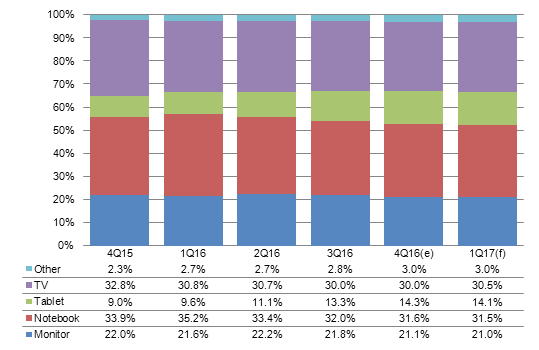

Chart 6: Worldwide shipments by application, 4Q15-1Q17 (k units)

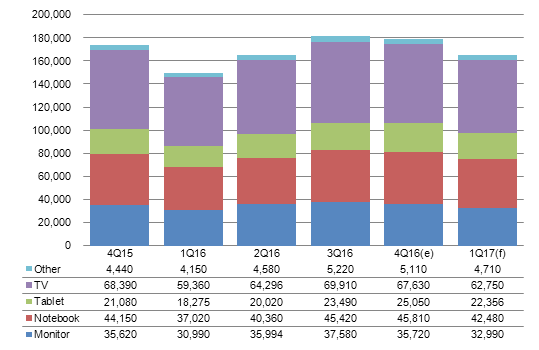

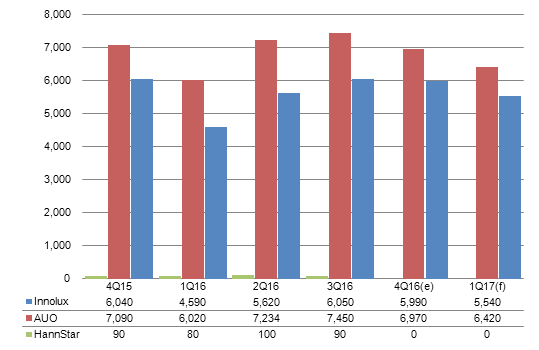

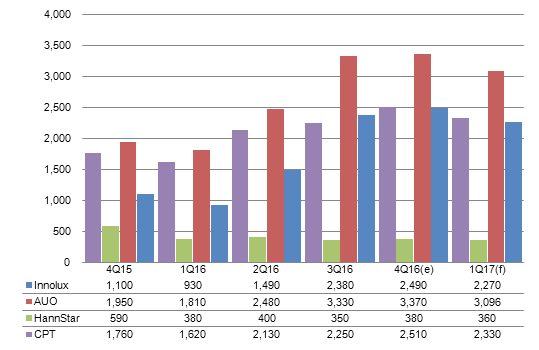

Chart 7: Monitor panel shipments by maker, 4Q15-1Q17 (k units)

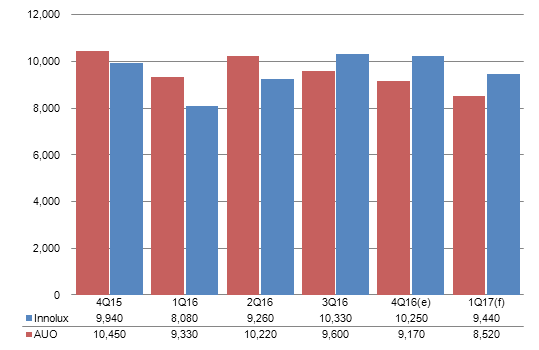

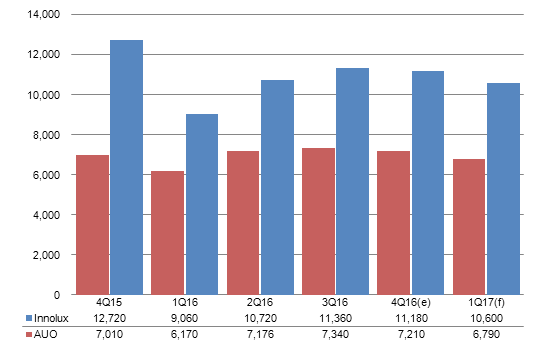

Chart 8: Notebook panel shipments by maker, 4Q15-1Q17 (k units)

