Gartner has raised the CAGR of the foundry market from 2021 to 2025 to over 16%, and TSMC's aggressive deployment is expected to boost its global market share from 57% in 2021 to 64% in 2025. The Gartner-defined foundry market is smaller than what we perceive. If we take the 2021 foundry market at US$109.9 billion, TSMC's market share is 52%. But whether it is 52% or 57%, we agree that the foundry market is still growing and TSMC will still be the winner.

TSMC believes it must leverage its leadership during the downturn to extend its leadership further. While TSMC still has room to raise prices for advanced manufacturing processes, or still has bargaining chips when equipment deliveries are delayed, the room of growth for Samsung Electronics is being squeezed further.

Samsung's foundry business in the past few years accounted for 17% of the global total. In recent years, Samsung has been keen on reinforcing its foundry business. In terms of the capex of its semiconductor division, the System LSI department that focuses mainly on foundry business has seen its share rise from 16% to about 25% over the past two years, and its share is now heading towards the 40% mark. The fact that over 80% of the System LSI revenue comes from the foundry services shows that Samsung hopes to boost the foundry business and have it contribute more profits for the company.

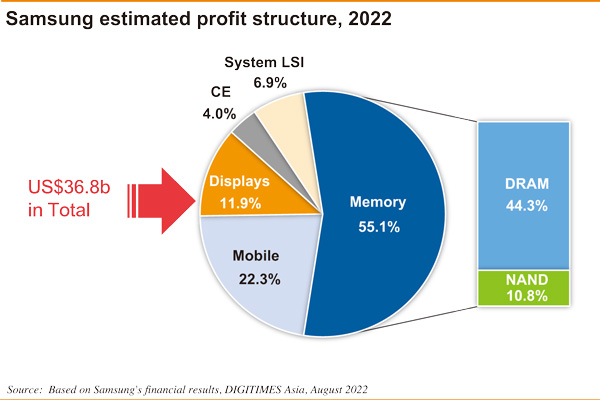

In the past, Samsung's own application processors (APs), display driver ICs (DDIs), and even special specification memory for the captive market accounted for half of its own foundry output. Now it is aggressively seeking foundry orders from Qualcomm, Nvidia and AMD, and its foundry business stands a chance of achieving more than 20% growth. The foundry business' contribution to the company's revenue is expected to increase to 9.2% in 2022 from 7.3% in 2021, and the profit contribution is expected to more than double from 3% to over 6%.

In terms of foundry capex, Samsung is getting a bit closer to TSMC: the Taiwanese firm's capex is now about 2-2.5 times the Korean maker's foundry business, down from the previous difference of three times. But in terms of advanced EUV capacity, TSMC is about 3.5 times as much as Samsung's.

And TSMC continues to expand its customer base. It is understood that TSMC has a clientele of up to 1,000 companies, while Samsung's foundry business has only about 150 customers. The two sides are actually not competitors on the same level. Samsung has been "provocative" in its race against TSMC, who nevertheless has not shown much interest in provocation. In the foreseeable three to five years, it will be very difficult for Samsung to have head-to-head competition against TSMC.

Samsung's foundry division was launched in 2005, and in 2017 it was cut off from the AP/SoC, DDI, CIS and other divisions in a bid to reduce conflicts of interests as much as possible when dealing with customers. It expects to receive orders from Qualcomm, Intel and Nvidia. In particular, Samsung's leadership in 3nm GAA technology will still give it a chance to increase its foundry market share, while its early introduction of EUV equipment in 4th generation DRAM technology is also highly valuable in accumulating IP.

But Samsung's global foundry market share has not changed much, despite years of efforts trying to make gains. The handset market has been the main driver of foundry growth in the past few years, but the key in the next few years will be high performance computing (HPC).

Of Samsung's 2021 capex, KRW10 trillion is estimated to have been allocated for DRAM, KRW12.5 trillion for NAND, and KRW13 trillion for foundry - a total of KRW35.5 trillion, or about US$33.2 billion at a time when US$1 could exchange for around KRW1,067. As of the end of August 2022, the Korean won had depreciated to 1,340 to US$1, which is putting even more pressure on Samsung's investment costs.

(Editor's note: This is part of a series of 10 articles by DIGITIMES Asia president Colley Hwang about Samsung's outlook.)