Table 1: Key vendor factors affecting 1H21 smartphone shipments in China

Table 2: Key trends affecting smartphone shipments to China in 1H21

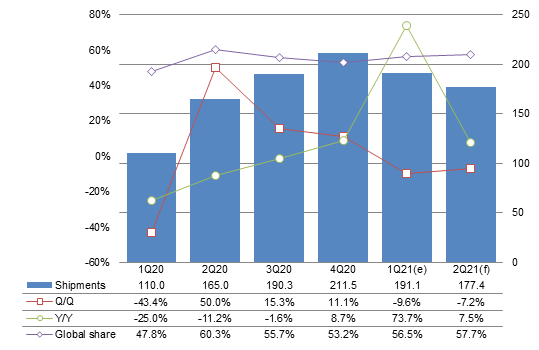

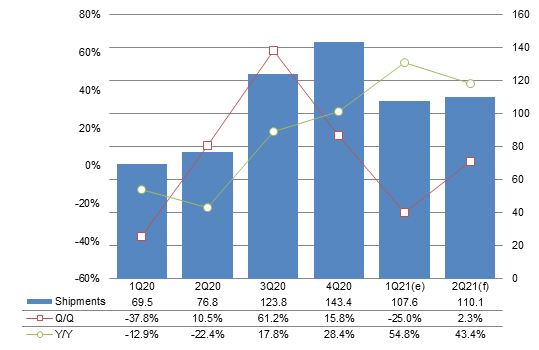

Chart 1: China smartphone market shipments, 1Q20-2Q21 (m units)

Chart 2: China smartphone market shipments - international and local brands, 1Q20-2Q21 (m units)

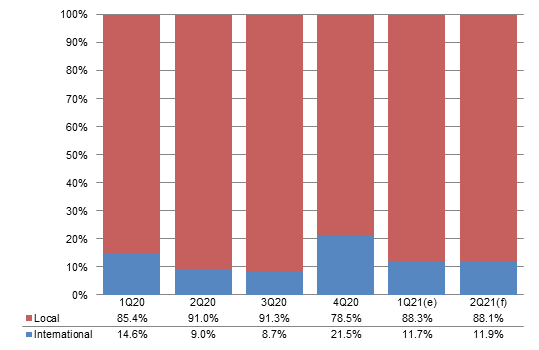

Chart 3: China smartphone market share - international and local brands, 1Q20-2Q21 (m units)

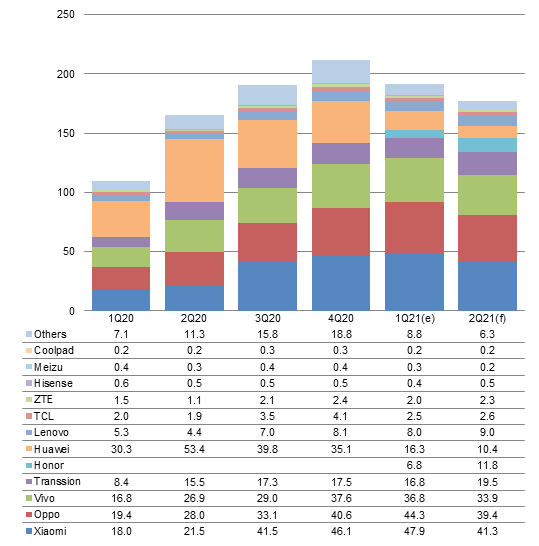

Chart 4: China smartphone market shipments, by China-based players, 1Q20-2Q21 (m units)

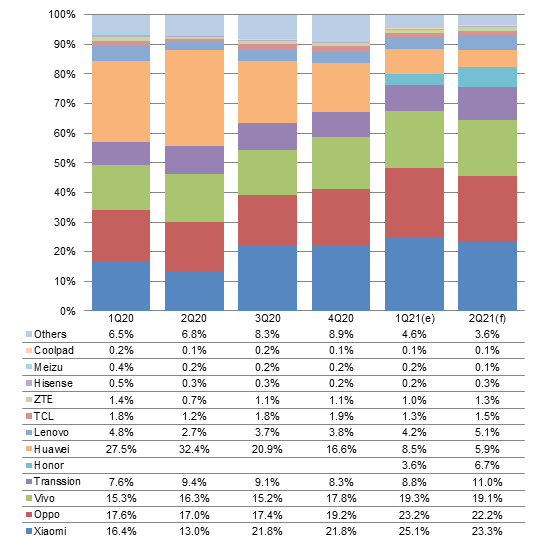

Chart 5: China smartphone market shipment share, by China-based players, 1Q20-2Q21

Chart 6: China smartphone market shipment growth by quarter by China-based players, 1Q20-2Q21

Chart 7: International brand smartphone shipments in China market, 1Q20-2Q21 (m units)

