Three main factors will influence the smartphone industry in 2013: relationships between platform leaders and hardware manufacturers, market demand and carrier support, and the decisions of a number of major players with regard to key transitions or major trends.

Google will continue to step up its control over the Android ecosystem and its partners; even the majority of tier-one hardware brands are now wary of crossing Google. But many telecom carriers are unenthusiastic about a market divided solely between Android and iOS, and have already decided to support Windows Phone as a third platform.

Amazon could move into the smartphone market in 2013, while the two former giants, Nokia and RIM, will have a "make or break" year of transition.

Nokia's smartphone sales have fallen far short of even its own forecasts in 2012, with sustained losses steadily eroding its once plentiful cash reserves. If the company fails to reverse this trend in 2013, there is a good chance that it will be broken up and sold off. If this were to happen, Microsoft could snap up Nokia's already Windows Phone-oriented smartphone division, giving it access to the Finnish firm's global service and carrier relationships, as well as its sales channels - a useful tool for Microsoft as it prepares to launch its own Windows Phone handsets.

If sales of new models featuring the BlackBerry 10 platform set for launch in early 2013 are less than ideal, RIM will also face the prospect of being sold, or perhaps transitioning away from hardware to become a software and service-focused firm. Such a move would potentially leave other players to fight over the business handset sector that RIM has long dominated.

While the European debt crisis seems to be abating, many Western European nations are experiencing a resulting drop in government expenditure and consumer spending, issues that are likely to persist into 2013. Telecom carriers in these regions are tightening their belts and reducing subsidies, which will impact on smartphone sales in general and high-end models in particular. However, smartphone penetration rates will continue to rise rapidly in emerging markets such as China, Russia, India, Indonesia and South America; it is these markets that will contribute the bulk of shipment growth in 2013.

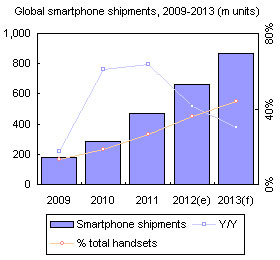

Digitimes Research projects that global smartphone shipments will rise from 655 million in 2012 to 865 million in 2013, with a year-on-year growth rate lower than those in 2010 and 2011. But the proportion of overall handset shipments accounted for by smartphones will rise to 43.9%.

Table: Analysis of key factors in the 2013 smartphone industry

Chart 1: Not being selected as hardware partner by Google is tantamount to punishment

Microsoft and Amazon branded handsets unlikely to have major impact until 2014

Chart 2: Microsoft and Amazon will complicate the competitive picture in 2H13

Chart 3: Smartphones will continue to see strong growth in emerging markets in 2013

Chart 5: Apple smartphone shipments (2011-2013) and revenue growth, 4Q11-3Q12

Former industry leaders Nokia and RIM will struggle to rebound

Chart 8: Lenovo, ZTE and Huawei smartphone shipments, 2011-2013

Samsung and LG will together take more than a third of the market

Chart 10: Emerging markets will see growth above the industry average

Chart 11: Top 10 vendors' annual smartphone shipments, 2012-2013 (m handsets)

Chart 13: Year on year growth rate trends for smartphone shipments by platform, 2010-2013

Share for open platforms within major vendors' 2013 shipments

Chart 17: Android smartphone shipment share, by vendor, 2012-2013

Chart 18: WP smartphone shipment share, by vendor, 2012-2013