Various satellite projects and applications have been increasingly thriving, which leads to a huge amount of data transmission and processing. Such business opportunities attract cloud juggernauts including Amazon, Microsoft, and Google to justle for the space market.

According to DIGITIMES Research, the major public cloud platforms mainly come in three types: basic cloud services, ground station with cloud services, and in-house satellite network.

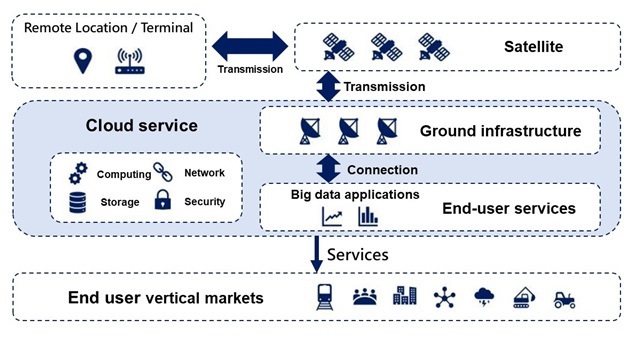

Cloud computing via satellite value chain

Credit: DIGITIMES

The satellite ecosystem consists of satellites, ground stations and receivers. Satellites perform different functions such as earth observation, signal transmission and telecommunication. Ground stations are responsible for satellites control, data downlink and processing, as well as streaming to a variety of users and applications.

Amazon, Microsoft and Google have been deploying cloud-based ground station as a service (GSaaS). Cloud service providers operate data centers worldwide to integrate antennas into their own clouds. With direct connections, satellite operators could reduce the cost of data transmission nodes and self-built ground infrastructures. Cloud connectivity is made through package of services.

The cloud computing giants are vying to provide more differentiated services. For example, Google Cloud Platform (GCP) focuses on strengthening data computing and geospatial service, integrating BigQuery, Earth Engine, Vertex AI, and Google Maps to build a complete satellite management portfolio.

With existing cloud services, Amazon Web Services (AWS) and Microsoft Azure employ global data center resources and invest in ground station antenna facilities to develop ground infrastructure hosting services, which attract satellite companies. Amazon's Project Kuiper satellites have been designed and developed in-house to maximize performance while reducing costs. It is worth noting that Kuiper satellites have been designed and developed in-house to achieve vertical integration in the satellite value chain. An in-house satellite system can not only develop satellite broadband and IoT markets but also serve as the backbone of the group's infrastructure, combining with other primary divisions to achieve synergy.

According to DIGITIMES Research analyst Aaron Chen, the main difference between Microsoft Azure and Amazon's satellite services lies in the openness of ecosystem services.

Due to the high integration of ground station antennas and global data centers, AWS is a more "closed" operating system that provides ground station services. AWS partners with startups such as Maxar, BlackSky, Capella, and D-Orbit, rather than traditional satellite or GSaaS companies. AWS provides independent solutions and establishes a vertical integration model, which has the potential for maximum benefit. However, AWS faces more challenges in expanding its market: it competes with existing satellite companies while providing basic cloud services. Moreover, Amazon plans to invest US$10 billion in Project Kuiper to build and scale the ground network. Therefore, the overall deployment carries the highest risk, and the project implementation is expected to be relatively cautious.

Azure Space builds a platform and ecosystem to make cloud connectivity across different industries. In contrast to AWS's closed ecosystem, Microsoft rather focuses on collaboration with other satellite companies. For example, by using Microsoft's Azure Orbital, satellite operators can gain flexibility, while also collaborating with third-party providers for their ground facilities. Azure Orbital opens up a broad ecosystem of partner options: it not only attracts traditional satellite companies like SES and Viasat to collaborate, but also works with SpaceX for satellite-powered connectivity. Nonetheless, as the number of ecosystem members increases, maintaining stable growth of the ecosystem and achieving cooperation synergy is not an easy task. Therefore, ecosystem governance will be a significant challenge.

According to DIGITIMES Research, AWS has the highest potential benefits and risks, while GCP has the most stable potential benefits and lowest risk. Azure, on the other hand, has a moderate level of risk and benefits that vary depending on the development of the satellite ecosystem.

About the analyst

Aaron Chen has an MA degree in Sociology and a bachelor's degree in history. He has accumulated more than 5 years of research and project management experience at the Telecom Technology Center (TTC), Industrial Technology Research Institute (ITRI), etc. Currently, his main research areas include the cloud industry and application market observation, such as SDN, NFV, AI, and cloud computing development trends.