Yamaha Motor Ventures(YMV) has emerged as a beacon of corporate innovation, blending strategic investments with an eye towards sustainability and global market penetration. At the recent Bike Venture Summit 2024, CEO Kei Onishi offered insights into Yamaha's diverse portfolio and its approach to venture capital in the tech realm.

Yamaha's business landscape is expansive, comprising numerous units ranging from motorcycles and marine products to factory automation and financial services. With a whopping multiple business units and a staggering US$16 billion in revenue, Yamaha sees its land mobility businesses, including motorcycles, contributing significantly to sales, representing approximately 65% of the company's revenue. Meanwhile, the marine sector boasts the highest operating income ratio, particularly in the US market.

Previously, Yamaha Motor invested in the Finnish startup Skipperi and acquired Germany's electric marine propulsion manufacturer Torqeedo to strengthen its development capabilities, which continues to gain speed within the marine industry.

Diverse portfolio and strategic investments

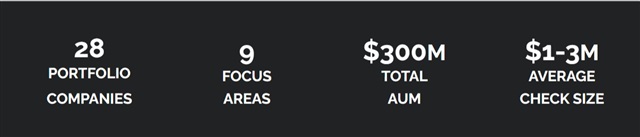

In the realm of venture capital, YMV manages three funds: Yamaha Motor Exploratory Fund 1 and 2, and Yamaha Motor Sustainability Fund, each with a US$100 million allocation. "We invest into three categories: carbon management and removal, energy transition, as well as advanced materials. Those are the sectors we make our investment out of Yamaha Motor Sustainability Fund." added Onish.

Source: Yamaha Motor Ventures

With an asset under management (AUM) of US$300 million, Yamaha has invested in 28 portfolio companies across various sectors, predominantly in North America. Onishi emphasized the importance of focusing on regions where Yamaha has a physical presence, facilitating relationship building and strategic partnerships.

YMV's investment strategy prioritizes cross-unit applicable technologies, aiming to enhance efficiency and innovation across diverse business sectors. This shift from industry-specific focuses to functional approaches emphasizes investments in fundamental technologies. "For instance, our focus lies in technologies such as manufacturing, AI for manufacturing, logistics, and materials sciences, which can benefit multiple business units simultaneously. We aim to invest in enabling technologies that serve as a foundation for enhancing operations across the organization."

By investing in enabling technologies that benefit multiple business units simultaneously, Yamaha mitigates risks associated with industry fluctuations and ensures resilience against market volatility.

AI's impact on corporate dynamics

From a corporate perspective, Onishi expressed AI's impact is twofold: customer experience and internal processes. He noted the proliferation of AI-driven innovations such as ChatGPT and Sora, particularly in enhancing customer engagement and marketing strategies. As traditional methods like SEO on Google evolve, marketers must pivot towards influencing emerging platforms and agents that consumers increasingly rely on for decision-making.

Internally, Onishi underscored AI's capacity to revolutionize manufacturing processes, citing examples like Atomic Industries, which automate tasks such as dye design for plastic injection molding. This acceleration in automation promises to drastically reduce design timelines, transforming R&D and manufacturing within a span of just a few years.

Onishi emphasized the strategic advantage held by corporations in the AI landscape, pointing to the significance of proprietary data. While foundational AI models may become standardized, the true value lies in organizations' ability to leverage their data assets effectively. He urged companies to safeguard their proprietary data, recognizing it as a key determinant of future competitiveness.

In navigating this evolving AI ecosystem, Onishi acknowledged the pivotal role of startups, particularly in AI applications and agent development. However, he emphasized that corporations possess a distinct advantage due to their ownership of proprietary data, which will shape the trajectory of AI-driven innovation.

Notably, Yamaha prioritizes startups that offer the potential for significant financial returns, aiming for a 10x return on investment. While acknowledging the volatility of certain sectors, Onishi emphasized the importance of avoiding hype-driven investments and maintaining a focus on long-term value creation. He highlighted the shift in startup preferences towards corporate venture capital (CVC), recognizing the strategic advantages of partnering with corporations as customers and strategic partners.

Credit: DIGITIMES

Prioritizing sustainability and global reach

In line with its commitment to sustainability, YMV seeks investments that can help decarbonize its supply chain, particularly through the Yamaha Motor Sustainability Fund. By investing in sectors such as carbon management, energy transition, and advanced materials, Yamaha aims to drive positive environmental impact while securing future growth opportunities.

When it comes to investment criteria, Yamaha typically invests in Series A startups with an average first check size ranging from US$2 million to US$10 million. However, Onishi stressed the importance of technology that can be applied across Yamaha's diverse business units, favoring investments in enabling technologies with broad applicability.

Geographically, Yamaha focuses primarily on North America due to its established presence and familiarity with the market landscape. "We possess extensive familiarity with local investors and laws. When it comes to Europe, we are interested because of sustainability and climate initiatives, Europe is more mature," said Onishi.

As Yamaha Motor Ventures continues to navigate the complex terrain of corporate innovation, its strategic investments and commitment to sustainability position it as a driving force in shaping the future of mobility and technology.