Since moving into the new economic era in the 1990s, India has chosen the information service sector as its core industry. Much of the loans and subsidies from the World Bank have been spent on infrastructure such as satellite communications, which has made software business process outsourcing (BPO) a mainstream business in India. The fundamental industrial structure of BPO has been well developed since the 1990s.

The total output of India's information services industry reached US$67.5 billion in 2020, with TATA, Infosys, HCL, Wipro, and Tech Mahindra contributing 87.1%, and the top 20 contributing 98%, according to data collected by DIGITIMES. It is an industry of international race, where each of the five players reports annual revenues of more than US$5 billion. They are all well experienced in international businesses. For foreign players aiming for opportunities for system integration, partnerships with the local service providers are indispensable.

Considering potential partnerships, TATA and the subsidiaries of India's big business groups operate in all areas nationwide. Since its inception in 1981, Infosys has been aggressive in seeking overseas business opportunities, demonstrated by an overwhelming proportion of overseas business and a slim 3% from home market.

HCL initially focused on hardware business and had a joint venture with HP. It thereafter switched its core business to the information service sector which now contributes 90% of its revenues. Optimistic about India's networking/communications business opportunities, HCL collaborates with Cisco and actively explores 5G and others.

Wipro started its business with agricultural processed products, then switched to manufacturing, and transformed to the information service industry and software contracting. Wipro is now very actively exploring O-RAN business opportunities. Tech Mahindra operates deeply in the Indian domestic market and is also a subsidiary of a large business group. In India, big business groups also go head to head with one another. For instance, TATA Group's TCS is closely aligned with Bharti. Tech Mahindra is allied with Reliance Jio. HCL is collaborating closely with Cisco. Tech Mahindra is also a global partner within Rakuten's O-RAN network, which is even more indicative of intense competition among different camps.

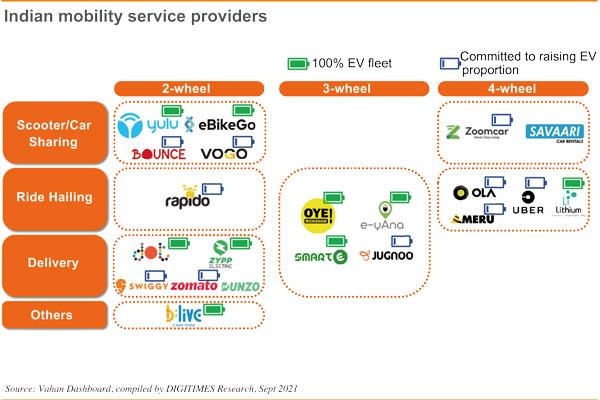

We gleaned and compiled some data regarding local startups in the motor vehicle industry. Many startups are engaged in goods/food delivery, ride-hailing, scooter/car sharing and other innovative services. Service plans for two-wheelers, three-wheelers, four-wheelers have been actively developed and rolled out. Some have even completed the deployment of electric vehicle (EV) fleets.

Interestingly though, most of these new startups are concentrated in cities such as Bangalore, Gurgaon and Mumbai. We can come up with the distribution map of startups to compare with the key regions where smart applications could be implemented in the early stages in India.

(Editor's note: This is part of a series of analysis on India's industry and market by DIGITIMES Asia president Colley Hwang.)