India's huge population of 1.37 billion supports a sizeable motor vehicle market. On top of that, subsidies for EVs from both the central and state governments will drive the country's EV market to grow by leaps and bounds in the coming years.

Battery swapping, power units and IoV solutions are among the strengths of Taiwan's EV component suppliers and are also what India needs. These are the critical areas where Taiwan's and India's EV supply chain can join forces.

To drive EV industry development and boost EV sales, the Indian central government has laid out the FAME II scheme that totals nearly INR100 billion (about US$1.4 billion) to subsidize EVs and car-charging infrastructures. State governments are also offering a range of incentives and tax exemptions to attract EV makers to build factories and consumers to buy EVs.

Introduction

The electric vehicle (EV) sector is a strategic focus of leading countries' industrial development efforts today. Aside from Europe, China and the US, Digitimes Research thinks India's EV industry also has great development potential.

India's huge population of 1.37 billion supports a sizeable motor vehicle market. On top of that, subsidies for EVs from both the central and state governments will drive the country's EV market to grow by leaps and bounds in the coming years. Battery swapping, power units and IoV solutions are among the strengths of Taiwan's EV component suppliers and are also what India needs. These are the critical areas where Taiwan's and India's EV supply chain can join forces.

To drive EV industry development and boost EV sales, the Indian central government has laid out the FAME II scheme (Faster Adoption and Manufacturing of Hybrid and EV) that totals nearly INR100 billion (about US$1.4 billion) to subsidize EVs and car-charging infrastructures. Local governments are also offering a range of incentives and tax exemptions to attract EV makers to build factories and consumers to buy EVs.

Electronics systems and software are the two fundamental elements to an EV. Taiwan-based suppliers are known for their strengths in electronics components while India has a robust software sector. India's EV supply chain needs energy systems, power units and IoV solutions and will be able to find all the components it needs from Taiwan-based suppliers. As such, these areas are good starting points for Taiwan-based suppliers to penetrate into the Indian market as India makes efforts to boost domestic EV production.

According to India's Society of Manufacturers of Electric Vehicle (SMEV), EVs sold in India are largely two-wheelers and three-wheelers so battery swapping stations and chargers installed at small shops will be the most popular form of charging facilities. Furthermore, due to their low income, Indian consumers are very price sensitive and are likely to respond more enthusiastically to electric scooters priced under INR90,000.

Source: World Bank, SIAM, compiled by Digitimes Research, September 2021

India is a regional market with tremendous development potential to the EV industry for the following reasons:

With a huge population of 1.37 billion, a high demographic dividend (65% of its population are below the age of 35) and 50 registered vehicles for every thousand people, India's automotive market is poised for explosive growth.

Its EV market outlook is even more promising due to the following:

India relied on imports for about 85% of its domestic oil needs in 2020. Its government is pushing the transition to EV to reduce oil imports.

India's EV penetration (including cars and motorcycles) stood at 1% in 2020. Subsidies from the central and local governments are expected to drive EV penetration to 10% by 2025.

India EV industry

Government projects and policies

*Note: FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) is a program aimed to drive hybrid and electric vehicle adoption and manufacturing.

Source: The India government, compiled by Digitimes Research, September 2021

To drive EV industry development and boost EV sales, the Indian government has laid out the FAME II scheme.

The Indian government announced NEMMP-2020 (National Electric Mobility Mission Plan 2020) in 2013, followed by FAME in 2015. Both are aimed at promoting EV industry developments.

India is currently rolling out FAME II, effective April 1, 2019 through March 31, 2024.

A total budget of INR100 billion to subsidize EVs and car-charging infrastructures

Government subsidies to promote the use of EVs and guide private sector investments

Source: SMEV, complied by Digitimes Research, September 2021

According to SMEV director general Sohinder Gill, both the central and local governments have proposed a wide range of incentives to attract EV makers to build factories in India.

Local governments, especially in Southern India, offer incentives such as land, capital and labor subsidies, in an effort to boost domestic EV production.

Local governments implement different levels of Value Added Tax (VAT) reductions. Among them, Madhya Pradesh, Chandigarh, Chattisgarh and Karnataka cut their state VAT from 12.5% to 0%.

Market scale

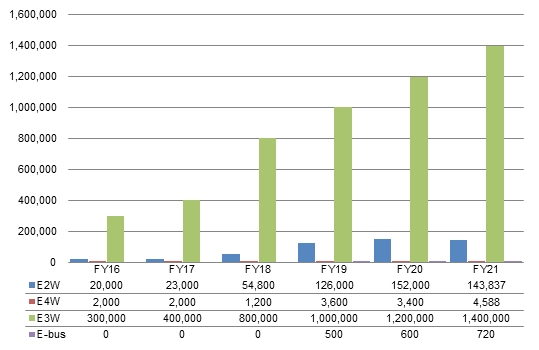

Chart 1: India EV market scale, FY2016-2021 (units)

Source: SMEV, compiled by Digitimes Research, September 2021

India's automotive market is dominated by two- and three-wheelers so 90% of EVs sold in India are electric two-wheelers and three-wheelers.

