Amidst the rising tension between Washington and Beijing, Tesla is rechanneling its resources to North America for its electric vehicle (EV) market. The EV heavyweight is building a Gigafactory in Mexico, which is expected to begin production in 2024. Following Tesla's new plan, an increasing number of Taiwan-based suppliers are opting for Mexico as their investment destination.

Tesla currently has five Gigafactories, in Nevada, Texas, New York, as well as two overseas plants located in Shanghai, China and Berlin, Germany. According to DIGITIMES Research analyst Jessie Lin, compared to Tesla's largest production facility in Shanghai, which has an annual capacity of 750,000 vehicles, the new factory planned in Mexico boasts an even higher capacity of up to 1 million vehicles. Additionally, it will be the world's largest Tesla plant in size, which is nearly twice the size of its Giga Texas and 20 times the size of its Shanghai factory.

Despite Tesla's plan to establish the Shanghai facility as a vital manufacturing hub, it has recently encountered several crises. These challenges encompass customer complaint and protest; restrictions imposed by China due to data security concerns, resulting in Tesla EVs being barred from entering military and government compounds. Additionally, BYD's EV sales in China have not only outperformed Tesla but have also widened the gap even more in 2022, which poses a significant threat to Tesla's business in China.

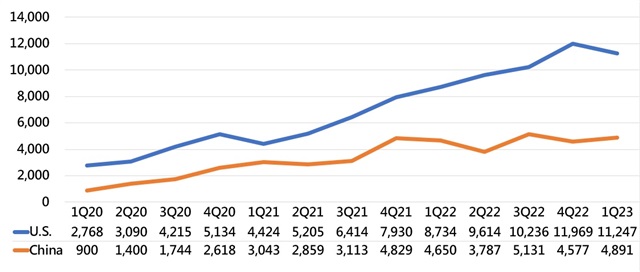

Tesla revenue from the U.S. and China, 1Q20-1Q23 (Unit: $m)

Source: Tesla, DIGITIMES Research, June 2023

In contrast to China, Mexico possesses several advantages. Firstly, it is part of the North American Free Trade Agreement (NAFTA) along with the United States, which has been replaced by the United States-Mexico-Canada Agreement (USMCA) and the Inflation Reduction Act (IRA). These agreements provide tax deductions, thereby securing vehicle supply chains in North America. Secondly, the close proximity to the U.S. promises faster delivery and lower transportation costs.Thirdly, the current EV penetration rate in the U.S. is still relatively low, indicating significant potential market demand. DIGITIMES Research concludes that the number of EVs on U.S. roads is projected to reach 8.5 million units by 2030, which will boost Tesla's sales, growth, and business opportunities in North America.

With an annual production of over 3 million vehicles, Mexico ranks as the world's seventh-largest auto producer, with 90% of its output destined for international markets. Notably, 85% of Mexico's autos are exported to the U.S. As Mexico solidifies its position as a key production base for Tesla, Taiwanese suppliers, such as Foxconn, Pegatron and Quanta, have opted to establish or expand their manufacturing facilities near the U.S.-Mexico border.

About the analyst

Jessie Lin received a master's degree from the Department of Business Administration at the National Taiwan University of Science and Technology. Her research focuses on automotive, LED, and display panels.