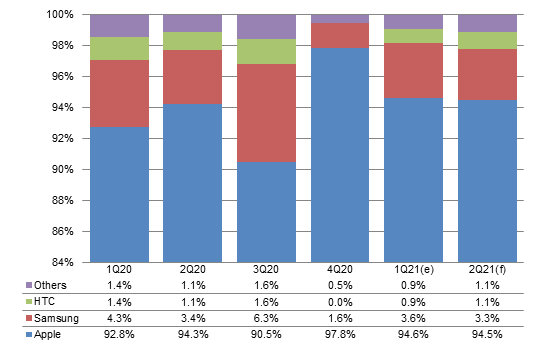

Chart 8: China smartphone market shipments by international brands, 1Q20-2Q21 (m units)

Chart 9: China smartphone market shipment share by international brands, 1Q20-2Q21

Chart 10: China smartphone market quarterly shipment growth by international brands, 1Q20-2Q21

Chart 11: China smartphone market shipments by all vendors, 1Q20-2Q21 (m units)

Chart 12: China smartphone market shipment share by all vendors, 1Q20-2Q21

Chart 13: China telecom carriers' overall subscribers, Oct 2020-Mar 2021 (m users)

Chart 14: China telecom carriers' increased subscriber, Oct 2020-Mar 2021 (m users)

Chart 15: China telecom carriers' 4G and 5G subscribers, Oct 2020-Mar 2021 (m users)

Chart 16: China telecom carriers' increased 4G and 5G subscribers, Oct 2020-Mar 2021 (m users)

Table 3: Key factors affecting the 1H21 China smartphone industry (Supply)

Table 4: Key factors affecting the 1H21 China smartphone industry (Demand)

Chart 17: China smartphone industry shipments, 1Q20-2Q21 (m units)

Chart 22: China smartphone industry's export shipments, 1Q20-2Q21 (m units)

Chart 23: Export shipments by China player, 1Q20-2Q21 (m units)

China smartphone market

Based on the analysis and survey Digitimes Research conducted, smartphone shipments to the China market amounted to 94.6 million units in first-quarter 2021, climbing 9% quarter-over-quarter and soaring 99.6% year-over-year due to a low base period, as tier-one brands made aggressive shipments in an attempt to grab market shares and New Year holiday promotions spurred a rebound in consumer demand.

Going forward into second-quarter 2021, with the exception of Honor, which will be launching new phones and thus ramp up shipments, the other smartphone brands will see their shipments fall back. Total smartphone shipments to the China market are estimated to decline 19.3% sequentially.

In first-quarter 2021, Huawei's shipments kept trending downward and Apple's shipments had already peaked. As to the three leading China-based brands, Xiaomi took early action in boosting component orders with Oppo and Vivo soon following suit so they had a relatively adequate component supply despite the ongoing global chip shortage.

Their all set new records for first-quarter shipments in history as they were able to make shipments without disruption and quicky expand their market shares. Although Honor launched new phones in first-quarter 2021, it struggled with component shortage and its bread-winning phones are set to enter the market in second-quarter 2021 so Honor only made small-volume shipments in first-quarter 2021.

On the demand side, the market enjoyed rebounding demand amid the New Year festivity in first-quarter 2021. With Huawei cutting back its shipments, consumers turned their attention to the slew of affordable phones offered by Oppo, Vivo and Xiaomi. In the flagship phone segment, Apple still enjoyed brisk demand and won over a lot of Huawei's affluent customers at the top of the pyramid. Oppo, Vivo and Xiaomi also successfully enticed Huawei's users to make a switch after their flagship phones with new hardware features and relatively affordable prices entered the market. However, ongoing component shortage and rising costs on top of few new phones on the roadmap will curtail second-quarter smartphone shipments to the China market.

The top five smartphone brands in terms of shipments to China in first-quarter 2021 experienced a quick reshuffle with Honor joining the game after the spin-off. The top five are Oppo, Vivo, Xiaomi, Huawei and Apple in the order of shipment volumes, together representing 91.8% of the China market. If adding Honor, these top brands accounted for 98% of the China market, indicating that tier-two brands and white-box vendors had virtually no room for survival in the face of component shortage and strong competition from large brands. Looking into second-quarter 2021, Honor will ramp up shipments and market share by launching new phones while Oppo, Vivo and Xiaomi stand a good chance of holding onto their market positions.

Key factors affecting the China smartphone market

Key factors affecting China smartphone market shipments in first-half 2021:

Vendors (China-based/International brands)

Oppo, Vivo and Xiaomi geared up efforts toward the China smartphone market so their first-quarter 2021 shipments showed an upsurge while the other brands' shipments exhibited a sequential decline.

Apple's performance was ordinary with iPhone 12 shipments already having peaked.

Huawei introduced ultra-high-end foldable Mate X2 and affordable flagship Mate 40E but continued to make small-volume shipments due to its declining chip inventory.

Honor only had one new phone entering the market in first-quarter 2021 and thus made low-volume shipments. On top of that, Honor had trouble securing chip supply as its rivals including Xiaomi took early action in ramping up component orders. As such, Honor's shipment momentum maintained in low gear.