According to SMEV, about 144,000 electric two-wheelers (E2W) and more than one million electric three-wheelers (E3W) were sold in FY2021 in India.

The market for electric four-wheelers (E4W) in India is grim due to the country's low per capita income, which was recorded at US$2,080 in 2020.

Only 4,588 E4Ws were sold in FY2021 in India, far below the sales of E2Ws and E3Ws.

Electric buses come with much higher price tags and their promotion will have to rely on government efforts and subsidies. A total of 720 electric buses were sold in FY2021 in India.

Source: Vendors, complied by Digitimes Research, September 2021

Among India's leading manufacturers of various types of EVs, those producing E2Ws and E3Ws make up the largest group, including well-known brands and market newcomers.

India's traditional automaker Mahindra not only has added an E4W product line but also has expanded into the enormous E3W market.

Charging solutions

Source: Companies, complied by Digitimes Research, September 2021

There are three ways to charge EVs in India: charging stations, battery swapping stations and chargers installed at small shops or charging points.

Charging stations are mainly built by the government. Charging station solution providers that have expanded into India include ABB, Delta Electronics, Siemens, Raychem and Exicom.

Battery swapping is a more convenient solution to the Indian EV market with a dominance of E2Ws and E3Ws. Leading battery swapping service operators in India include Sun Mobility, Lithion Power and OLA Electric.

Having chargers installed at roadside shops (for example, ice cream and cigarette stands) is a low-cost alternative.

EV drivers can eliminate range anxiety as they can go to the nearest charging point when the battery runs low.

For short trips, it may take only 15 to 20 minutes for the driver to get the EV charged and go home or wherever they want to.

Such charging points can be in service for long hours from 7am to 11pm.

Taiwan ICT supply chain

*Note: Those written in red are Taiwan-based suppliers' strengths and are areas where India would like to seek partnerships with Taiwan-based suppliers.

Source: SMEV, complied by Digitimes Research, September 2021

Electronics systems and software are the two fundamental elements to an EV. Taiwan-based suppliers are known for their strengths in electronics components while India has a robust software sector.

By engaging in collaborations, Taiwan and India can complement each other and together drive India's EV industry upgrade.

India's EV supply chain needs energy systems, power units and IoV solutions.

Energy systems include battery management, battery swapping and smart charging solutions.

Battery swapping has tremendous market potential in India so the country is eager to bring in Gogoro and Kymco's technologies.

Power units encompass high-power motors and high-efficiency motor controllers. Taiwan-based suppliers in this area include Delta Electronics, Fukuta, Teco and Chroma.

In terms of IoV solutions, India's price sensitive consumers will not be willing to pay for subscriptions so the low-cost Narrowband Internet of Things (NB-IoT) technology will be suitable for India.

Taiwan-based suppliers including Sercomm and Gemteks are experienced in NB-IoT technologies.

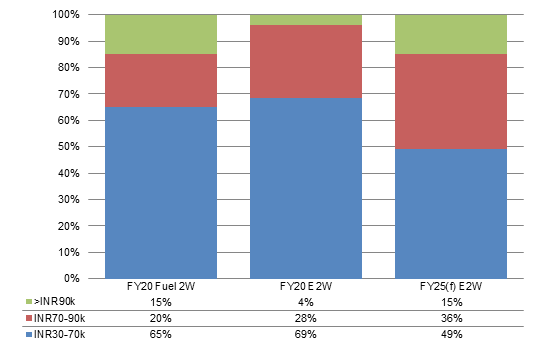

E2W pricing

Chart 2: India sales share of 2-wheel vehicles running on electricity and fuel by vehicle pricing, FY2020, 2025

Source: Hero Electric, compiled by Digitimes Research, September 2021

Due to the country's low per capita income, which was recorded at US$2,080 in 2020, Indian consumers are very price sensitive when they make EV purchases.

For example, more than 90% of E2Ws purchased in FY2020 cost no more than INR90,000. The average purchase price was even lower than that for gasoline-fueled scooters.

According to Indian EV manufacturer Hero Electric, 85% of E2Ws on the market in India will come with a price tag below INR90,000 by 2025.

In other words, most consumers will respond to EVs in the same price range as gasoline-fueled vehicles. The high-end segment will not see rapid growth for the next five years.

Taiwan-based suppliers foraying into India will have to highlight their cost advantages and provide the EV components that are suited to the local market needs.