Chart 9: Tablet panel shipments by maker, 4Q15-1Q17 (k units)

Chart 11: Monitor panel shipments by size, 4Q15-1Q17 (k units)

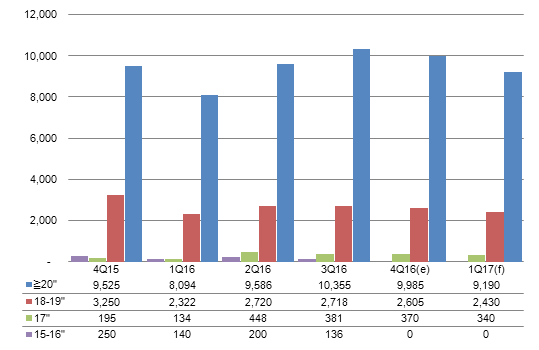

Chart 13: Notebook/tablet panel shipments by size, 4Q15-1Q17 (k units)

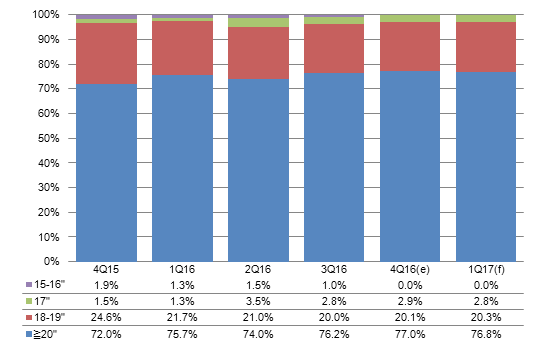

Chart 14: Notebook/tablet panel shipment share by size, 4Q15-1Q17

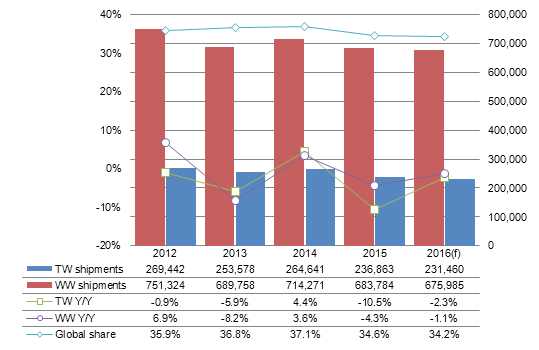

Chart 17: Taiwan large-size panel shipments and share of global market, 2012-2016 (k units)

Chart 20: Worldwide shipments by application, 2014-2016 (k units)

Introduction

- Taiwan's large-size LCD panel shipments reached 61.37 million units in the fourth quarter of 2016, decreasing 1.5% sequentially but increasing 2% on year.

- Taiwan's large-size LCD panel shipments will reach 57.07 million units in the first quarter of 2017, down 7% sequentially but up 15.5% on year.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.

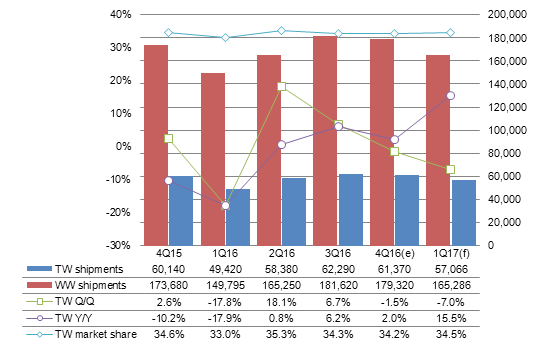

Chart 1: Large-size TFT LCD shipments, 4Q15-1Q17 (k units)

Source: Digitimes Research, January 2017

- Taiwan's large-size LCD panel shipments reached 61.37 million units in the fourth quarter of 2016, down by 1.5% from the previous quarter but up by 2% from the same period a year ago. Large-size LCD panels were still in tight supply in the fourth quarter, particularly TV applications, as a result of Samsung Display's move to close down its 7G L7-1 panel line. Downstream vendors, in anticipation of the tight supply, were aggressive in placing orders to stock up their inventory.