By ensuring uninterrupted component supply, Xiaomi was able to maintain smooth shipments. Originally falling behind in the China market, Xiaomi successfully expanded its market share with its aggressive efforts. Its first-quarter 2021 shipments even exceeded the volume delivered in the prior quarter.

Oppo and its subsidiary brands Realme and OnePlus offer products across all market segments and with compelling pricing, their shipment performance was strong.

Vivo has always focused on the China market. Its effort to boost first-quarter 2021 shipments generated results and buoyed its market share as well.

Small vendors were affected significantly by chip shortage and experienced a serious setback in shipments in the face of tier-one brands aggressively expanding their market shares.

Oppo, Vivo and Xiaomi will maintain large-volume shipments going into second-quarter 2021 but their momentum will slow down with shipments falling back. Honor, on the other hand, will work with ODM to bring new phones on the market and will therefore enjoy shipment growth.

Apple will not introduce an interim new phone in second-quarter 2021 as it did with the launch of iPhone SE (2020) last year. Moreover, the new purple iPhone 12 debuted in April is expected to make limited contribution to shipments. As a result, Apple's shipments will fall to a low point for the year.

With its phone component inventory virtually depleted, Huawei will soon be unable to ship any more phones.

Small vendors' shipments will remain weak in the midst of component shortage.

Source: Digitimes Research, May 2021

Market/Customer requirements

Market/consumer demand:

With production activities resuming, China's GDP, consumer spending and retail sales are on the rise, which shows consumption activities rebounding, fueling smartphone demand.

High-end phones offered by Oppo, Vivo and Xiaomi come with premium hardware spec and compelling CP ratios compared to Huawei's high-end models which are not only expensive but also in tight supply. This has become a major factor driving phone upgrades.

Chinese consumers spent the first Lunar New Year holiday after the COVID-19 outbreak in first-quarter 2021. They were more willing to upgrade their phones under the sentiment to get rid of the old to make way for the new and the encouragement of promotional campaigns.

Shortage of components, mainly chips, as well as rising component prices are putting pressure on smartphone brands' costs and even affecting the production of some high-end phones. Their supply is coming short of expectation.

The market is concerned over smartphone shortage in view of rising smartphone costs. Channel operators are more willing to keep a high inventory level as they anticipate their profit margins will narrow due to increasing purchase prices. Keeping a high inventory level can also ensure uninterrupted supply.

Prices of low-cost 5G phones cannot go much lower after taking a quick dive in second-half 2020. Smartphone brands are no longer able to offer deep discounts and will reflect their cost increase in new product spec and materials. This may weaken their products' competitiveness and affect consumer interest.

Source: Digitimes Research, May 2021

Shipment breakdown

Chart 1: China smartphone market shipments, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

According to Digitimes Research's statistics, first-quarter 2021 smartphone shipments to the China market amounted to 94.6 million units. The volume represented a growth of 9% quarter-over-quarter and an upsurge of 99.6% year-over-year due to a low base period in the corresponding period of 2020.

In first-quarter 2021, except February with fewer working days when shipments fell back, January and March both saw brisk shipments, unlike the shipment decline generally experienced in the past few years after the traditional fourth-quarter high season.

With overseas markets entering the traditional low season in first-quarter 2021, China's share among the global smartphone market climbed to 27.9%.

Going into second-quarter 2021, tier-one brands will continue to grab market shares but will exhibit a normal shipment decline amid the low season. The sequential decline is estimated to come to 19.3%.

On a year-over-year basis, second-quarter 2021 smartphone shipments to the China market will fall 21.3% due to a high base period in second-quarter 2020 when the supply chain resumed operation after the COVID-19 outbreak.

Chart 2: China smartphone market shipments - international and local brands, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Chart 3: China smartphone market share - international and local brands, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

China-based smartphone vendors

Chart 4: China smartphone market shipments, by China-based players, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

The top four China-based brands in terms of first-quarter 2021 smartphone shipments to the China market are Oppo, Vivo, Xiaomi and Huawei.

Huawei shipped 14.2 million phones, plunging 49.5% from the prior quarter and 26.2% from the prior year.

Huawei's large decline was a result of its attempt to slow down the depletion of its chip inventory. Moreover, Honor's shipments were separately calculated after the spin-off, which also caused Huawei's shipments to show a deep dive.

Honor's shipments being calculated separately also resulted in a reshuffle of the rankings among Huawei, Vivo, Oppo and Xiaomi in first-quarter 2021.

Oppo and Vivo shipped 23.7 million and 22 million phones respectively, both setting a new high for the corresponding period in their history. Their shipments performed outstandingly, jumping 73.7% and 41.6% from the prior quarter.

Oppo's shipments were driven by brisk sales of the Reno 5 series. Its subsidiary brands Realme and OnePlus also gradually gained visibility in the China market.

