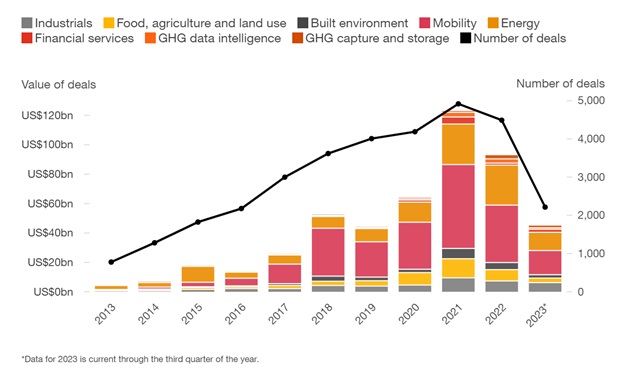

Will green investment will pay off over time? In 2023, climate tech start-ups faced a significant funding decline, reaching levels not seen in the past five years. Despite the growing demand for climate technology, equity investment in these start-ups has steadily decreased annually, reflecting challenging conditions within private markets. PwC's State of Climate Tech Report 2023 underscores this trend.

Source: Pitchbook, PwC analysis

The past two years have tested the resilience and adaptability of investors in climate technology ventures. A mix of geopolitical uncertainties, declining valuations, inflation, and rising interest rates has impacted private markets across various sectors. Total venture and private equity investment experienced a 50.2% year-over-year decrease, totaling US$638 billion in 2023. Specifically, funding for climate tech start-ups in private market equity and grant funding dropped by 40.5% over the same period, returning to levels seen five years ago.

While the global push for decarbonization remains politically expedient, it is economically insufficient. Mahmood Pradhan, the Head of Global Macro Economics at Amundi Investment Institute, emphasized that the expectations for achieving net zero are exceedingly challenging for governments alone; they must also emanate from the private sector.

The International Energy Agency (IEA) suggests that annual global clean energy investment needs to be more than triple by 2030 to around US$4 trillion to achieve net-zero emissions by 2050. The IEA's net-zero scenario reveals that over one-third of the required emissions reductions in 2050 rely on technologies still in development, emphasizing the ongoing need for substantial innovation capital.

Despite these challenges, climate tech's share of private market equity and grant investment increased to 11.4% in Q3 2023, with an annual growth rate of 10% for the year to date.

However, some sectors still face funding shortfalls relative to their emissions share. Yet, there is a positive trend when considering funding in relation to technologies' emissions reduction potential. Investors are progressively allocating capital to technologies with greater emissions reduction potential (ERP), such as carbon capture, green hydrogen, and alternative foods, signaling a shift in investor openness to diverse climate technology solutions.

Venture-stage funding remains critical for climate tech innovation, especially in high-emission sectors. To achieve a significant impact, increased financing is essential, not only in the form of venture capital but also in growth capital to facilitate rapid expansion.

Widespread deployment of climate tech solutions requires financing from both companies and governments. Policy and standards shifts, as well as increased cooperation across organizations and sectors, are equally vital. As the world places greater value on climate action, innovative investors stand to find more opportunities at the forefront of climate tech.