- The tight supply is in general favorable to panel makers in the low season in first-quarter 2017. Taiwan makers' shipment volume is expected to slip 7% sequentially to reach 57.07 million units in first-quarter 2017 - a relatively mild decline judging from the seasonality and fewer working days during the Luna New Year period. Taiwan makers' worldwide market share will rise slightly to 34.5%.

- Compared to the same quarter a year ago, Taiwan's shipment volume is expected to grow 15.5% in the first quarter of 2017. The on-year increase will be down to the fact that Taiwan's large-size panel shipments in first-quarter 2016 was seriously impacted by a strong earthquake that hit southern Taiwan and disrupted panel makers' production.

Shipments breakdown

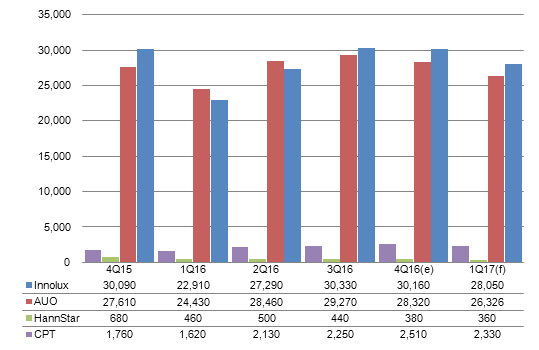

Chart 2: Shipments by maker, 4Q15-1Q17 (k units)

Source: Digitimes Research, January 2017

Chart 3: Shipment share by maker, 4Q15-1Q17

Source: Digitimes Research, January 2017

Applications

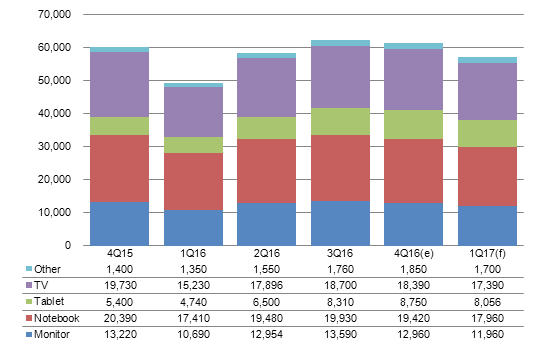

Chart 4: Shipments by application, 4Q15-1Q17 (k units)

Source: Digitimes Research, January 2017

Chart 5: Shipment share by application, 4Q15-1Q17

Source: Digitimes Research, January 2017

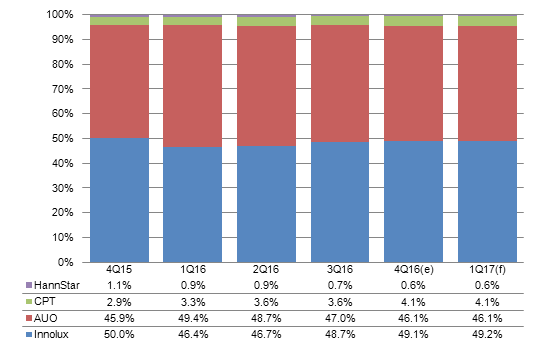

- Taiwan's large-size panel shipments for TV applications had a smaller sequential drop (1.66%) than those for notebooks (2.56%) and monitors (4.64%) in the fourth quarter of 2016. The tight supply in the TV panel segment prompted clients to fill up their inventory.

- The tablet segment was the only one with sequential shipment growth in the fourth quarter of 2016 since demand for tablets enjoyed a recovery. Chunghwa Picture Tubes (CPT) also had a strong growth in its large-size tablet panel shipments.

- In the first quarter of 2017, Taiwan's makers will continue to see the benefits of tight supply in the TV segment. Taiwan's TV panel shipments will have a smaller sequential shipment drop (5.4%) than those of other applications (around 7%).