Vivo did not ramp up component orders as aggressively as Xiaomi and Oppo so it got overtaken by Oppo in terms of shipment volume. However, Vivo still delivered a good shipment performance with an outstanding product mix and brisk X60 sales.

Xiaomi shipped 16.4 million units in first-quarter 2021, soaring 83.2% sequentially. The volume was the highest for the corresponding period in the company's history.

When Honor has yet to gain a foothold, Xiaomi secures its market position on the foundation of its strategy to offer compelling CP ratios, which it has excelled at. Meanwhile, the Xiaomi 11 series is also gaining market recognition.

Looking into second-quarter 2021, with the market entering the traditional low season, Oppo, Vivo and Xiaomi are expected to experience a sequential decline but will still maintain large-volume shipments.

Samsung's poor process yield and the shutdown of its semiconductor plant in Austin, Texas in February 2021 due to winter storms disrupted the supply of Samsung's smartphone application processors (AP) and RF IC. This somewhat affected smartphone brands' shipments, directly impacting Xiaomi, which uses Qualcomm's AP in a slew of its phones, and Vivo, which uses Samsung's AP in some of its models.

Honor will work with ODMs to launch new phones with mid-range and entry-level positioning and can therefore expect shipment growth.

Chart 5: China smartphone market shipment share, by China-based players, 1Q20-2Q21

Source: Digitimes Research, May 2021

Chart 6: China smartphone market shipment growth by quarter by China-based players, 1Q20-2Q21

Source: Digitimes Research, May 2021

First-quarter 2021 smartphone shipments to the China market by China-based vendors were bipolarized. Only Oppo, Vivo and Xiaomi enjoyed high growth while the other brands experienced large sequential decline.

Huawei's shipments plummeted 49.5% quarter-over-quarter as it only launched flagship Mate X2, Mate 40E and P40 4G with high-end pricing, which could hardly make significant contribution to its shipment volume.

Oppo, Vivo and Xiaomi enjoyed large sequential growth. Xiaomi and Oppo, shifting focus to the domestic market amid the overseas low season, showed particularly significant growth.

Tier-two brands and white-box vendors struggled with chip shortage and tier-one brands driving them out of the market. Their first-quarter 2021 shipments exhibited considerable decline.

Except Honor, the other tier-one China-based brands will see their shipment momentum slow down and experience sequential shipment decline in second-quarter 2021.

After making strong shipments in first-quarter 2021, Oppo, Vivo and Xiaomi will launch fewer phones in second-quarter 2021 and their component inventory will run low so their second-quarter 2021 shipments will fall from the prior quarter.

Honor is set to bring new phones to the entry-level and mid-range market segments where it excels so its second-quarter 2021 shipments will buck the trend to show growth among tier-one brands.

International vendors

Chart 7: International brand smartphone shipments in China market, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

International brands shipped a combined total of 11.1 million phones to the China market in first-quarter 2021, down 40.3% quarter-over-quarter but up 60.9% year-over-year. Their market share in China fell back to 11.7%.

The year-over-year growth in first-quarter 2021 was due to a low base period in first-quarter 2020 when the China market sustained COVID-19 impact.

Looking into second-quarter 2021, Apple will lower its shipments as part of a routine adjustment so international brands' shipments to China will continue on a downward trend, to fall 18% sequentially. On a year-over-year basis, international brands' shipments to China will moderately increase 4.6% still due to a low base period in second-quarter 2020.

Chart 8: China smartphone market shipments by international brands, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Apple shipped a total of 10.5 million phones to China in first-quarter 2021, down 42.3% quarter-over-quarter but up 61.5% year-over-year.

With iPhone 12 sales already having peaked, market attention then turned to new flagship phones from the Android camp.

Shipments of iPhone 12 largely concentrated in fourth-quarter 2020 and fell back to a somewhat bigger extent in first-quarter 2021. However, the total volume did not decline significantly compared to years past, which indicates the demand for new iPhones remains strong.

Shipments of iPhone did not grow in correspondence as China-based brands ramped up their shipments. However, Apple still has captured a good portion of the demand Huawei has lost as it loses ground in the high-end segment.

Samsung's shipments to China increased slightly to 0.4 million units in first-quarter 2021, representing a 33.3% growth sequentially and a 60% growth annually as it grabbed some of Huawei's lost market share.

Looking into second-quarter 2021, Apple will routinely lower its shipments to China, which are estimated to come to 8.6 million units. Apple will show growth for two consecutive quarters from the levels seen in the corresponding period of 2020 and 2019.

Samsung has practically lost market presence in China and can only win over a limited portion of Huawei's lost market share.

Chart 9: China smartphone market shipment share by international brands, 1Q20-2Q21

Source: Digitimes Research, May 2021

Chart 10: China smartphone market quarterly shipment growth by international brands, 1Q20-2Q21

Source: Digitimes Research, May 2021

Apple's sequential decline of 42.3% in first-quarter 2021 shipments to China was mainly due to a high base period resulting from new iPhone 12 shipments concentrating in fourth-quarter 2020.

