The current approach to fixing climate change is not promising. Not only are many efforts going into the net-zero project, but the outcome is always the bathtub metaphor.

In further words, even if people emit less carbon dioxide, the amount still increases from day to day.

DIGITIMES Asia agreed with Dr. Bjørn Lomborg, one of TIME magazine's 100 most influential people in the world for his contributions to humanity, the world needs to implement carbon pricing.

"This is not a controversial idea," Lomborg wrote in his book titled False Alarm. "Most economists agree that the most effective way to reduce the worst damage of climate change is to levy a tax on carbon dioxide emissions."

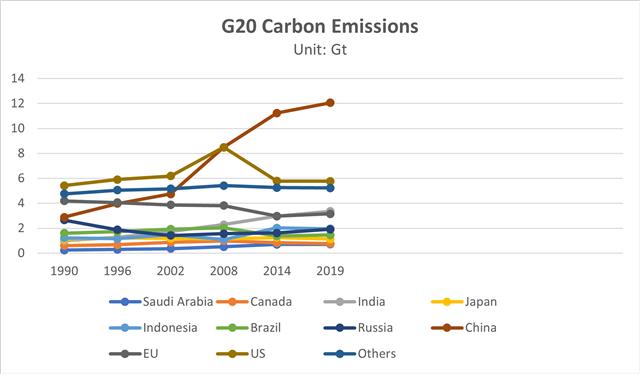

The below figure shows that the majority of G20 countries had an increase in carbon emissions between 1990 to 2019.

Source: Climatewatch. Compiled by DIGITIMES Asia in July 2022.

Carbon Pricing

Carbon pricing can be grouped into two categories, namely direct and indirect carbon pricing.

Direct carbon pricing refers to carbon pricing tools that incent a proportionate price according to the emission levels of a product or service, mainly through a carbon tax or emissions trading system (ETS).

Indirect carbon pricing refers to tools that change the price of products associated with carbon emissions in ways that are not directly proportional to those emissions. Examples are fuel and commodity taxes and fuel subsidies affecting energy consumers.

The question is, why a carbon tax?

A carbon tax encourages all stakeholders in the market to be more environmentally conscious and reduces carbon emissions.

Consider, for example, a laptop one bought from Harvey Norman. Carbon emissions happen at every stage of the process, ranging from the chip-making process in a fab clean room to the customer's study desk.

With a carbon tax, Harvey Norman would pay a little more for fuel. Companies on a tight budget would find the best stratagems to strengthen the supply chain and reduce their vulnerability. This includes assessing areas with a high climate risk factor or a high greenhouse gas emission rate.

Even charging the laptop in a café will add a tiny extra cost because the café pays slightly higher electricity bills.

One can see that the costs of implementing a carbon tax are passed on to every other stakeholder. Eventually, every stakeholder in the chain will always reflect on their own carbon footprint in monetary terms.

Like a coin, every consequence has two sides. On the other side, carbon tax makes the world poorer than it is now, as it causes damage to the economy.

One may ask, "What about an alternative solution?"

How ethical is carbon offsetting?

Carbon offsetting has become an increasingly popular way for companies to reduce their carbon emissions and do their part in fighting climate change.

Companies can purchase offsets, compensating third parties who are involved in emissions reduction projects like reforestation and methane capture, to make up for any emissions that the company cannot reduce.

This is where the carbon offset wrangle comes in. John Doerr, chairman of venture capital firm Kleiner Perkins, in his own words, argued that "offset" is a "loaded" term, both "heavily criticized" and "broadly used."

At its worst, offset is degrading to an exercise in greenwashing. Doerr commented, "a way to absolve companies or individuals from responsibility for bad behavior."

In an article titled "The fantasy of carbon offsetting," Robert Watt stated, "If capitalism is understood as a system offering enjoyment, then carbon markets can reinforce its promises of jouissance by offering to remove the 'stain' of excess carbon (which threatens capitalist enjoyment) via pricing, trading, and offsetting."

"However, knowledge of problems and contradictions, generating symptom, does not necessarily generate change," Watt continued. "Even if people recognize that their activity involves following an illusion; still, they are doing it."

