Introduction

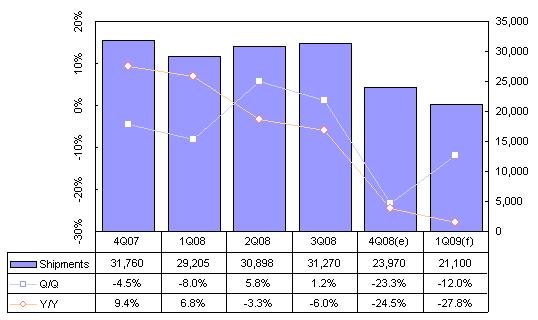

- Taiwan shipped 23.9 million LCD monitors in the fourth quarter of 2008, down 23% sequentially and 25% from the same period one year earlier.

- LCD monitor shipments will drop another 12% in the first quarter of 2009, and shipments will be down 28% from the same period in 2008.

- Taiwan shipped 115.3 million LCD monitors in 2008, representing a drop of 7.2% from 2007 and trailing the global growth rate of 2.8%.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers

Chart 1: LCD monitor shipments, 4Q07-1Q09 (k units)

Source: Digitimes Research, January 2009

Industry watch

- Shipments fell 23% in the fourth quarter as a result of a number of factors, including seasonality, a worsening economy and a maturing market for LCD monitors.

- TPV suffered a 25% shipment drop sequentially in the fourth quarter. The shipment gap between TPV and second-place Innolux narrowed from 3.7 million units in the third quarter to only 1.5 million units in fourth quarter.

- However, these two players are increasingly dominating Taiwan's LCD monitor industry. With the LCD market maturing, customers are depending less on second and third source makers, leading to consolidation in the industry, at the expense of smaller players.

- Taiwan shipments in the second half of 2008 only accounted for 48% of full-year shipments in 2008. Second-tier players were hit especially hard in 2008.

- The sequential shipment decline is expected to narrow to 12% in the first quarter of 2009. The market bottomed out in December 2008, and despite falling shipments in the first quarter, shipments in January and February are actually above December levels.

- Global Top-10 LCD monitor brands will grab a combined share of more than 80% in 2009, when the market is forecast to contract by 3.9%. The Top-5 vendors will manage shipment growth in 2009, whereas the non Top-5 may experience a decrease of 17.6%.

- Samsung moved up to the first position among LCD monitor vendors in 2008, while becoming more price-competitive with the depreciating Korean won. The Korean vendor will likely retain its top spot in 2009 with a double-digit shipment growth. Along with Samsung, LG Electronics' shipments will also grow by double digits.

Shipment breakdown

Production value and ASP

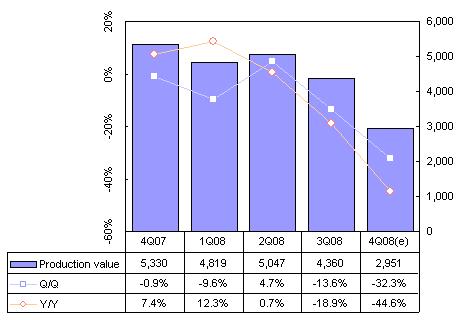

Chart 2: Taiwan LCD monitor production value, 4Q07-4Q08 (US$M)

Source: Digitimes Research, January 2009

- With the shipment breakdown to various size segments not changing dramatically in 4Q, the steep drop in production value can be attributed to a drop in panel pricing.

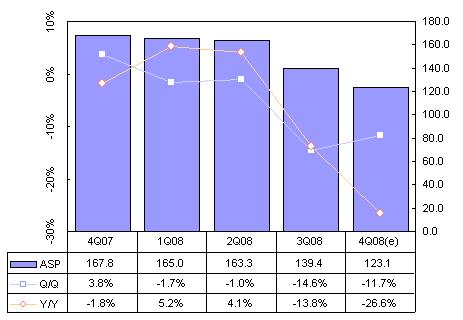

- The ASP for Taiwan LCD monitors slid from US$139 in 3Q to US$123 in 4Q.

Chart 3: Taiwan LCD monitor ASP, 4Q07-4Q08 (US$M)

Source: Digitimes Research, January 2009

Market share

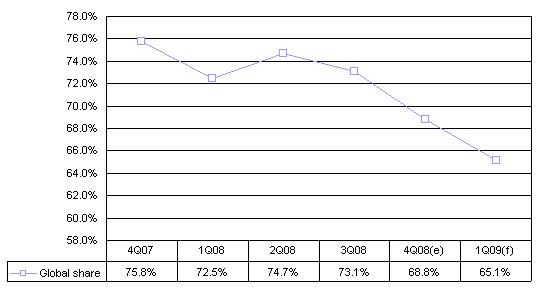

Chart 4: Worldwide market share, 4Q07-1Q09

Source: Digitimes Research, January 2009

- Taiwan's LCD monitor global share took a major hit in 1Q08 when Lite-On experienced a fire at its China plant. Although, share rebounded in 2Q, Wistron – was not able to recapture the bulk of the lost share, and Taiwan's market share slipped in the second half of the year.

- Korea-based Samsung Electronics and LGE are Taiwan's main competitors in the LCD monitor industry. These makers are not the major suppliers for US vendors, who have been affected more by the recent economic downturn. Therefore, they have managed to maintain their relative share, while Taiwan makers have borne the brunt of the recent global slowdown.