The same as China-based brands, Samsung also moved up the launch of its flagship S21 series in first-quarter 2021, which buoyed its shipments to grow moderately by 33.3% from the prior quarter.

Going into second-quarter 2021, both Apple and Samsung are set to experience a sequential decline in shipments to China with the local market in low season.

Shipments and market share of all vendors

Chart 11: China smartphone market shipments by all vendors, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Taking into account smartphone shipments by international and China-based brands to the China market, the top five vendors in terms of first-quarter 2021 shipments are Oppo, Vivo, Xiaomi, Huawei and Apple. They together represented 91.8% of the China market. If including shipments by Honor, which is now operating independently, the combined share amounted to 98%, edging upward 0.5pp from the prior quarter, indicating an even higher concentration.

Oppo dethroned Huawei to become the top player with the largest share of the China market.

Oppo, Vivo and Xiaomi all enjoyed leaping growth in their market shares, up 9.4pp, 5.3pp and 7pp respectively from the prior quarter as their aggressive efforts to ramp up shipments and expand market presence generated impressive results.

Apple's market share fell back to 11.1% at a similar level to years past.

Being temporarily at a disadvantage in component supply and product launch pace, Honor only registered a 6.1% market share.

Digitimes Research expects to see Oppo's and Xiaomi's market shares fall back moderately in second-quarter 2021 as their shipment momentum slows down but Oppo, Vivo and Xiaomi will secure their top three rankings.

Honor will see its market share significantly climb with its new phones entering the market. It will mainly be taking over Huawei's remaining market presence in its initial stage of operation.

Chart 12: China smartphone market shipment share by all vendors, 1Q20-2Q21

Source: Digitimes Research, May 2021

China telecom carriers

Chart 13: China telecom carriers' overall subscribers, Oct 2020-Mar 2021 (m users)

Source: Digitimes Research, May 2021

The three leading telecom operators in China started to include 5G users in their statistics from January 2020.

As of March 2021, China's 5G service market has 391.84 million users, representing 24.4% of the country's total mobile service users.

Comparing China Mobile's user base between December 2020 and the end of March 2021, its 4G subscribers increased 1.3 million and its 5G subscribers increased 23.76 million. China Mobile is adding both 4G and 5G users but at a slower pace.

China Unicom released its 5G user statistics for the first time in January 2021. As of the end of March 2021, China Unicom serves 91.85 million 5G subscribers.

Comparing China Telecom's user base between December 2020 and the end of March 2021, it added 5.23 million mobile service (2G+3G+4G+5G) subscribers. Its total 5G users came to 111.23 million, officially breaking through the 100 million mark.

Chart 14: China telecom carriers' increased subscriber, Oct 2020-Mar 2021 (m users)

Source: Digitimes Research, May 2021

Chart 15: China telecom carriers' 4G and 5G subscribers, Oct 2020-Mar 2021 (m users)

Source: Digitimes Research, May 2021

Chart 16: China telecom carriers' increased 4G and 5G subscribers, Oct 2020-Mar 2021 (m users)

Source: Digitimes Research, May 2021

China smartphone industry

According to Digitimes Research's statistics and analyses, as a result of leading smartphone brands aggressively taking over Huawei's market share, China-based smartphone vendors shipped a total of 191 million phones in first-quarter 2021, down only 9.6% from the level of fourth-quarter 2020, which is smaller compared to more than 20% decline seen throughout corresponding periods of years past before the COVID-19 pandemic.

On a year-over-year basis, first-quarter 2021 smartphone shipments by China-based vendors surged 73.7%. Going forward into second-quarter 2021, low-season effects and component shortage concerns will remain so China-based vendors will see their strong shipment momentum in the domestic market slow down but will maintain similar performance in overseas markets. Their total shipments are estimated to decline 7.2% quarter-over-quarter but will continue to show growth compared to the corresponding period of 2020 due to a low base period.

In terms of first-quarter 2021 shipments by China-based smartphone brands, Xiaomi, Oppo and Vivo continued to erode Huawei's domestic market share while Xiaomi and Oppo made progress in overseas markets. The three brands shipped a combined total of 129 million phones, representing 67.5% of shipments made by China-based smartphone brands, jumping from 58.8% in fourth-quarter 2020. With its chip inventory soon to be depleted, Huawei shifted focus back to the China market and on launching ultra-high-cost phones, causing its shipments to plunge 53.6% sequentially.

In its early stage of incorporation after the spin-off, Honor's sales were still driven mostly by existing models so its first-quarter 2021 performance was ordinary. Transsion continued to benefit from feature phone users upgrading to smartphones in emerging markets.

On top of that, by offering a portfolio of products with compelling cost-performance (CP) ratios, Transsion only experienced a slight sequential decline in first-quarter 2021 shipments. In the face of a growingly intense structural semiconductor shortage and cost increase, tier-two and smaller brands were struggling with supply chain management and thus suffered a far bigger sequential decline in first-quarter 2021 shipments than tier-one brands.