Developed by the Voluntary Carbon Markets Integrity Initiative (VCMI), the Provisional Claims Code of Practice, a multi-stakeholder initiative, was launched last July in response to the carbon offsetting debate.

The objective of the initiative is to ensure that voluntary carbon markets are actually delivering the levels of mitigation and sequestration needed.

The VCMI Code is made to increase the clarity of carbon-offsetting claims when said claims are valid. There are three categories: Gold, Silver and Bronze. Claims can be made by the company as a whole or on a brand-, product-, or service-specific basis.

The Code provides corporations with a roadmap for integrating the VCMI's 12 principles into their annual bottom line:

Principles for high-Ambition and high-integrity voluntary climate action by companies | |

Principle | Description |

1. Science-Based | a. Company strategies, targets, activities, and engagement in voluntary carbon markets account for the latest scientific consensus on safe upper limits for global warming. b. Alignment with the Paris Agreement temperature goal to limit global warming to 1.5 degrees Celsius is the ultimate objective. |

2. Comprehensive | Companies build their climate targets and actions upon accurate and complete greenhouse gas inventories in line with the most recent requirements set out by the GHG Protocol (or equivalent should one be developed). |

3. Net-Positive Benefit | a. Companies' climate action accords net-positive benefits to individuals and communities impacted by the supply and use of carbon credits, including Indigenous Peoples, local communities, women, and underserved communities. b. Such action maximizes social and ecological co-benefits and avoids or minimizes adverse impacts. |

4. Rights-Compatible | Company climate action respects protects and fulfills human rights under international law, including lack of discrimination on the basis of identity, the rights of Indigenous Peoples, and those associated with health, labor, land, and Free Prior and Informed Consent (FPIC). |

5. Nature-Positive | Company climate action aligns with the need to slow, halt, and reverse nature loss and moves toward a nature-positive state of recovery and renewal. |

6. Additional | Company action, investment, and carbon credit purchases support emissions reductions and/or removals that are additional to those that would occur in the absence of demand for carbon credits. |

7. Immediate | a. Companies prioritize taking immediate action to reduce their own emissions, including within their value chains. b. Action aligns with scientific evidence showing that the years leading up to 2030 are critical to averting environmental tipping points caused by increased concentrations of GHG emissions in the atmosphere. |

8. At Scale | a. Businesses progressively increase the ambition and significance of their investments in interventions that accelerate climate change mitigation within and beyond their value chains. b. Aim to reflect the value of unabated emissions within their value chains—including projects and programs that generate carbon credits for voluntary carbon markets. |

9. Transparent | a. Companies transparently disclose information relating to their climate commitments and activities, including their scope, coverage, underpinning strategies and assumptions, performance metrics, relevant definitions, and nature of carbon credits and their use. b. Companies publicly report on progress and learning as they move toward the achievement of net zero. |

10. NDC-Enabling | Companies' actions, investments, and demand for carbon credits support the implementation of national climate plans, contribute to and help exceed Nationally Determined Contribution (NDC) ambition, and avoid the potential to disincentivize increasing NDC ambition. |

11. Consistent | Companies' lobbying efforts and membership in industry associations are aligned with, not contrary to, their climate commitments. |

12. Collective and Predictable | Companies work together and with a diverse and broad range of stakeholders to act on climate change, including by publicly signaling their expected voluntary demand for carbon credits and aggregating demand for carbon credits to increase certainty and help drive systemic change. |

Source: The Voluntary Carbon Markets Integrity (VCMI) Initiative: Provisional Claims Code of Practice. Compiled by DIGITIMES Asia, July 2022.

VCMI's intention is to issue a final Claims Code in late 2022 or early 2023 based on the company's road testing, public consultation, and learnings through additional assessment. The initiative also expects to carry out a full review of the Claims Code in 2025.

Corporates such as Google, Unilever and Hitachi had already confirmed their participation in 'road-testing' the Provisional Code prior to the event.

In a nutshell, the lines between 'reality' and 'fantasy' of carbon offsetting are no longer blurry. With the new initiatives, it is more cost-effective and efficient than ever before.