Chart 6: Worldwide shipments by application, 4Q15-1Q17 (k units)

Source: Digitimes Research, January 2017

Chart 7: Monitor panel shipments by maker, 4Q15-1Q17 (k units)

Source: Digitimes Research, January 2017

- Because of seasonality, Taiwan's overall monitor panel shipments will drop 7.7% sequentially in the first quarter.

- The downstream LCD monitor market will see shipments drop 8-10% from a quarter ago in the first quarter.

- Panel makers are not much interested in producing monitor applications. They are mainly producing monitor applications to utilize their otherwise idle capacity and LCD monitor panel's average profits are much lower than that of the LCD TV panel. Taiwan's monitor panel shipments tend to have a lower growth than that for TV panels.

Chart 8: Notebook panel shipments by maker, 4Q15-1Q17 (k units)

Source: Digitimes Research, January 2017

- Taiwan's notebook panel shipments are expected to drop 7.5% sequentially in the first quarter of 2017.

- Samsung Display continued reducing its notebook panel supply in the fourth quarter of 2016 and the Korea-based maker's notebook panel shipments in 2016 went down 60% from those in 2015.

- China-based BOE has taken over most of Samsung Display's notebook panel orders and has been seeing rising shipments. Because of the China-based maker's competition, Taiwan's share in the worldwide notebook panel market shrunk from 46% in the first half of 2016 to only 42% in the fourth quarter of 2016.

Chart 9: Tablet panel shipments by maker, 4Q15-1Q17 (k units)

Source: Digitimes Research, January 2017

- Increased demand for tablets prompted vendors to place more panel orders with their upstream suppliers in the fourth quarter of 2016. Of the Taiwan-based suppliers, CPT, which mainly supplies panels to white-box tablet players, achieved the highest shipment growth in the quarter at 11.6%.

- Due to seasonality, Taiwan's tablet panel shipments will drop 7.9% sequentially in the first quarter of 2017.

Chart 10: TV panel shipments by maker, 4Q15-1Q17 (k units)

Source: Digitimes Research, January 2017

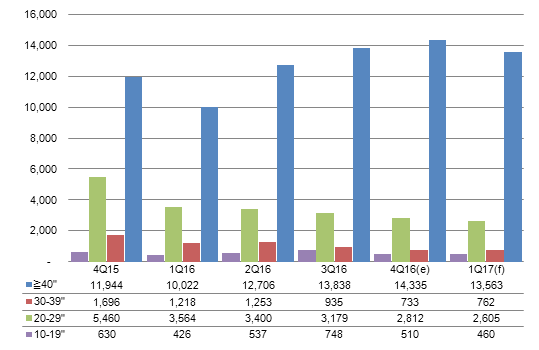

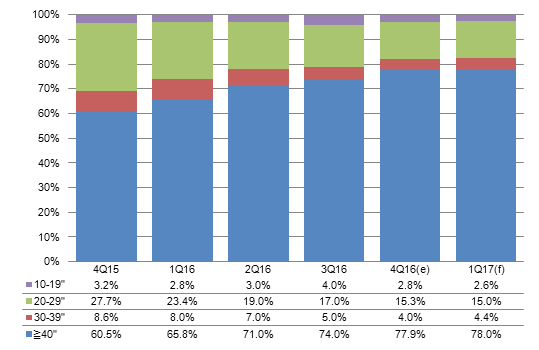

- Samsung Display's move of closing down its L7-1 production line to transform it into an AMOLED panel line is expected to continue creating tight supply for the TV segment.

- Since the L7-1 production line was mainly used to supply 40-inch panels, LG Display, Innolux and AUO, all of which have similar production lines, are benefiting the most from Samsung Display's departure.

