Rising DRAM and CPU prices are feeding through the display supply chain, with AUO estimating that end-product prices could increase by 10% to 30%. While LCD panel prices have firmed on tighter supply, upstream semiconductor cost inflation is reducing demand visibility for consumer electronics in 2026.

RISC-V gains traction in automotive and industrial markets despite ecosystem risks, while India's tech landscape sees heightened AI, semiconductor and smartphone activity—from Phison Electronics CEO Khein-seng Pua meeting Narendra Modi and Anthropic's trademark dispute, to Xiaomi's premium push, the launch of PRITVI-ACE by Centre for Development of Advanced Computing, expanded deep tech support, and an arbitration case between Wingtech Technology and Luxshare Precision

Memory chip shortages and soaring prices could constrain shipments of consumer electronics in 2026, including smartphones, PCs, notebooks, and TVs, while Netronix, the world's largest e-reader original design manufacturer (ODM), expects e-reader shipments to hold steady or grow 5–10% if market impacts remain manageable. Hsin-yung Lu, Netronix president, cautioned that significant retail price increases might dampen consumer demand.

LED automotive lighting module maker Laster said it expects China's car purchase subsidies and trade-in programs to stimulate domestic demand in the first quarter of 2026, and that overall end-market automotive demand should remain relatively robust.

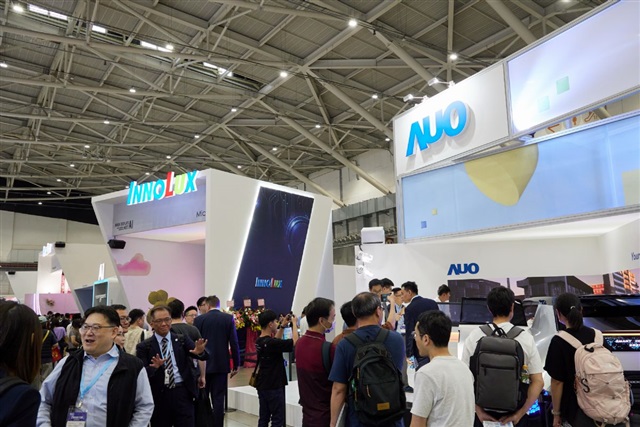

Taiwan's display supply chain earnings season is starting, led by AUO and Coretronic, followed by BenQ Materials, Radiant Opto-Electronics, and Daxin Materials. Intensifying competition is pushing the sector into broad structural transformation, with new business execution and commercialization progress becoming the central focus.

Chinese television manufacturers are intensifying pressure on South Korean brands that have long dominated the global market, as shipment growth at companies such as TCL and Hisense contrasts with stagnation at Samsung Electronics and LG Electronics. What began as a volume-driven push is increasingly paired with premium strategies, setting the stage for fiercer competition across the global television industry.

Sharp said on February 10, 2026, that the planned sale of its Kameyama No. 2 liquid crystal display factory in central Japan to its Taiwanese parent, Foxconn, had collapsed after the contract manufacturer withdrew, citing persistent weakness in LCD panel prices.

AUO is overhauling its business model to make Vertical Solution and Mobility Solution the dominant revenue sources, targeting a combined 70% share of sales by 2030 while expanding into AI, chip-scale optical packaging, waveguide optics, and low-Earth orbit (LEO) satellite hardware.

Taiwanese display solutions provider Coretronic reported consolidated revenue of NT$3.21 billion (US$101.86 million) for January 2026, down 21% from NT$4.06 billion in December 2025, but up 12% compared to NT$2.86 billion in January 2025. The company attributed the decrease primarily to weaker seasonal demand.

Coretronic said shipments of its energy-saving and imaging products will fall in the first quarter of 2026 due to seasonal factors and fewer working days, while projecting 10–20% year-on-year shipment growth for both categories across 2026. The company reported stronger fourth-quarter revenue and modest annual results.

Taiwanese display driver IC (DDI) giant Novatek recently held an investor briefing, where Vice Chairman and General Manager Steve Wang said that memory supply and costs will be the most critical factors affecting various electronic products, especially smartphones and PCs, in 2026. Aside from traditional DDI products, Novatek has recently made progress in new areas such as system-on-chip (SoC), application-specific ICs (ASICs), imaging, and edge AI. The company plans to continue launching new products and expand into diverse applications.

More coverage