Suppliers in almost all sectors in the semiconductor ecosystem are raising prices to reflect tight capacity amid strong demand. But there have been concerns that the upward pricing trend may send end-device prices up, deterring consumers. For chip vendors, such as driver IC specialist Novatek, price hikes are expected to drive up their revenus and profits in first-quarter 2021. But for China-based foundry house SMIC, which is on a US export blacklist, pricing may be a lesser concern than availability. SMIC may run out of chemical raw materials needed for chip fabrication.

Rising upstream costs may dampen device demand growth in 1H21: Rising manufacturing and raw material costs may bring variables to end-market demand in the first half of 2021, as device vendors and manufacturers are looking to pass the increased costs onto clients, according to industry sources.

Novatek to lead new wave of price hikes for DDI, TDDI chips: Taiwan's leading display driver IC (DDI) vendor Novatek Microelectronics is expected to take the lead to raise its quotes soon to reflect increased foundry costs, which may send its revenues, gross margins and net earnings hitting new highs in first-quarter 2021, according to industry sources.

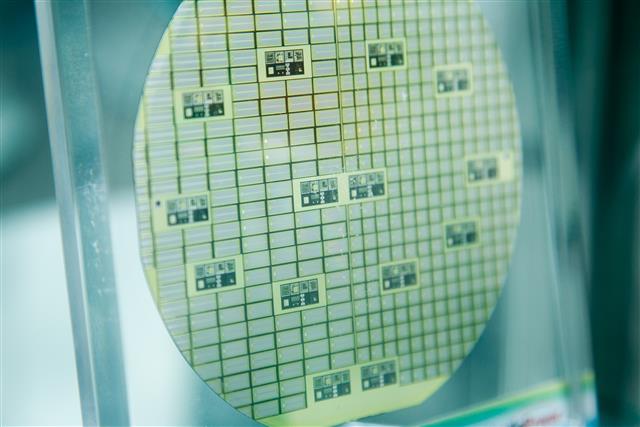

SMIC sees US ban hit supply of chemical raw materials and consumables: The US trade ban against China-based SMIC has restricted the pure-play foundry's capability of obtaining semiconductor equipment for its process technology advancements. Nevertheless, a more significant challenge facing SMIC is insufficient supplies of chemical raw materials and some crucial consumables for use in chip fabrication, according to sources at Taiwan's fabless chipmakers.