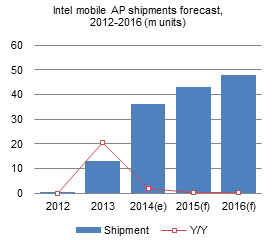

Since 2014 Intel has successfully penetrated into the mobile device market quickly by providing partners various subsidies and establishing a supply chain in China, helping it to achieve a shipment record of 46 million mobile application processors (APs) in the year. At the same time, the CPU giant also generated an enormous loss of US$4.2 billion from the business, causing its Mobile and Communications Group (MCG) to have been merged by the PC Client Group (PCCG) and the company has turned conservative about its mobile market strategy for 2015.

However, demand for 2-in-1s and the launch of Windows 10 are still expected to bring business opportunities to Intel in 2015. Intel's China Tech Ecosystem (CTE) supply chain is gradually growing mature and the Atom X3 (SoFIA) processors, which Intel has jointly developed with a China AP supplier, has also started finding opportunities in the market despite the overall environment still remaining competitive.

This Digitimes Research Special Report details Intel's mobile AP strategies, status, advantages, partnerships and operating system support for different smart mobile device markets. It analyzes the CPU giant's operation progress in different industries in 2014 and forecasts Intel's development and direction for 2015 and beyond.

Table 1: Mobile device definitions and coverage for this report

Table 3: Key Intel mobile market strategy areas, 2015 (part 1)

Table 4: Key Intel mobile market strategy areas, 2015, (part 2)

Chart 2: Intel mobile AP shipments forecast, 2012-2016 (m units)

Chart 3: Intel mobile AP shipment share by vendor segment, 2014-2015

Chart 5: Intel mobile AP shipment share by mobile device type, 2014-2015

Chart 6: Intel mobile AP shipment share by product lines, 2014-2015

Chart 7: Intel mobile AP shipment share by end device size, 2014-2015

Chart 8: Intel major strategies for branded tablet market, 2014

Chart 9: Intel major strategies for white box tablet market, 2014

Chart 11: Intel Atom product lines' prices and shipment schedule, 2015

Chart 12: Intel Atom-based detachable Windows tablet shipments, 1Q14-4Q14

Sub-9-inch Windows tablets benefit from free Windows licensing and CTE support

Chart 13: Surface Pro 3 specification and price change, 2012-2014

Surface Pro 3: Key to Microsoft entry into larger screen 2-in-1 tablet market

Chart 14: Intel Atom-based small-sized Windows tablet shipments, 1Q14-4Q14 (m units)

Chart 15: Intel focus shifting from Android to Windows tablet in 2015

Branded, Surface 3 and white-box models each find a niche in the market

Table 5: Comparison of inexpensive notebooks and 2-1/tablet Windows licensing fees

Large-size Surface Pro models to account for largest share of shipments in 2015.

Chart 19: Microsoft Surface Pro and Surface shipments, 1Q15-4Q15 (m units)

Chart 21: Intel-based ZenFone quarterly shipment forecast for 2015 (m units)

Chart 22: Intel white-box tablet and smartphone partners in 2015