As of 2013, the 10 ASEAN nations had a total of over 700 million mobile subscriptions, with the CAGR from 2003-2013 reaching 24%, and the share of the global user base rising from 4.9% to a high of 10.6%. This Digitimes Research Special Report analyzes the various mobile broadband markets in ASEAN and looks at the respective trends in 4G LTE development for those markets.

Large emerging consumer markets consisting of young consumers

Analysis of current ASEAN mobile/fixed-line subscriptions and revenues status

Large discrepancies exist between different nations in terms of fixed-line broadband development

Analysis of mobile/fixed-line industry development in the various ASEAN nations

Chart 5: ASEAN mobile phones/ mobile broadband penetration rate comparison matrix, 2013

Next-generation mobile network technologies undermine fixed-line resources

Penetration rates of smart mobile terminals rapidly increasing

Chart 6: ASEAN fixed line broadband penetration rate comparison matrix, 2013

Analysis of ASEAN mobile technology and 4G network development

Chart 7: ASEAN markets by technology standards supported, 2013

Chart 8: Southeast Asia LTE development and coverage matrix, 1Q14

User ARPU on the decline as bonus mobile services are practically useless

Chart 9: Singapore mobile service providers, ARPU, 1Q13-1Q14

Developing All over LTE services to increase user data traffic

Chart 10: Singapore mobile service providers transitioning to 4G

Growth in the mobile user market has reached a saturation point

Social network services and prices are driving the growth of smartphone penetration rate

LTE post-paid was unpopular and low cost pre-paid plans competed for customers

Next-generation mobile broadband subscribers have become the highlight of revenues growth

Chart 14: PLDT transition to next generation network facing bottlenecks

Chart 16: Indonesia telco operators not riding the wave to LTE

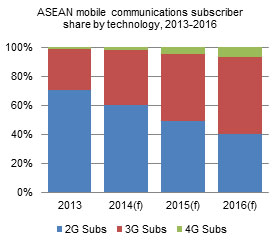

3G user numbers enter market take-off phase 4G users could reach 50 million in 2016

Rapid growth in number of ASEAN fixed-line broadband subscriptions

Chart 19: ASEAN and global fixed broadband subscribers, 2003-2013 (million)

Chart 20: ASEAN fixed broadband household penetration rate by country, 2003-2013 (million)

Priority in increasing penetration rate of fixed-line broadband subscriptions

Chart 21: ASEAN broadband policy goals by country, compared with 2013 actual growth

Develop differentiated value-added services for fixed-line broadband

Chart 23: IPTV deployment data among broadband users by region, 2013

Chart 24: SWOT analysis for broadband development in the ASEAN region