According to data collected by DIGITIMES, all 949 publicly traded electronics firms in Taiwan generated sales totaling NT$953 billion in 2022. Manufacturers of electronic devices, such as handsets and notebooks, accounted for about NT$500 billion, of which about NT$400 billion came from the top-6 makers – Foxconn, Pegatron, Quanta, Wistron, Compal, and Inventec. These six firms alone purchase as much as US$300 billion worth of components each year, and if they stopped production at the same time, the impact would be immeasurable. The US bid to rebuild meaningful control of the supply chain has definitely sent shockwaves across the ecosystems supporting these top-6 makers.

Manufacturing capability is in the DNA of the top-6 electronics manufacturers. Of the total output from the world's top-30 EMS providers, Taiwanese firms account for 72%. As the "G2" geopolitical game unfolds, Taiwanese firms, particularly the top-6 electronics firms, have found themselves in the global spotlight. But how are the top-6 going to respond to such a new situation?

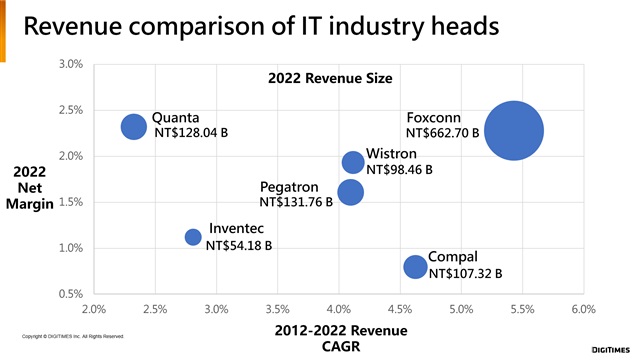

We try to imagine what moves the top-6 would make for ASEAN and South Asia, based on the firms' probable needs. These firms have lived mostly on massive orders from Apple, HP, Dell, and other major vendors. They have managed to build up economies of scale, but profit margins have been very low. In 2022, Foxconn, Quanta, and Compal were the top-3 in terms of net profit margins, but they were all under 2.5%. Compal's net profit margin was even less than 1%. These major electronics manufacturers may be crucial to the world, but their R&D has been limited by the specs dictated by their clients. They have been unable to play a major part in software-hardware integration or providing localized services.

But the situation is changing. Many emerging economies are now rethinking their national strategies in the direction of constructing their independent industrial ecosystems. As they aspire to build their own semiconductor value chains, they would look at the electronics assembly sector differently, compared to the views of the US and European brand vendors.

ASEAN and South Asia are rich in resources. In terms of the young demographic group from 15 to 24 years of age, there are 210 million people in China. India has many more – 380 million. A lot of other countries with young populations are also in ASEAN and South Asia, such as Bangladesh, Indonesia, Pakistan, and the Philippines. With East Africa being a potential market, the countries along the Indian Ocean area have a total population of 2.2 billion and they should be the top choice for manufacturers looking to set up new production bases for handsets and notebooks. Power management, green energy, EV, and IoV will emerge as new applications markets in the region. Further ahead, metaverse and AI applications will also generate local business opportunities. The regionalization of the supply chain is not just about deglobalization; it's also about enormous business opportunities.

How should we respond to Warren Buffet offloading his TSMC stocks due to geopolitical concerns? Should we remain nonchalant, or should we try to make a point that the world needs us?

Credit: DIGITIMES