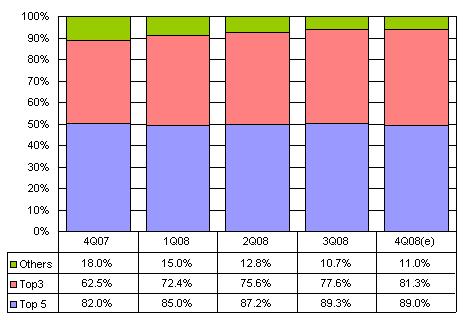

Shipment concentration

Chart 5: Top-5 makers' share of shipments, 4Q07-4Q08

Source: Digitimes Research, January 2009

- The Top-5 LCD monitor players in 4Q08 were TPV, Innolux, Qisda, Wistron and Techview.

- Despite acquiring Lite-On's display business earlier in 2008, Wistron was not able to prevent its market share from dropping. As second-tier players, Wistron and Techview are facing a difficult challenge trying to grab orders in a tough economic environment.

- The top three LCD monitor players accounted for more than 80% of Taiwan shipments for the first time in 4Q.

- TPV and Innolux shipments are expected to grow in 2009, whereas the remaining Top-8 makers will experience double-digit shipment drops.

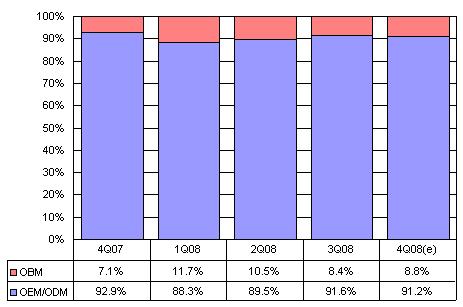

OBM, OEM/ODM breakdown

Chart 6: Taiwan LCD monitor share by production mode, 4Q07- 4Q08

Source: Digitimes Research, January 2009

- Taiwan makers generally focus on OEM/ODM business, which is seasonal. The fourth quarter is usually the low season, as most holiday orders are fulfilled in the third quarter.

- Despite OBM shipments dropping around 20% in 4Q, branded shipments still gained market share in the quarter.

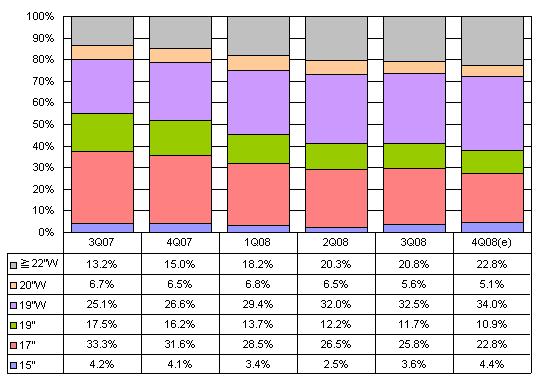

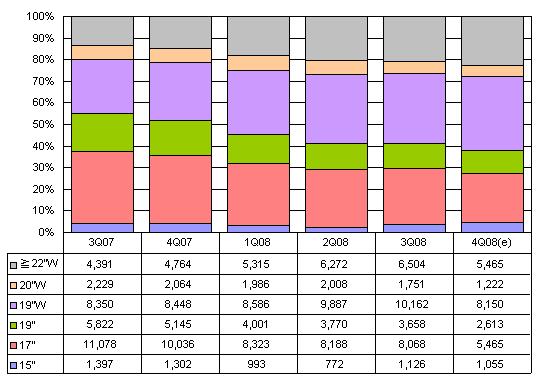

Screen size

Chart 7: LCD monitor share by screen size, 3Q07-4Q08

Source: Digitimes Research, January 2009

Chart 8: LCD monitor shipments by screen size, 3Q07-4Q08

Source: Digitimes Research, January 2009

- The 19-inch segment continues to be a major focus of Taiwan LCD monitor production.

- The 20-inch wide segment is losing ground to larger sized segments. Shipment growth in emerging-size panels such as 21.5- and 21.6-inch widescreen models have thus become a major growth driver for shipments in the 21-inch and above LCD monitor segment.

- The 15-inch segment continues to maintain stable shipments, on demand from emerging markets. The stable shipments, combined with a tougher overall climate in the market, allowed the segment to increase its share in the fourth quarter.

Outlook till 2011

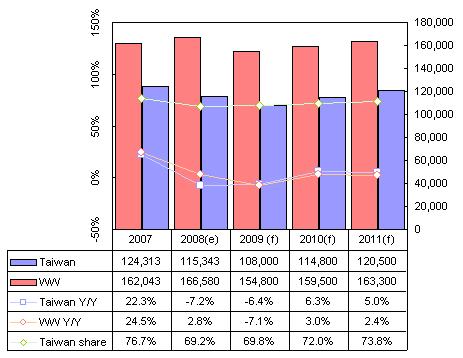

Chart 9: Global LCD monitor shipments, 2007-2011 (k units)

Source: Digitimes Research, January 2009

- More second-tier players will likely be phased out of the market, with TPV and Innolux being the major contributors to Taiwan shipments in 2009.

- Taiwan lost market share in 2008 due to the region having more second-tier makers. However, as orders become more consolidated among first-tier makers, Taiwan will see its share slowly rebound.

- Taiwan LCD monitor share remains almost unchanged, but both worldwide and Taiwan shipments will experience annual drops in 2009.