Geopolitical influences and rising labor costs in China are bringing drastic changes to the global supply chain, prompting high-tech companies to relocate their production bases to Southeast Asia. For its convenient geographic location, competitive labor market and policy support, Vietnam has attracted Korean, Japanese and Taiwanese firms to establish factories in the country. As opposed to the other countries, Taiwan invests particularly heavily in ASEAN member states. According to the Investment Commission, Ministry of Economic Affairs, in 2021, more than 37% of Taiwan's overseas investments went to ASEAN member states, which overtook China to represent the largest portion of Taiwan's overseas investments with a focus on the electronics industry. In response to the trend, Andrew Chen, in charge of Dimerco Express' Vietnam operation, advises that companies should get a full grasp of the pros and cons while leveraging partners that have been cultivating the local market for years so as to take advantage of what Vietnam has to offer.

With a relatively small domestic market, Taiwan has been heavily dependent on foreign trade. This is especially true in the case of the Taiwan electronics industry. Taiwan has risen to become a key player in the global economy after decades of building up its technological strength. China's reforms and opening-up in the 1990s made China an investment target to the Taiwan electronics industry. A triangular trade model has therefore been created, in which orders are taken in Taiwan, goods are made in China and they are then exported to the U.S.

The start of the U.S.-China trade war in 2018 and the establishment of the ASEAN Economic Community (AEC) in 2015, which opened up a pathway to an enormous market and labor supply, have prompted global manufacturers including electronics makers to relocate production bases out of China to Southeast Asia. Chen notes among Southeast Asian countries, Vietnam appears to be extremely attractive as a manufacturing hub.

Vietnam has the third largest population among ASEAN countries. The enormous workforce coupled with the reform policies launched in 1980 drove Vietnam's transition from an agricultural to an industrial economy. Although farm produce still represents a major portion of Vietnam's exports, Japanese and Korean electronics manufacturers began to invest in the country in 2000, pushing its industrial transformation forward. Taiwanese electronics manufacturers are also picking up the pace of their expansion into Vietnam. To name a few, Wistron, Pegatron, Compal and Inventec have all been stepping up their investments in Vietnam.

Based on Chen's insight, Vietnam appeals to global leading manufacturers for three reasons. The first is its large labor market. Vietnam's labor force, aged 15 to 60, represents almost half of its population, which is close to 100 million. Vietnamese people are diligent workers and quick learners so they are suitable for complex electronics manufacturing jobs. Electronics factory workers in Vietnam earn on average US$200 to US$250 a month. The labor costs are cheaper in Vietnam compared to China, where employers have to contribute to five kinds of insurance and a housing fund.

The second is its convenient geographic location. Vietnam is situated at the heart of Southeast Asia and bordered by China. Electronics parts that are shipped by road transport from Southern China through the Friendship Pass, a border control between China and Vietnam, can arrive in the electronics cluster in northern Vietnam for assembly within a day. This allows manufacturers with production bases in Vietnam to control logistics costs while taking advantage of China's complete supply chain ecosystem.

The third is its policy support. Vietnam has significantly eased the restrictions on foreign investments to increase its appeal to foreign businesses. Moreover, it has entered into free trade agreements (FTA) with 15 countries, allowing goods exported from Vietnam to enjoy tariff reductions. It also offers incentives to high-tech firms and knowledge industry firms to drive the country's industrial transformation.

Chen states that manufacturers worldwide have been pressured by rapid supply chain changes spurred by geopolitical tensions and COVID-19. Despite Vietnam's advantages, electronics manufacturers with production bases in the country have to stay on top of Vietnam's industrial and economic environment and strategize accordingly. Logistics that is critical to production and delivery should be a focus of their attention. In today's supply chains, orders demanding rush delivery or short lead times have become the norm. Things are expected to stay this way for at least five years. With Vietnam's industrial ecosystem yet to mature, electronics manufacturers must still import their parts because local parts production cannot keep up with demand. Under such circumstances, the global competitiveness of these companies hinges on the completeness of their logistics service system.

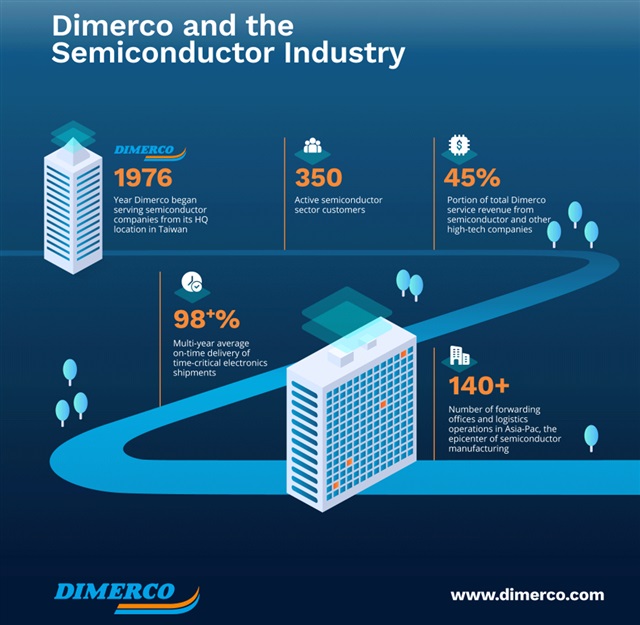

Taking Dimerco for example, Chen notes that Dimerco has been in operation for longer than five decades with service centers located in major cities throughout the world and 128 corporate-owned offices in Asia Pacific. Dimerco's Vietnam branch was established in 2008 and has teams stationed across Northern and Southern Vietnam to deliver tailored logistics services suited to various industries at different geographic locations.

Dimerco provides complete freight services via air, land and sea transportation. With a far-reaching worldwide logistics network that connects Asia with the world, Dimerco partners with more than 10 global ocean freight forwarders and five cargo airlines, including Eva Air and China Airlines, and cross-border land transportation firms in Asia. Aside from physical freight shipping, Dimerco also leverages digital transformation to create a more refined user experience. According to Chen, Dimerco's self-developed technology platform connects different systems through electronic data interchange (EDI) so that customers can log into the MyDimerco Portal – a 24/7 online resource for freight tracking and performance monitoring. Furthermore, Dimerco has obtained ISO 27001 Information Security Management System certification so customers can be assured their data is safe.

Chen points out that Vietnam now plays a vital role in electronics manufacturers' planning as they compete in the global market. Apart from strengthening their manufacturing capabilities, manufacturers also need a robust logistics partner to ensure stable and on-time delivery of raw materials and finished products. Serving a large number of Taiwan-based electronics manufacturers in Vietnam, Dimerco offers high-reliability and high-quality logistics services at reasonable costs, with strong system integration, via a complete shipping network and with an enthusiastic spirit. Making logistics a pillar to customers' competitive edge, Dimerco helps customers conquer market challenges and tap upcoming opportunities.

Dimerco and the Semiconductor Industry

Key Logistics Expertise and Capabilities Required to Serve the Semiconductor Supply Chain