Key factors affecting the China smartphone industry

Key factors affecting the China smartphone industry shipments in first-half 2021:

Supply side

As many regions have found a way to cope with COVID-19 and the pandemic gets contained with vaccines being administered in more and more countries, the market is seeing a wave of demand for semiconductor and other components from IT devices, network equipment and automotive electronics. This has resulted in tight supply of foundry, testing and assembly capacity and longer lead time. The supply and demand imbalance is unprecedented in recent years.

China-based smartphone brands started to ramp up their component orders and largely boost their inventory in second-half 2020 as Huawei faded out of the market. The market was yet to foresee a tight semiconductor supply at that time so the supply was ample enough for shipments to maintain strong in first-quarter 2021.

In February 2021, the frigid weather forced Samsung to halt the operation of its semiconductor plant in Austin, Texas, which disrupted the RF IC supply to Qualcomm and aggravated the concern over chip shortage. The impact to smartphone shipments will manifest in second-quarter 2021.

Poor yield of Samsung's 5nm process affects the shipments of Qualcomm's flagship Snapdragon 888 application processors (AP).

In the midst of tight mature process capacity, MediaTek supplies 5G solutions (AP+PMIC) at a higher priority, making 4G chips in shortage. As a result, smartphone brands have difficulty fully satisfying the demand for 4G smartphones in recovering overseas markets.

Brand vendors:

After spinning off the Honor brand, Huawei could no longer make large-volume shipments with existing component inventory. Worse yet, with Google Mobile Services (GMS) being unavailable on most of its phones, Huawei's shipments keep trending downward.

Honor started component order ramp-up later than the other smartphone brands so it can only rely on existing inventory to maintain shipments of old models.

Honor is set to launch new mid-range phones in second-quarter 2021 so its shipments can gradually climb after that.

Moving up the launch of their flagship phones, Xiaomi, Oppo and Vivo attempt to grab market attention and spur shipments of mid-range and entry-level phones as they continue to snatch Huawei's domestic market share.

Securing their market positions in overseas markets, Xiaomi and Oppo enjoy continuingly strong shipment momentum extending from fourth-quarter 2020.

Vivo ships phones largely to the China market while its overseas shipments are shrinking.

Although Transsion's shipments fell back slightly amid the low season in markets abroad, Transsion will still be able to deliver whole-year growth.

Tier-two brands and white-box vendors face component shortage and thus suffer a major setback in shipments with virtually no chance of recovery in first-half 2021.

Source: Digitimes Research, May 2021

Demand side

Local market:

China's first-quarter 2021 GDP indicates significant growth in consumer spending and retail sales after the pandemic. This shows consumer confidence in China has recovered, which is one of the factors that support smartphone sales.

Xiaomi, Oppo and Vivo have successfully enhanced the brand image for their flagship phones. The pricing and spec of their main sales drivers are appealing enough to encourage consumers to upgrade their phones.

Starting from second-quarter 2021, rising component prices will take a toll on China-based smartphone brands' costs. Prices of 5G phones quickly fell to their sweet spot in late 2020. As such, vendors will hardly be able to keep lowering prices to spur demand.

In anticipation that rising component prices and supply shortage will show no sign of easing anytime soon, sales channels are willing to maintain a high phone inventory level to ensure stable sales in the future.

The China domestic market enjoyed brisk demand extending from the Chinese New Year in first-quarter 2021, which favored smartphone shipments.

Overseas markets:

COVID-19 vaccination rates in some overseas markets were on the rise starting first-quarter 2021, which helped the economy recover and spurred buying interest.

Although overseas markets entered traditional low season and consumer demand fell back in first-quarter 2021, inventory replenishment needs fueled China-based vendors' shipment momentum so there was little low season effect.

Source: Digitimes Research, May 2021

Shipment breakdown

Chart 17: China smartphone industry shipments, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Based on analysis on the statistics gathered from surveys Digitimes Research conducted on the supply chains in Taiwan and China, smartphone shipments by China-based vendors both home and abroad maintained strong momentum, amounting to 191.1 million units in first-quarter 2021, a new high for the corresponding period in history.

The volume represented a small decline of 9.6% quarter-over-quarter and an upsurge of 73.7% year-over-year due to a low base period a year ago when COVID-19 broke out.

With Apple's iPhone 12 shipments having reached a peak, the share of smartphone shipments by China-based vendors among the global total rebounded to 56.5% from the level of fourth-quarter 2020.

China-based vendors are expected to ship a total of 177 million phones in second-quarter 2021, down 7.2% quarter-over-quarter and up 7.5% year-over-year.

With inventory levels running high after vendors ramped up shipments, smartphone shipments to the China domestic market are estimated to plummet 20% sequentially amid low season influences. On a year-over-year basis, the decline will exceed 20% due to a high base period in second-quarter 2020 when the supply chain resumed operation.