Monitor applications by size

Chart 11: Monitor panel shipments by size, 4Q15-1Q17 (k units)

Source: Digitimes Research, January 2017

Chart 12: Monitor panel shipment share by size, 4Q15-1Q17

Source: Digitimes Research, January 2017

Notebook/tablet applications by size

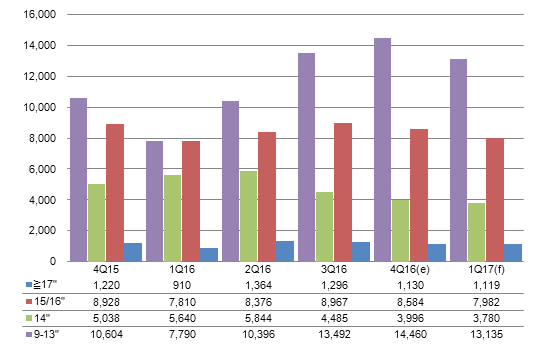

Chart 13: Notebook/tablet panel shipments by size, 4Q15-1Q17 (k units)

Source: Digitimes Research, January 2017

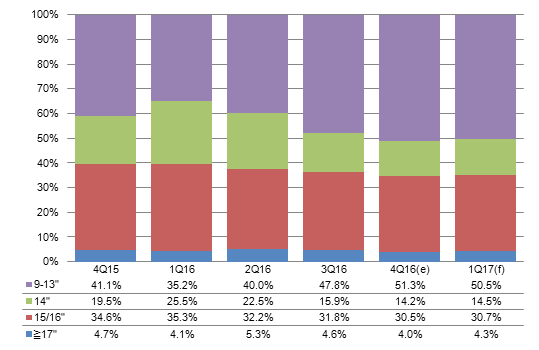

Chart 14: Notebook/tablet panel shipment share by size, 4Q15-1Q17

Source: Digitimes Research, January 2017

TV applications by size

Chart 15: TV panel shipments by size, 4Q15-1Q17 (k units)

Source: Digitimes Research, January 2017

Chart 16: TV panel shipment share by size, 4Q15-1Q17

Source: Digitimes Research, January 2017

Annual shipments

Chart 17: Taiwan large-size panel shipments and share of global market, 2012-2016 (k units)

Source: Digitimes Research, January 2017

- Taiwan's large-size LCD panel shipments saw a bigger drop than the worldwide average in 2016, with Taiwan's global share dropping to a new low.

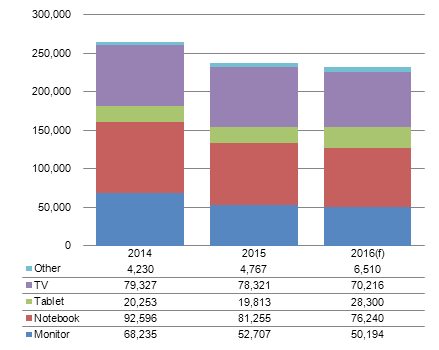

Chart 18: Shipments by application, 2014-2016 (k units)

Source: Digitimes Research, January 2017

- All applications except tablet panels suffered on-year shipment declines in 2016.

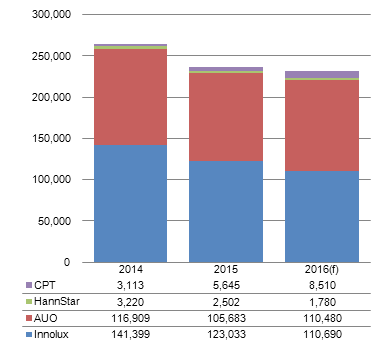

Chart 19: Shipments by maker, 2014-2016 (k units)

Source: Digitimes Research, January 2017

- HannStar's large-size panel shipments continued to drop in 2016 as a result of the company's shift of focus to the small-to-medium-size panel market.

- CPT saw its shipments rise to more than 8.5 million units in 2016 mainly due to its increased tablet panel orders.

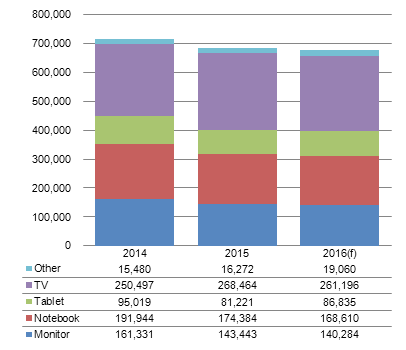

Chart 20: Worldwide shipments by application, 2014-2016 (k units)

Source: Digitimes Research, January 2017