The global deployments of data centers are still dominated by China and the US, but the proportion outside of China and the US is gradually increasing, and the overall demand is still strong. Taiwan's server industry still still booming. According to DIGITIMES Research analyst Frank Kung, Taiwan's server industry still stands a chance of seeing a 6% growth in 2022, although the client structure will be much different.

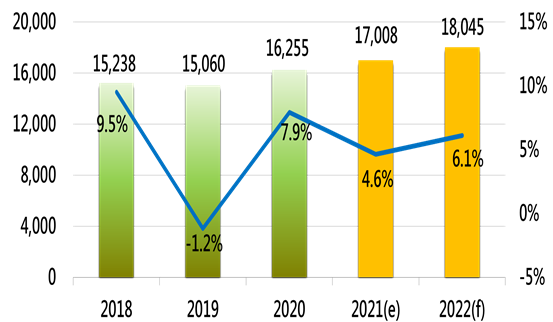

DIGITIMES Research has worked with three major components distributors, namely WPG, WTMicroelectronics and Avnet, to compile information on several key industries and jointly grasp the changes and demand for parts in key industries, and servers are one of them. According to the latest quarterly DIGITIMES Research statistics, the total production volume of servers worldwide was 16.25 million units in 2019, 17 million units in 2020, and will reach 18.04 million units in 2022, basically maintaining an upward trend, but with gradual structural changes.

We can roughly divide the server customers into several categories. Meta, Amazon, Google, and Microsoft are in demand for their own use, and in the demand structure of network giants actively deploying cloud centers, the annual growth rate of these four major manufacturers is over 10%.

Hewlett-Packard (HP), Dell and Lenovo are selling servers under their own brands, but these traditional majors are gradually transforming to strengthen the proportion of system integration, thus focusing not on "quantity" but on "quality." Supermicro, a US-based server start-up with deep ties to Taiwan, continues to grow well and has the highest share of production in Taiwan.

As a result of the US-China trade war, Chinese companies continue to increase their self-production rates, with Lenovo estimated to have a 68% self-production rate in 2022 and Inspur, which targets China's local networking giants, to have an 80% self-production rate in 2022. As for Huawei, which was hit the most, its sales declined 39% in 2021. In 2022, it may follow the pattern of cell phones, which sees procurement, production and shipments handled by other systems.

Currently, 39% of the global data center market is concentrated in the US, China contributes 10%, and the rest is distributed in different countries. Now, regional data centers are also increasing in size, coupled with the impact of the US-China trade war, many manufacturers are expanding their production in Taiwan, and there are also operators in Thailand and Malaysia.

In addition to the impact of the trade war, the recent lockdowns in Chinese cities created major problems for manufacturers.

Global server shipments, 2018-2022 (k units)

Source: DIGITIMES Research, May 2022