With overseas market demand maintaining flat growth, smartphone shipments by China-based vendors abroad are projected to moderately increase 2.4% sequentially in second-quarter 2021.

Shipments by maker

Chart 18: Shipments by China players, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

With the exception of Xiaomi and Oppo, the other China-based vendors experienced sequential decline in smartphone shipments amid the first-quarter 2021 low season. The top four China-based vendors in terms of shipment volumes are Xiaomi, Oppo, Vivo and Transsion.

Digitimes Research started to separately tally Huawei's and Honor's shipments from first-quarter 2021. Huawei's shipments came to 16.3 million units to rank No. 5, surpassed by Transsion.

Honor shipped 6.8 million phones as it was still to trying to renegotiate contracts with domestic and overseas channel partners as well as suppliers. Moreover, with components remaining in tight supply, Honor could only make ends meet with existing stock.

Xiaomi made the most aggressive effort in stocking up on components so its domestic and overseas shipments could grow sequentially to 47.9 million units.

Xiaomi's phones received enthusiastic responses in China and the rest of the world after the pandemic thanks to Xiaomi's affordable pricing strategy and brand marketing through Hongmi and POCO.

Xiaomi was able to turn the tables in the China market by introducing the Xiaomi 11 series featuring innovative hardware spec to build up a high-end image. On top of that, with a complete product mix encompassing high-end, mid-range and entry-level offerings, Xiaomi set a new record for single-quarter shipments.

Trailing Xiaomi, Oppo prepared adequate inventory and was therefore able to ship 44.3 million phones in first-quarter 2021, which also marked a new high in the company's history for single-quarter shipments.

By building a distinguished brand image, Oppo's subsidiary brands Realme and OnePlus performed outstandingly in overseas markets and turned to target the China market, which boosted Oppo's shipments.

Vivo was not as aggressive as Xiaomi and Oppo in component inventory preparation. This was reflected in its shipment performance. Vivo's first-quarter 2021 shipments fell moderately to 36.8 million units. However, the volume was still the second highest single-quarter shipments in the company's history as Vivo largely rolled out shipments to the China domestic market.

Transsion maintained strong shipment momentum in India, Africa, Southeast Asia and Pakistan, shipping 16.8 million phones, only slightly below the level of the prior quarter.

Lenovo, TCL and ZTE respectively shipped 8 million, 2.5 million and 2 million phones in first-quarter 2021, all experiencing sequential decline, as they struggled with tight component supply.

Looking into second-quarter 2021, smartphone shipments by China-based vendors are estimated to fall 7.2% from the prior quarter due to significant low season effects in the China market and flat growth in overseas markets.

Huawei's shipments will further slide to 10.4 million units.

With the launch of new phones, Honor's shipments are expected to soar to 11.8 million units, officially surpassing Huawei.

Shipments by Xiaomi, Oppo and Vivo will fall back to a more significant extent but will still outperform the levels seen in the corresponding period of years past.

Rebounding overseas market demand will buoy Transsion's shipments to 19.5 million units, the highest single-quarter shipments ever for the company.

Chart 19: Shipment share by China players, 1Q20-2Q21

Source: Digitimes Research, May 2021

The top three brands (Xiaomi, Oppo and Vivo) represented 67.5% of the phones shipped by all China-based vendors in first-quarter 2021, up 8.7pp from the 58.8% share in fourth-quarter 2020, indicating a higher concentration on a few vendors.

The combined share of phones shipped by Huawei and Honor in first-quarter 2021 fell 4.5pp from Huawei's share in fourth-quarter 2020. Huawei's lost share was divided among Xiaomi, Oppo and Vivo.

The share of phones shipped by tier-two and smaller brands as well as white box vendors declined significantly as they struggled with component shortage. Part of their overseas market share was taken over by Transsion, which was better able to maintain steady shipments.

Going forward into second-quarter 2021, the top three brands Xiaomi, Oppo and Vivo will account for 64.6% of the phones shipped by all China-based vendors, down 2.9pp from the prior quarter while Transsion will see its share climb 2.2pp.

Honor will be launching new phones and can therefore expect its share to trend upward.

Chart 20: Q/Q shipment growth by China players, 1Q20-2Q21

Source: Digitimes Research, May 2021

With the exception of Xiaomi and Oppo, the other China-based smartphone vendors all experienced sequential decline in first-quarter 2021 shipments.

Xiaomi's and Oppo's overseas shipments experienced a seasonal decline amid the low season. However, buoyed by continuingly growing domestic shipments, their total shipments still climbed respectively 3.9% and 9.1% quarter-over-quarter.

Vivo also made strong shipments to the China market but its overseas performance fell short of Xiaomi's and Oppo's and thus its total shipments dipped 2.1% sequentially in first-quarter 2021.

The low season had little effect on Lenovo's and Transsion's shipments as Lenovo kept introducing new phones and Transsion's affordable pricing strategy made it unrivalled in its target markets.

