In the 5G era, Open RAN is expected to form an emerging market. However, according to a survey conducted by DIGITIMES Research, the industry is still cautious about when the market will take off.

According to DIGITIMES Research analyst Benson Wu, various 5G user cases are disaggregating the relationship between software and hardware. More operators are moving beyond bundled solutions provided by leading suppliers, such as Ericsson, Nokia, and Huawei, and can procure software for different verticals along with standardized COTS (commercial off-the-shelf) equipment, such as X86 architecture, for network deployment.

Furthermore, datacom suppliers are eyeing a piece of the telecom industry, which a few suppliers dominate. Operators expect more bargaining power provided by the openness of RAN when negotiating with telecom gear suppliers.

According to Wu, various network deployment options may coexist in the 5G or even 6G era when everything connects to the internet. One approach, a single-vendor approach that adopts proprietary gear, provides better performance and reliability. Another approach, a semi- or fullly-open RAN, may help operators reduce costs.

Still, although openness of RAN is regarded as an emerging trend by some in the industry, Wu pointed out that since the forming of the O-RAN Alliance, only 32 of more than 800 4G and 5G operators in the world joined the group, implying a cautious view from telecom operators toward Open RAN.

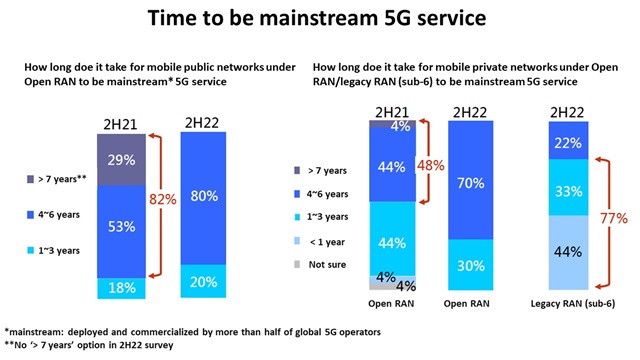

According to research conducted by DIGITIMES Research in second half of 2021 and 2022 based on a survey of more than 20 Taiwan-based suppliers of 3GPP-based RAN, Open RAN, or O-RAN products and services, 80% of the respondents believe that it would take more than four years before Open RAN can become the mainstream of 5G public networks (deployed and commercialized by more than half of global 5G operators).

Source: DIGITIMES Research, January 2022

Besides, the share of those who believe that Open RAN private networks are expected to be the mainstream architecture in three years dropped from 48% in 2021 to 30% in 2022. According to Wu, it's not that respondents are pessimistic about the Open RAN/O-RAN, but they share the same question regarding when it will take off.

Wu pointed out the major challenges for Open RAN when it comes to large-scale deployment and commercialization. For example, even if devices comply with the O-RAN standard, there may still be compatibility issues between units, and 5G technologies. For example, mMIMO (massive MIMO), CA (carrier aggregation), and DSS (dynamic spectrum sharing) require compatibility.

In addition, it is difficult for devices under Open RAN to reach optimization, be it performance or power consumption optimization, as RAN units from different vendors have different parameter sets of their products, which is not an issue under the single-vendor approach. Besides, with more open architecture comes more risk of being hacked, Wu said.

Although some believe that Open RAN provides a cost advantage over legacy RAN, Wu quotes the 'Secure and Trusted Communications Networks Reimbursement Program' conducted by FCC, showing that Open RAN base stations may not always be cheaper than legacy RAN, even maybe pricier due to the lack of economies of scale. Another piece of evidence was demonstrated by financial statements by Rakuten, which deployed the world's-largest Open RAN mobile network; the company has seen a worsening loss from the mobile segment despite growing sales of the business.

Meanwhile, Wu said that the Bejing government actively supports domestic suppliers such as Huawei and ZTE, limiting the potential of Open RAN/O-RAN in China. As China accounts for more than half of 5G users and base stations globally, it restricts Open RAN/O-RAN to gain economies of scale. Developing countries in Africa and Asia, where operators' ARPU is low compared with developed countries, are thereby seen as potential markets for Open RAN/O-RAN, and solutions provided by Huawei and ZTE have cost and performance competitiveness in these markets. So, unless local telecom operators are pressured by their governments to ban Huawei and ZTE, it makes little sense for local operators to adopt Open RAN.

According to Wu, the industry still believes that RAN is moving toward openness, but there is a division of opinion about when Open RAN/O-RAN will gain its scale.

About the analyst

Benson Wu graduated from Indiana State University with an MA degree in communication. He worked for FETNet and Industrial Technology Research Institute (ITRI). He is senior analyst and project manager at DIGITIMES Research, covering mobile and wireless communications, global telecom industry, and IoT standards and applications.

DIGITIMES Research analyst Benson Wu; Credit: DIGITIMES