LCD TV shipments reached 10.09 million units in the fourth quarter of 2016, increasing 5.5% sequentially but decreasing 1.4% on year.

- Taiwan makers' LCD TV shipments will reach 7.48 million in the first quarter of 2017, down 25.8% sequentially but up 1.8% on year.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.

Chart 1: Taiwan LCD TV shipments, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

- Taiwan's LCD TV shipments grew 5.5% sequentially to reach 10.09 million units in the fourth quarter of 2016, but were still down by 1.4% on year.

- The shipments in the first quarter are expected to drop sharply by 25.8% on quarter because of seasonality, but the volume will still see growth compared to the same quarter a year ago.

Shipments breakdown

Business models: OBM, OEM/ODM

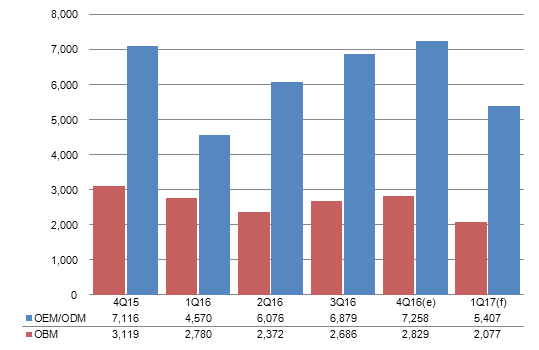

Chart 2: Shipments by business model, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

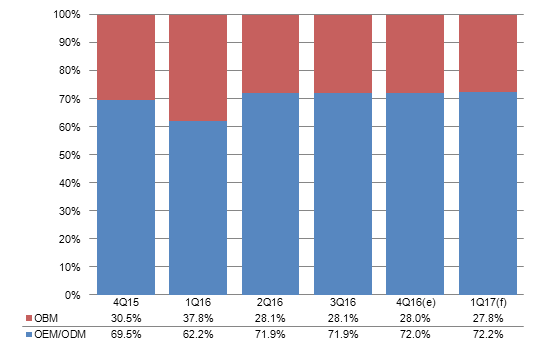

Chart 3: Shipment share by business model, 4Q15-1Q17

Source: Digitimes Research, February 2017

- TPV's OBM (own brand) shipment proportion has been rising since the third quarter of 2016.

- Compal saw decreased OBM shipment proportion in the fourth quarter of 2016 since the company stopped making Toshiba-branded LCD TVs for Europe and discontinued its brand licensing with Toshiba in Europe.

- Amtran and Foxconn also have some OBM shipments, but they both account for less than 2% of their total shipments.

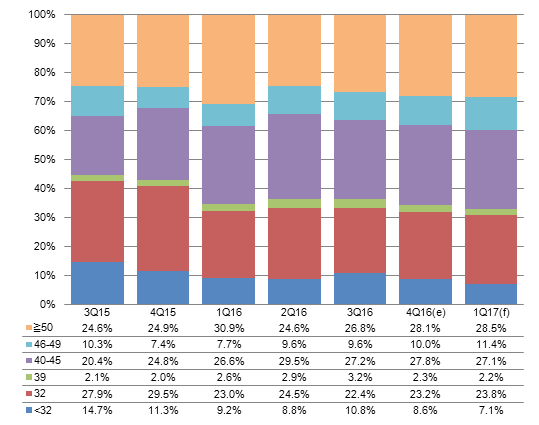

Geographic markets

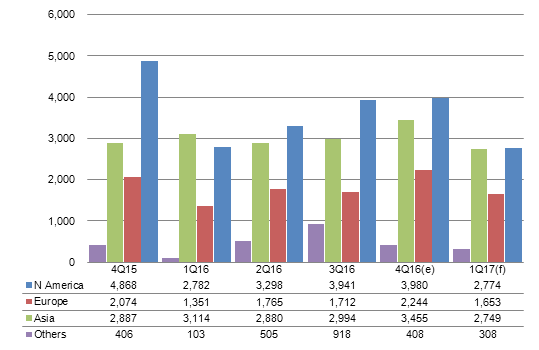

Chart 4: Shipments by region, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

Chart 5: Shipment share by region, 4Q15-1Q17

Source: Digitimes Research, February 2017

- Taiwan's fourth-quarter 2016 LCD TV shipments to North America were up almost 1% from a quarter ago, but the region's share was down from 41.2% in the third quarter to less than 40% because shipments to other regions saw better growths.

- Shipments to North America are expected to drop by over 30% sequentially in the first quarter of 2017 because of seasonality.