Looking into second-quarter 2021, the three leading brands will experience larger decline in shipments as they adjust inventory levels. Honor, with new phones entering the market, and Transsion, with focus on overseas markets, will be able to enjoy sequential increase in shipments.

Chart 21: Y/Y shipment growth by China players, 1Q20-2Q21

Source: Digitimes Research, May 2021

Most China-based smartphone vendors all enjoyed year-over-year growth in overall shipments in first-quarter 2021 mainly because of a low base period in first-quarter 2020 when COVID-19 broke out.

Huawei's shipments plunged 46.2% from a year ago, going on an irreversible downward trend.

Xiaomi, Oppo and Vivo successfully snatched market shares. Their shipments skyrocketed 166.1%, 128.4% and 119% respectively, showing astonishing year-over-year growth.

Thanks to rebounding overseas market demand, Transsion was able to maintain high growth by offering products with compelling CP ratios. Its shipments soared 100% year-over-year.

Going forward into second-quarter 2021, except Huawei, most China-based smartphone vendors will maintain year-over-year growth mainly due to high levels of shipments and low base period in overseas markets.

Xiaomi and Oppo are expected to deliver 92.1% and 40.7% year-over-year growth as they maintain a more adequate chip inventory compared to the other vendors and they have long established market presence in Europe and the Middle East, enabling them to keep taking over Huawei's lost market share.

Vivo lacks market presence in Europe and the Middle East and it is more conservative toward stocking up on IC chips. As such, its second-quarter 2021 shipments are estimated to only increase 26% from a year ago, falling short of Xiaomi's and Oppo's growth.

Exports

Chart 22: China smartphone industry's export shipments, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

After reaching a peak in fourth-quarter 2020, smartphone shipments by China-based vendors abroad amounted to 107 million units in first-quarter 2021 amid the low season in overseas markets, down 25% quarter-over-quarter.

With a low base period in first-quarter 2020 and Xiaomi, Oppo and Vivo continuingly making progress in overseas markets, smartphone shipments by China-based vendors abroad soared 54.9% from a year ago and 34.8% from two years ago (79.8 million units).

Overseas market demand is expected to maintain flat growth in second-quarter 2021 so smartphone shipments by China-based vendors abroad are estimated to increase 2.4% quarter-over-quarter and 43.4% year-over-year due to a low base period in second-quarter 2020.

As smartphone brands aggressively ramp up overseas shipments, the condition of low channel inventory levels in some markets may be easing and some channels may even have a high inventory level.

Chart 23: Export shipments by China player, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

China-based smartphone vendors all experienced sequential decline in overseas shipments in first-quarter 2021. However, their performance remained strong despite the low season. Xiaomi, Oppo, Vivo and Transsion set new records for first-quarter shipments.

Huawei already lost presence in overseas markets. Honor, still in its initial stage of incorporation, only shipped existing models. As such, Huawei's overseas shipments came to 2.1 million units and Honor's arrived at 1 million units.

Gaining visibility in Europe and maintaining large-volume shipments to India, Xiaomi shipped 31.5 million phones abroad in first-quarter 2021.

Aside from low season effects, logistics disruptions hindered Xiaomi from depleting its channel inventory in India, which also affected its shipment performance.

Oppo as well as its subsidiary brands Realme and OnePlus together shipped 20.6 million phones, representing a slight sequential decrease, as they made adjustments amid the low season in markets abroad.

Vivo shipped 14.8 million phones abroad in first-quarter 2021, showing a somewhat bigger sequential decline than Xiaomi and Oppo.

Enjoying significant advantages in emerging markets, Transsion's overseas shipments only fell 0.7 million units from last quarter.

Going into second-quarter 2021, most China-based vendors will benefit from rebounding overseas market demand and enjoy sequential growth in shipments.

Honor will start to ship new phones through ODM and can therefore expect growth in its overseas shipments.

Xiaomi will not further ramp up its shipments in second-quarter 2021 in a bid to keep its momentum for second-half shipments.

In the midst of component shortage and rising costs as well as pressure from tier-one brands, white-box vendors still face serious challenges and will have difficulty making shipments despite rebounding overseas market demand.

Chart 24: Export shipment share by China player, 1Q21

Source: Digitimes Research, May 2021

Xiaomi, Oppo and Vivo all saw their ratios of overseas shipments plunge in first-quarter 2021 as they made aggressive efforts toward the China domestic market.

Xiaomi's ratio of exports lowered from 80.6% to 65.8% but overseas markets remained its main target.

Oppo's ratio of exports fell from 66.4% to 46.5%. Realme successfully penetrating into the China market was a contributing factor.

Oppo's ratio of exports decreased from 58.6% to 40.1%.

Focusing efforts on the China domestic market, Honor only had some visibility in Russia and a few other markets abroad.

Continuingly losing ground, Huawei's ratio of exports kept trending downward to 12.8%.

Pressured by the three leading brands in the China domestic market, most tier-two brands such as Lenovo and ZTE saw their ratios of exports on the rise.