Samsung Electronics has introduced its solid state drive (SSD) utilizing toggle-mode DDR NAND memory.

The new 512GB SSD makes use of a 30nm-class 32-gigabit (Gb) chip that the company began producing last November. The toggle-mode DDR structure together with the SATA 3.0Gbps interface generates a maximum sequential read speed of 250-megabyte per second (MBps) and a 220MBps sequential write speed, both of which provide three-fold the performance of a typical hard disk drive. At these speeds, two standard length DVD movies (approximately 4GB each) can be stored in just a minute, the company said.

Samsung provides further gains in power efficiency by having developed a low-power controller specifically for toggle-mode DDR NAND. The resulting power throttling capability enables the drive's high-performance levels without any increase in power consumption over a 40nm-class 16Gb NAND-based 256GB SSD. The controller also analyzes frequency of use and preferences of the user to automatically activate a low-power mode that can extend a notebook's battery life for an hour or more.

Samsung said it plans to begin volume production of the 512GB SSD next month (July 2010). The new capacity extends its range of SSD densities from 64GB to 512GB.

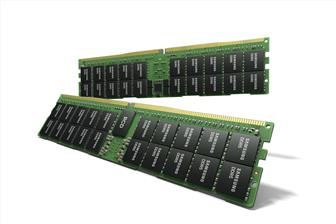

Samsung HKMG DDR5

Samsung Electronics has expanded its DDR5 DRAM memory portfolio with a 512GB DDR5 module...

Photo: Company

Nvidia GeForce RTX 30 series GPUs

Nvidia's GeForce RTX 30 series GPUs are powered by the company's Ampere architecture. The...

Photo: Company

Apple HomePod mini

Apple's HomePod mini is the newest addition to the HomePod family. At just 3.3 inches tall,...

Photo: Company

Apple 13-inch MacBook Pro with Magic Keyboard

Apple has updated the 13-inch MacBook Pro with the new Magic Keyboard for an improved typing...

Photo: Company

Apple iPad Pros

Apple's new iPad Pros comes with the latest A12Z Bionic chip, an ultra-wide camera, studio-quality...

Photo: Company

- AMD's AI story has lost some shine. Can earnings brighten the picture? (Apr 29) - MarketWatch

- Samsung labor unions vote for strike after wage talks break down (Apr 9) - The Korea Times

- US inflation jumps as fuel and housing costs rise (Apr 11) - BBC News

- US blacklists 4 more Chinese firms for helping boost military (Apr 11) - Bloomberg

- Huawei tests brute-force method for making more advanced chips (Mar 22) - Bloomberg

- China blocks use of Intel and AMD chips in government computers (Mar 25) - The Financial Times

- TSMC to win more than US$5 billion in grants for US chip plant (Mar 9) - Bloomberg

- China readies US$27 billion chip fund to counter growing US curbs (Mar 8) - Bloomberg

![]() Topco Senior CEO says geopolitics creates business opportunities

Topco Senior CEO says geopolitics creates business opportunitiesThe global supply chain for semiconductors is undergoing far-reaching changes due to the geopolitical...

![]() AI EXPO Taiwan 2024

AI EXPO Taiwan 2024AI EXPO Taiwan 2024 takes place at the Taipei Expo Park from April 24 to 26. The main theme of this year is "AIvolution," with a focus on five major...

Samsung handset supply chain in northern Vietnam

Based on an observation of upstream suppliers and downstream customers of Samsung Electronics and its associated companies in...

Status of EV solid-state battery market

China, Japan and South Korea are all keen on pushing the development of solid-state batteries for EVs with volume production...

Samsung strategy and capacity deployment in India and Vietnam

Samsung has been pushing investments in Vietnam and India and is expected to continue doing so for the next several years as...