- Shipments to Asia were up 15.4% sequentially in the fourth quarter of 2016, but are expected to be down by 20.4% in the first quarter of 2017. However, Asia's share of shipments is expected to rise from 34.3% in the fourth quarter of 2016 to 36.7% in the first quarter of 2017. The rising share is because Foxconn Electronics (Hon Hai Precision Industry) has cooperated with Sharp to mass ship LCD TVs since early fourth-quarter 2016, while TPV's over-the-top (OTT) clients have also increased orders for the two quarters.

- As for Europe, Foxconn's shipments to Sony Europe have achieved strong performances in both the fourth quarter of 2016 and the first quarter of 2017.

- Compal Electronics stopped producing Toshiba-branded LCD TVs for Europe in the third quarter and Turkey-based Vestel is the sole manufacturer of Toshiba-branded LCD TVs in the region. Toshiba only licenses the brand name with the brand operation controlled fully by Vestel.

- Shipments to the "Others" geographic segment dropped sharply by 55.6% in the fourth quarter of 2016. For some regions such as Latin America, shipments to these markets tend to fluctuate significantly due to factors such as exchange rate changes or long delivery time.

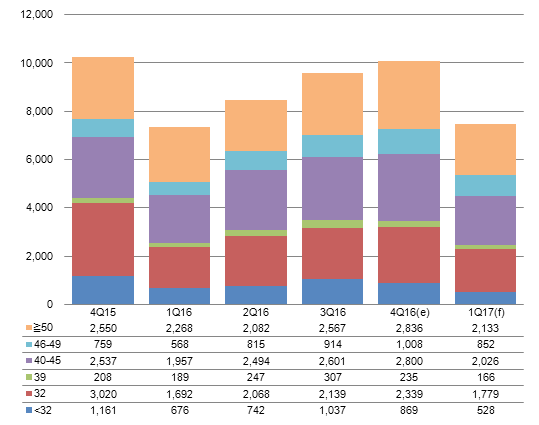

Screen sizes

Chart 6: Shipments by screen size, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

Chart 7: Shipment share by screen size, 4Q15-1Q17

Source: Digitimes Research, February 2017

- The 50-inch and above LCD TV segment had the largest share of Taiwan's shipments in the fourth quarter of 2016 and it will remain the largest in the first quarter of 2017 as large portions of Compal's and Foxconn's shipments belong to the size segment.

- Because of the shortages of 32- to 43-inch panels and their rising prices, some vendors have turned to place orders for 46- to 49-inch LCD TVs. The 46- to 49-inch segment's shipment proportion will rise further to 11.4% in the first quarter of 2017.

- The 40- to 45-inch segment enjoyed 7.7% sequential growth in shipments in the fourth quarter of 2016, but its share remained at about 27%.

- Innolux's newly established 8.6G capacity was originally scheduled to be used for 45-inch panel production, but has now been shifted to producing 43-inch panels instead to help fill the supply gap created by Samsung Electronics closing down its 7G production line that was used to supply 40-inch panels.

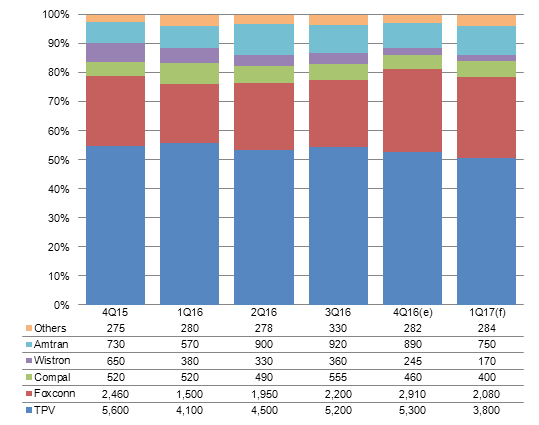

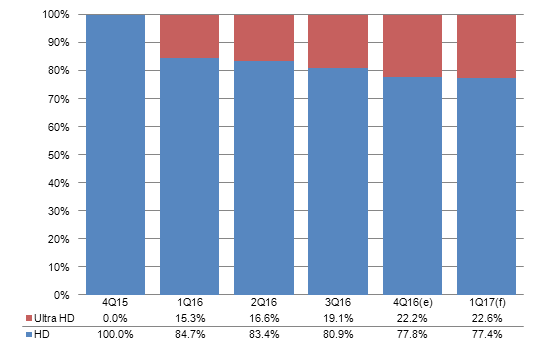

Makers

Chart 8: Shipments by top-5 makers, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

Chart 9: Shipment share by top-5 makers, 4Q15-1Q17

Source: Digitimes Research, February 2017

- Despite a sharp shipment drop in the first quarter of 2017, TPV will continue to account for over 50% of Taiwan's LCD TV shipments.

- Foxconn's shipments rose 32.2% sequentially in the fourth quarter of 2016 thanks to increased orders from Sony, Sharp and Vizio, while orders from LeEco were flat from a quarter ago.

- Amtran was the third-largest maker in Taiwan in the fourth quarter of 2016 and will keep its place in the first quarter of 2017. Xiaomi has been gradually shifting its orders to Amtran.

- Despite its departure from the Europe market, Compal still sees strong sales of its Cast TV (LCD TV with built-in Chromecast system) in North America.

- Wistron is expected to see a difficult 2017 since Vizio is the only client that still gives it meaningful orders. Wistron's present shipments to Xiaomi are for an old model.

- Vizio will add BOEVT as a new LCD TV supplier for 2017 to secure its panel supply from BOE. BOEVT is an LCD TV manufacturing subsidiary under the China-based BOE group. BOEVT is able to supply LCD TVs of the same size as those that Vizio has outsourced to Wistron.

- Because of panel shortages, Vizio is expected to maintain its partnership with Wistron, but Digitimes Research expects Wistron's orders from Vizio to be impacted by BOEVT's competition. Wistron's panels are from AU Optronics (AUO).

Source: Digitimes Research, February 2017

- The majority of Sony's LCD TVs marketed in Europe and North America are supplied by Foxconn. Foxconn's Sony LCD TV shipments to India are also stable.

- Foxconn and Sharp are aggressively promoting their LCD TVs in China and has seen increased shipments since the fourth quarter of 2016.

- Taiwan makers' shipments to LeEco dropped dramatically in the fourth quarter of 2016 because of delayed payments by the client.

- China-based online TV platform service providers such as Whaley and PPTV have seen increased sales recently and have increased their TV orders with Taiwan makers.

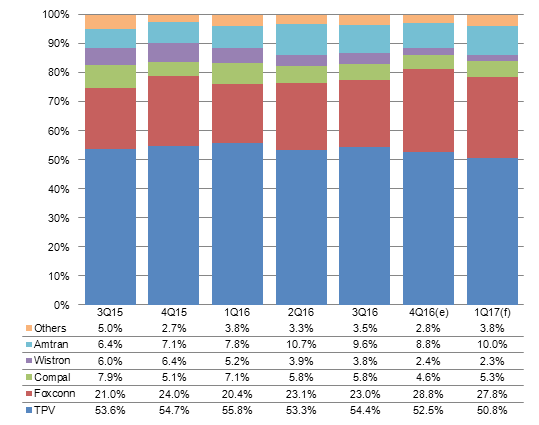

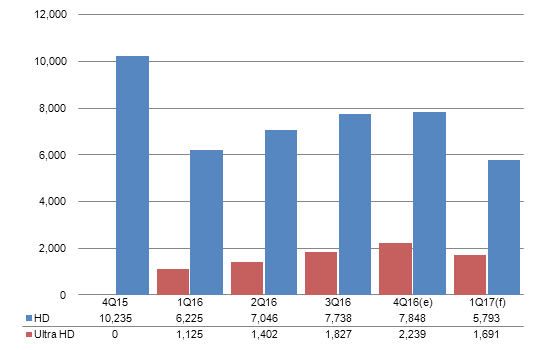

HD standard

Chart 10: Shipments by HD standard, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

Chart 11: Shipment share by HD standard, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

- Ultra HD LCD TVs accounted for over 20% of Taiwan's overall LCD TV shipments in the fourth quarter of 2016. However the proportion is unlikely to pick up sharply in the first quarter of 2017, as sales promotional campaigns by vendors have weakened dramatically.

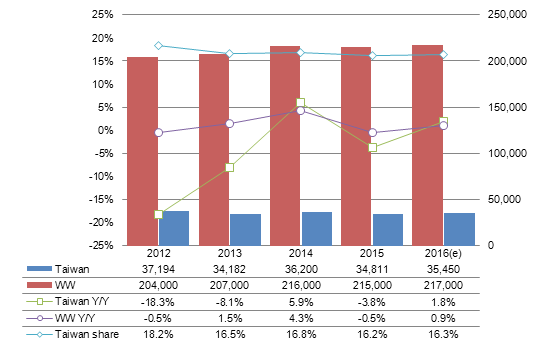

Annual Shipments

Chart 12: Taiwan and worldwide LCD TV shipments, 2012-2016 (k units)

Source: Digitimes Research, February 2017